The fintech industry finds itself at a crossroads right now. Despite the number of financial institutions willing to work with startups increasing every quarter, there is still a large battle ahead. Shaking up the financial industry is a delicate balancing act. Although collaboration is the buzzword right now, the battle lines between banks and fintech startups have not faded by any means.

Banks collaborating with fintech incumbents is a positive trend. Entrepreneurs can use all the guidance they can get during the initial stages of their venture. Additionally, a willing bank partner can help with funding and other strategic needs over time as well. But despite this amicable situation, fintech and traditional finance remain at odds with one another.

Fintech Is Here To Stay And Should Not Be Ignored

To put this into perspective, the financial sector has an annual revenue of roughly US$5tn. As is always the case, they want that number to keep growing. To do so, they partner with fintech startups to realise new ideas and improve existing infrastructure. Combining the US$5tn market with a US$20bn fintech industry can lead to exciting developments.

It is true established players are incapable of ignoring the fintech industry right now. However, while there are companies willing to partner, other startups will forge their own path. This creates an ongoing battle for revenue, consumers, and brand recognition on a global scale. As a result, this “war” will change the financial industry as we know it, and it is impossible to predict how things will play out.

Keep in mind this is a positive development, though. Banks partnering with fintechs are copying ideas and using them for their own benefit. However, it remains uncertain if the banking system can be changed from within. External competition forces the hand of financial players to innovate, which is an indication of fintech players winning smaller battles in the great war.

Regardless of collaboration or opposition, it all comes down to what the end user wants. Consumers will continue to demand innovation, regardless of who brings it to the table first. Brand loyalty is a thing of the past, and the first companies to offer consumers what they need will win them over.

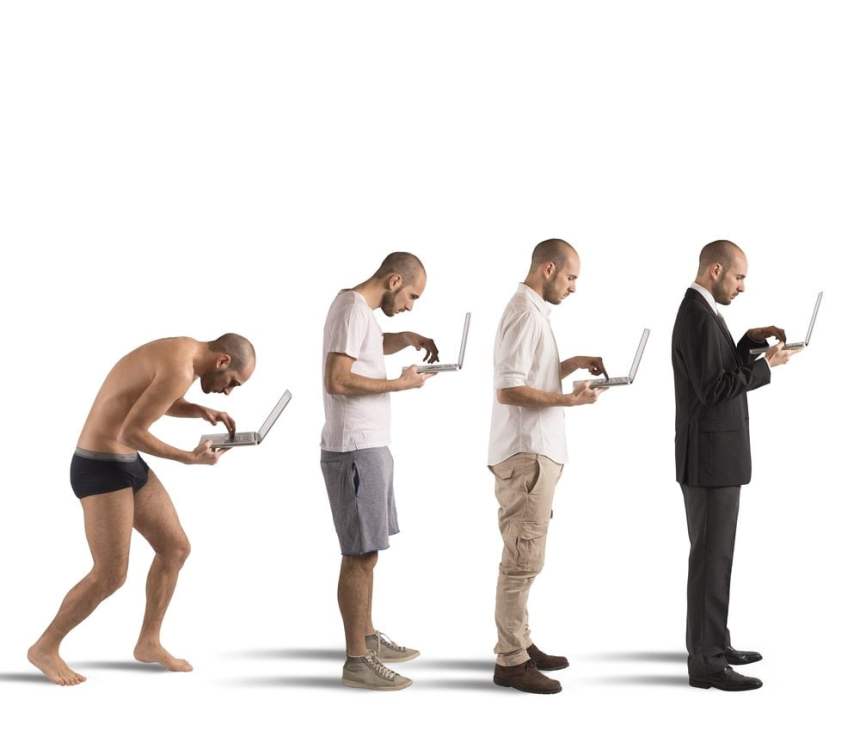

Change is inevitable at this stage. The sooner banks and financial institutions realise this inconvenient truth, the better for everybody. Fintech should not be ignored, and various subsectors of this industry are making waves. Blockchain, Bitcoin, robo advising, and AI are just a few examples of what the future holds. Exciting times are ahead of us, even though we are all cogs in the global financial war machine.

Header image courtesy of Shutterstock