In a death knell to the dollar, Peter Brandt says the goal should be to stockpile Bitcoin. The renowned trader admitted his previous trading goal, to accumulate dollars, was the wrong strategy to have. But in the last year, Brandt said his mindset has shifted to favor the leading cryptocurrency.

.@PeterLBrandt says he used to trade to acquire USD, which he now sees as accumulating a depreciating asset. However, he now uses Bitcoin as a way to measure his wealth.

How do you think about your wealth? In USD or BTC? pic.twitter.com/5VfhpDjG3q

— Laura Shin (@laurashin) April 13, 2021

Stacking Bitcoin is The Way to go

Speaking to Laura Shin, Brandt said he previously measured his wealth in U.S. dollars. His attitude was to stack dollars at the exclusion of everything else. However, within the last year, his mindset has shifted. He now sees Bitcoin as the asset to stack over everything else.

“And so, Bitcoin was just a trade, but I think really within the last year, my mindset has really changed… Bitcoin is where I would have wanted all my wealth at some point in time.”

His reasons for the flip? Like many before him have pointed out, Brandt said he wised up to the fallacy of measuring wealth in a depreciating asset. Even going as far as calling the dollar “the most depreciating asset in the world.”

With his new outlook, instead of trading Bitcoin for dollars, Brandt now sees Bitcoin as the measure of wealth, not dollars.

“what that now tells me is that I had a wrong goal because my goal was to accumulate the weakest asset in the world. The most depreciating asset in the world, and that’s U.S. dollars. And so, my mindset has really changed within the last year in terms of moving from Bitcoin as a trade to Bitcoin as a measure of wealth.”

The dollar crashed -844% against BTC in one year

A year ago this week, the first wave of stimulus check was deposited in the bank accounts of eligible Americans—the $2.2tr stimulus package aimed to help those struggling from the effects of the panic situation. Qualifying individuals received $1,200, with couples getting $2,400.

Analysis of the change in U.S. dollar value of Bitcoin bought at the time illustrates Brandt’s point to a tee.

On the day, Bitcoin was priced at $6.8k. $1,200 would have purchased 0.17549 BTC at the time.

At today’s BTC price, that $1,200 has grown to $11,332 – a whopping 844% increase in a year.

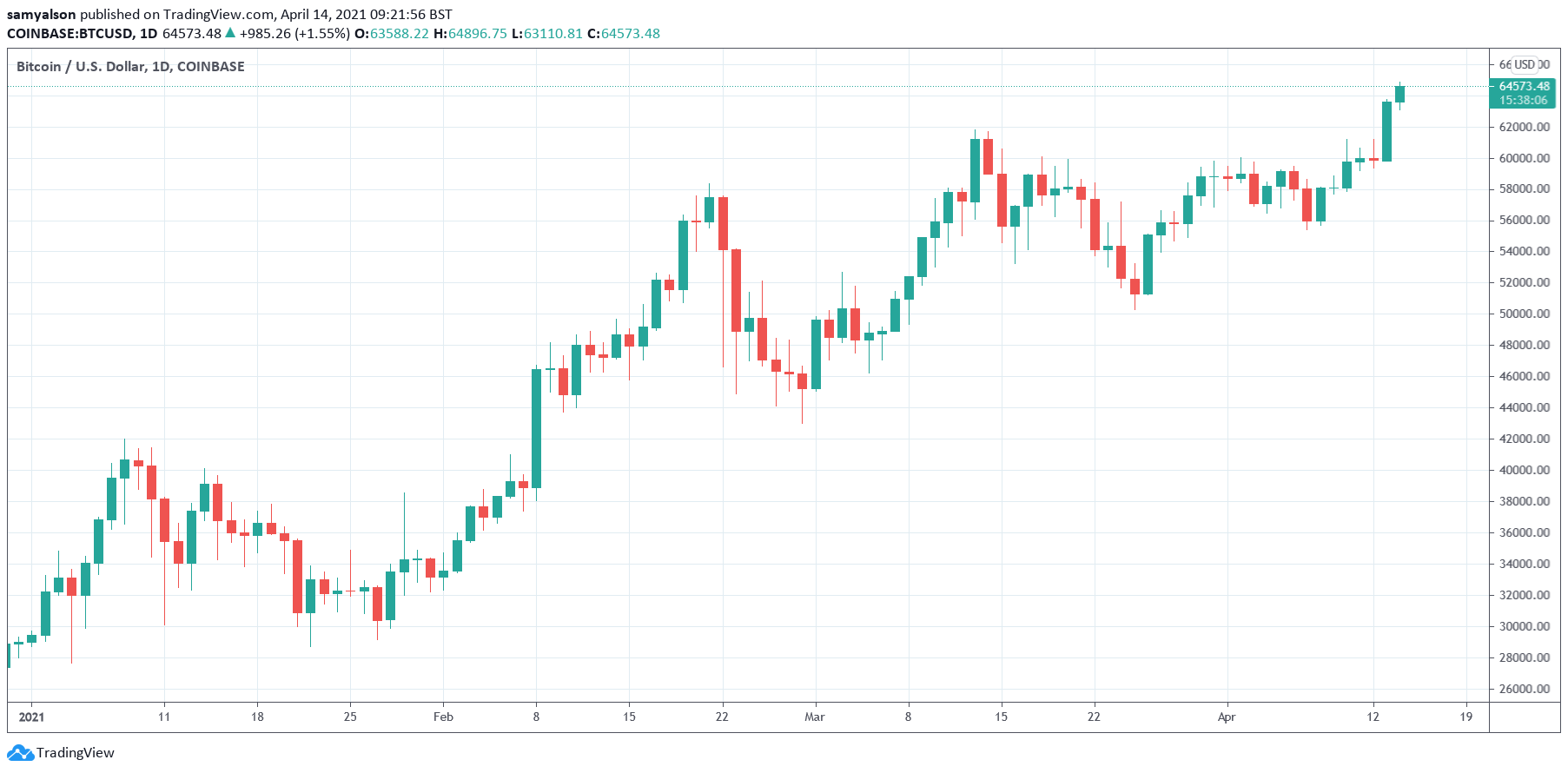

Yesterday BTC posted another new all-time high as it pushed past $62k. Today sees a continuation of momentum, gaining an additional 6% over the last 24-hours to $64.6k at the time of writing.

The big news of today is the Nasdaq debut of Coinbase. As the largest U.S. crypto exchange, hopes are high that this event will trigger what many crypto advocates want – to finally go mainstream.

With a market cap of $1.2tr, Bitcoin’s seemingly unstoppable rise will no doubt force others to re-evaluate their mindset on dollars versus BTC.

Source: BTCUSD on TradingView.com