In 2021, NFTs first captured the spotlight with their whopping prices; in 2022, many new NFT projects and use cases emerged, and as the NFT category matures, its segments are becoming increasingly versatile.

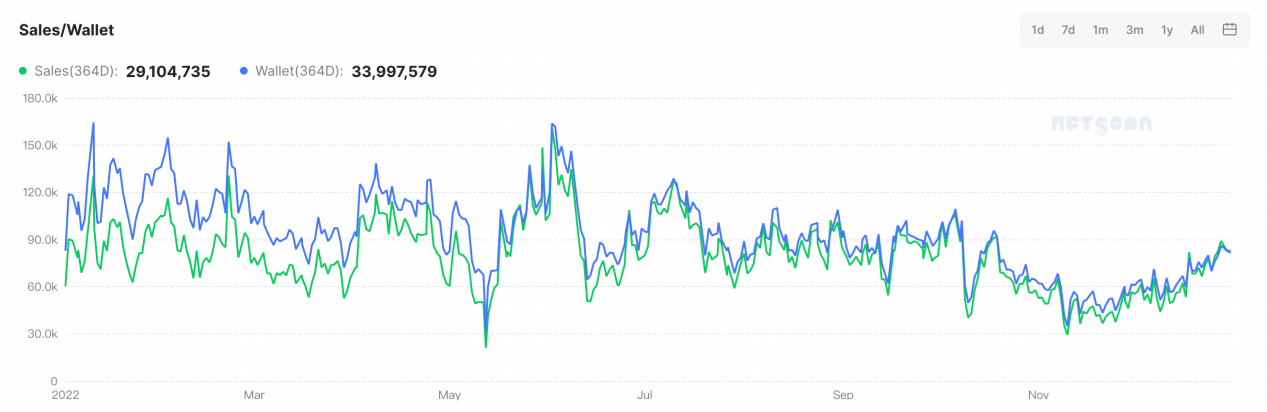

According to NFTScan, as of December 31, 2022, the total number of NFT transactions on Ethereum hit 29,104,735, with roughly 33,997,579 active wallets. Both figures saw a growth rate of over 200% YoY.

Source: NFTScan

The continued growth of the NFT sector has triggered the appearance of new applications, which include the extensive use of NFT artworks for branding and project promotion. However, there are also ongoing debates surrounding NFT royalties charged by creators. Amidst the market volatility last year, NFTs faced challenges and also managed to impress us with highlights.

In 2022, the NFT community came up with a series of financial solutions based on NFT liquidity and price discovery mechanisms to address the insufficient liquidity, heterogeneity, and limited use cases of NFTs.

The specific solutions include:

- NFT fragmentation protocols: Users obtain tradable, homogenized tokens by staking NFTs.

- NFT lending protocols: Users can use NFTs as collateral to borrow homogenized tokens from

- NFT liquidity pool protocols: These protocols provide a liquidity pool of NFTs/homogenized tokens, and users can deposit their NFTs into such pools to receive homogenized tokens minted at the same ratio.

- Floor price perpetuals: The solution offers users a tool to hedge against the floor price fluctuations of NFTs and engage in margin trading.

In 2022, NFT infrastructure projects such as NFT contract options, NFT lending, NFT fragmentation, and NFT valuation have facilitated the implementation of new use cases for NFTs. By the same token, NFT’s rapid development last year also prepared the category for more application scenarios and transformation in 2023.

To start with, as a growing number of big corporations venture into the field, NFTs are likely to transform the traditional ticketing and membership industry. The shift from traditional tickets to NFTs will offer more benefits to both issuers and participants, as NFTS provide holders with more privileges, such as exclusive event tickets or memberships, which have been widely adopted by sports clubs since last year. Additionally, thanks to the unique characteristics of NFTs, NFT tickets are also set to become an advanced anti-counterfeiting identification solution, thereby driving the digitization of the traditional ticketing industry.

Furthermore, no longer confined to the realm of artworks and gaming content, NFTs may revolutionize the content market. For instance, we have witnessed more NFTs in film and music. From films through television programs to music, many content markets could register greater revenue with the help of NFTs. We can tell that NFTs have disrupted the traditional art economy, which is great news for creators.

Finally, as Web3 and the metaverse become more extensively adopted, NFT might hit its peak. Undoubtedly, NFTs have built a bridge between users and the Web3 world, helping them understand and join Web3. In 2023, the NFT category is set to drive the mainstream adoption of blockchain technology through innovative use cases, thereby catalyzing the transformation of Web3.

Last year, CoinEx Smart Chain (CSC) identified many promising NFT projects through the Multi-Million Dollar Supportive Plan and MetaFi the CoinEx Smart Chain Hackathon. This year, CSC has introduced NFTMage on the chain to enable easy, fast NFT app development, which has helped NFT developers unlock new value, making sure that NFT products could be delivered and traded in the shortest period possible.

Although the NFT category might remain turbulent in the future, it will provide more use cases to attract users and enable the extensive adoption of crypto, as well as the growth of the entire crypto economy.