Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

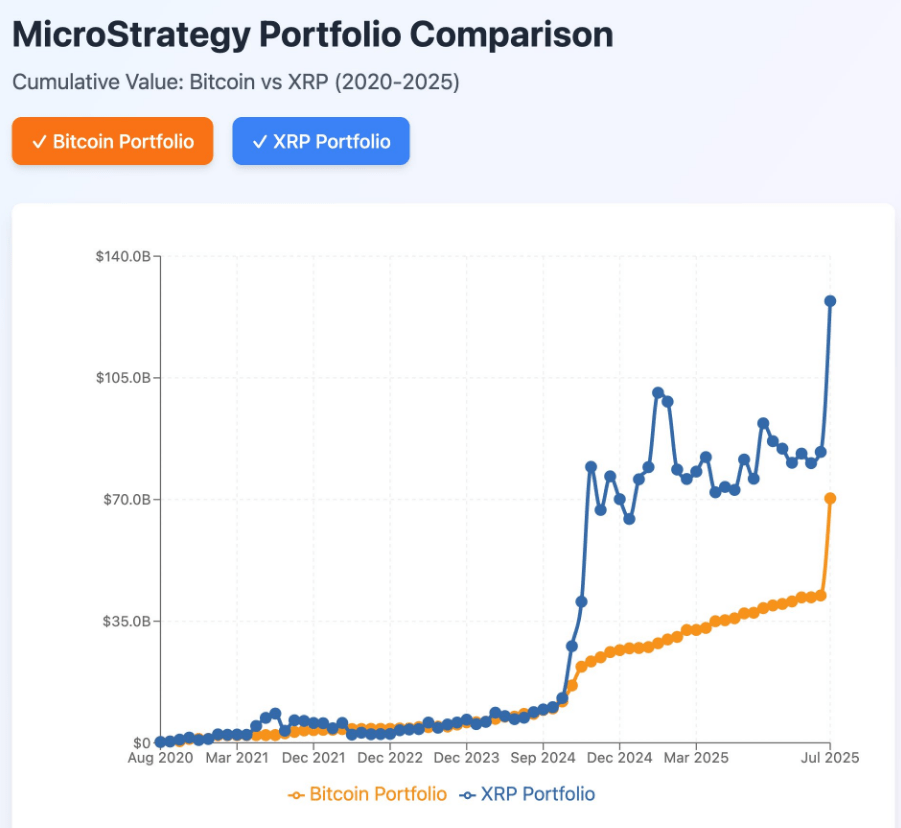

MicroStrategy’s (now Strategy) big bet on Bitcoin has paid off so far, but it may have left even more money on the table. According to Matt Hamilton, a former Ripple developer now at Asimove Protocol, the firm missed out on about $56.8 billion in extra gains by choosing BTC over XRP.

XRP Returns Versus Bitcoin

Based on reports, Strategy began its crypto journey on August 11, 2020, buying 21,454 BTC for $250 million at an average price of $11,653. Over the next year, it added another 29,646 BTC in December 2020 for $650 million, then 19,452 BTC in February 2021 for $1 billion.

By June 2021, the company had spent $490 million on 13,005 BTC at $37,617 each. Fast forward to late 2024 and early 2025, it snapped up 27,200 BTC in early November 2024 for $2 billion, and 20,356 BTC in February 2025 for nearly $2 billion.

More recently, between July 7 and 13, 2025, Strategy spent $472 million to add 4,225 BTC. Altogether, it holds 601,550 BTC bought for nearly $43 billion, now worth around $72 billion, netting roughly $29 billion in unrealized gains.

Based on Hamilton’s hypothetical XRP play, the same cash and dates would have grown close to $130 billion — nearly twice the Bitcoin haul.

For those wondering how BTC has compared to XRP as an investment over longer term, I’ve recalculated what Microstrategy’s portfolio would have looked like if they had invested the same dollar value in XRP vs BTC. If Saylor had invested in XRP instead of BTC the portfolio would be… https://t.co/srq92DRW4l pic.twitter.com/e9Np3ZWJgk

— Matt Hamilton (@HammerToe) July 19, 2025

Liquidity And Risk Factors

According to Hamilton, these figures don’t account for the fact that pouring $43 billion into XRP all at once would move the market a lot. Bitcoin’s market cap is around $2 trillion. XRP sits closer to $40 billion.

That gap means big buys in XRP would send its price soaring or stalling in unpredictable ways. Institutions often pick assets they can trade without blowing up the price. They also worry about custody, compliance and regulatory clarity.

Bitcoin has clear proof‑of‑work security and broad global acceptance. XRP still faces legal questions in the US.

Investor Appetite For Altcoins

Based on data, a handful of firms have started looking at XRP as a treasury asset. Everything Blockchain plans to collect $10 million in XRP. Others like Trident, Webus International and VivoPower have dipped their toes in.

But none have shown the kind of deep pockets or public push that Strategy did with Bitcoin. Even if these smaller buyers spark short‑term price jumps, the path to a steady, large‑scale treasury reserve in XRP remains untested.

Corporate Treasury Choices

According to experts, choosing a reserve asset isn’t just about raw returns. Boards weigh volatility, legal risk and how the move looks to shareholders. Strategy made waves by being the first public company to back Bitcoin.

That bold step helped spark ETFs, custodial services and reporting standards. An equally bold bet on XRP might have done the same for that token — but it could also have drawn more regulatory heat and questions about audit treatment.

Featured image from Meta, chart from TradingView