Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

- Bitcoin (BTC) stable and ranging

- The US SEC delays VanEck Bitcoin ETF decision date by another three months

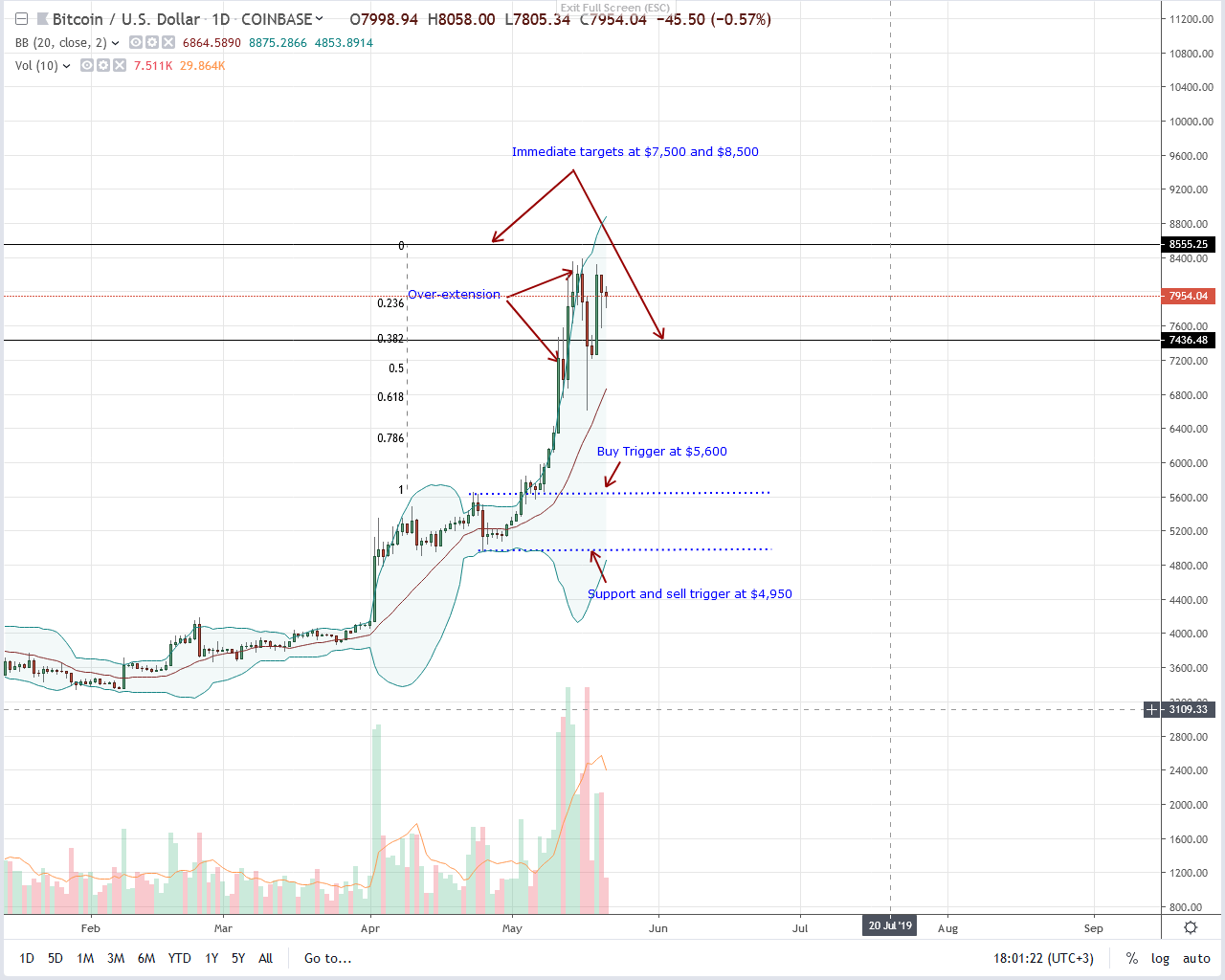

Bulls are resilience, and after shaking off the $1,000 drop of May 19, Bitcoin is stable and ranging. Even so, any break and close above $8,500 will draw buyers aiming at $10k or higher confirming bulls of early April.

Bitcoin Price Analysis

Fundamentals

That the dreaded crypto winter is finally over, is true. Analysts say fundamental and technical factors are aligning and that will likely lift Bitcoin prices to new highs as prices breach and close above the minor resistance at $8,500.

At spot rates, Bitcoin prices are in range mode. However, it is the reaction of the market to the news that the US SEC will delay their decision on the VanEck Bitcoin ETF by three months to August 2019.

Although they didn’t expound as to why they are taking their time, observers believe it has to do with their requirements of stringent surveillance tools to prevent fraud and other manipulative acts. It is until there is fulfillment of these conditions that the US SEC would be “comfortable” with a crypto investment vehicle where the interest of the investor is top priority, and there is transparency.

Candlestick Arrangements

As it is, and as aforementioned, BTC/USD is in range mode inside May 19 high low–which is bullish. Besides, the failure of prices to drop hours after the SEC delay of VanEck Bitcoin ETF proposal is bullish confirming the strong uptrend two days after bulls bounced back shaking the Bitstamp triggered a liquidation of May 18.

Even so, it is until when prices rally, closing above $8,500 that conservative traders can ramp up on dips with first targets at $10,000 or higher. Because Bitcoin (BTC) is ranging, aggressive traders can load up on dips with targets at $8,500 as in a confirmation of the bull breakout pattern of early April.

Nonetheless, we cannot discount deeper corrections. Assuming bears flow back, any drop below the middle BB or May 17th low at $6,600 nullifies our trade plan since prices may drop back to April 2019 highs or $5,600.

Technical Indicator

Our anchor bar is May 19. Even though volumes are light, any break and close above $8,500 ought to be with high volumes exceeding 25k and 37k of May 11. The same rules apply if BTC slide below $6,600 below the middle BB invalidating our bullish outlook.

Chart courtesy of Trading View. Image Courtesy of Shutterstock