Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

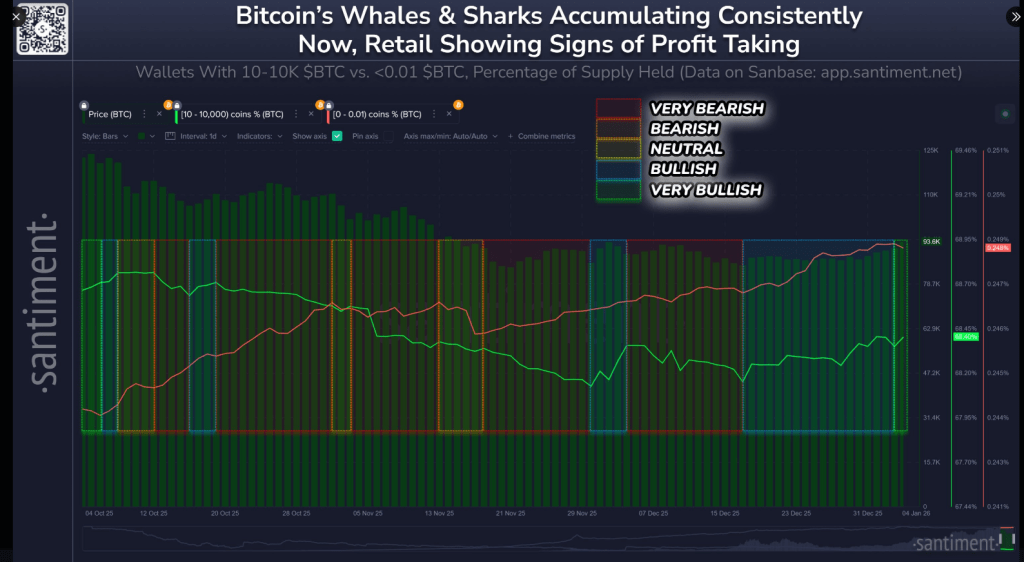

Bitcoin moved higher on renewed buying from large holders while smaller wallets were seen booking gains, a pattern that on-chain watchers view as supportive for further upside.

Whale Accumulation And Retail Profit-Taking

According to Santiment, wallets holding between 10 and 10,000 BTC — described as whales and sharks — have added 56,227 BTC since mid-December. At the same time, wallets with less than 0.01 BTC have been taking profits, suggesting some retail traders expect a bull trap or a fool’s rally.

This split — heavy accumulation by large holders while small accounts sell — raises the odds of market cap growth across crypto.

Supply Redistribution And Market Structure

Market observers say supply is shifting in a way that helps price action. Analyst James Check pointed out that the top-heavy supply share has fallen from 67% to 47%, a large move in a short span.

📊 Crypto markets typically follow the path of key whale & shark stakeholders, and move the opposite direction of small retail wallets. In our chart below:

🟥 Whales dumping, Retail accumulating (VERY BEARISH)

🟧 Whales dumping, Retail unpredictable (BEARISH)

🟨 Whales & Retail… pic.twitter.com/yoC0H1keBT— Santiment (@santimentfeed) January 5, 2026

That shift, paired with a drop in profit-taking and signs of a short-squeeze in futures, has supported higher prices even as overall leverage stayed low.

Bitcoin has been mostly rangebound between roughly $87,000 and $94,000 for about six weeks, but it briefly reached a seven-week high of $94,800 on Coinbase during late trading on Monday.

Options And Key Levels

Traders watching option interest see heavy call activity around the $100,000 strike for January expiry. Data shows Bitcoin as being in a bullish consolidation phase, with immediate resistance seen at $95,000 to $100,000 and support placed near $88,000 to $90,000.

A clean break above the upper zone could push prices higher, while a breach below the lower zone might invite deeper selling pressure.

Geopolitical Shock And Trading Volume

Following the capture of Venezuelan President Nicolás Maduro by US forces, Bitcoin moved to multi-week highs and traded above key levels near $93,000 on Monday, based on reports.

Analysts tied the move partly to geopolitical uncertainty pushing some investors toward alternative assets. Speculation about Venezuela’s alleged large BTC holdings — reportedly hundreds of thousands of coins — also added to market chatter and trade activity.

Overall, the event coincided with higher volatility and volume, reflecting broad market reactions to global tension rather than serving as a direct driver of Bitcoin’s fundamental value.

What This Means For Traders

The current mix of big-wallet buying and retail profit-taking gives the market a tilted bias. If accumulation by whales continues, the chance of an upward breakout rises. Yet the retail sell-off warns that short-term reversals remain possible.

The $95,000 to $100,000 range appears to be a key area for a potential breakout, while support around $88,000 to $90,000 could influence sentiment if prices fall below it.

Reports and on-chain data suggest momentum leans toward further gains, though the market may remain volatile as traders respond to both technical levels and geopolitical developments.

Featured image from Unsplash, chart from TradingView