As the first spot Bitcoin ETF approval looks inevitable, a string of Bitcoin derivatives are appearing on the market that seek to capitalize on its introduction.

In particular, the newly launched Bitcoin ETF ($BTCETF) is turning heads as traders start to divest in this Bitcoin derivative.

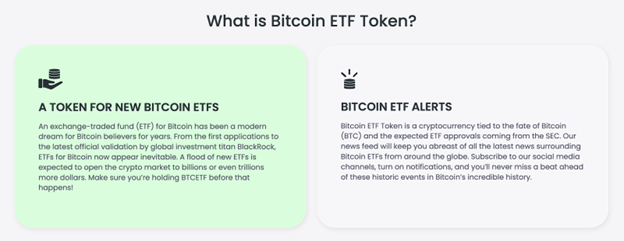

Bitcoin ETF is a project that allows investors to gain exposure to the Bitcoin ETF approval ahead of time, with a staking utility and a burning mechanism tied to the official Bitcoin ETF approval.

With over $30,000 raised in its first few hours of going live, it’s clear that the appetite for Bitcoin ETF derivatives is strong as early adopters expect 10x returns from $BTCETF.

What is Bitcoin ETF ($BTCETF)?

Bitcoin ETF ($BTCETF) lets investors ready their wallets before the first US-based Bitcoin ETF is approved, allowing them to get exposure to the landmark milestone in Bitcoin’s history ahead of time.

The project is a token tied to the looming Bitcoin ETF approval, which is expected to be authorized by Q1 2024.

Buying $BTCETF grants investors exposure to the Bitcoin ETF approval with its token’s value growth directly bound to it.

In short, Bitcoin ETF lets investors capitalize and celebrate the hype of the incoming ETF approval.

The project was launched by a group of savvy developers who realized that investors were looking for alternative vehicles to profit from the Bitcoin ETF approval besides buying Bitcoin.

Bitcoin ETF introduces a unique burning mechanism that creates deflation each time a real-world milestone is reached related to the ETF approval.

In addition, it has a groundbreaking staking mechanism that provides staggering returns for holders.

To bring peace of mind to investors, its smart contracts have been fully audited by Coinsult.

Why is there such hype behind a Bitcoin ETF?

The Bitcoin ETF used to be a pipe dream for crypto aficionados.

Despite being nothing more than a fanciful hope, crypto enthusiasts have always longed for inclusion in the financial mainstream through an Exchange Traded Fund (ETF).

Recently, the pipe dream became a reality as high-profile asset managers, such as BlackRock and Fidelity, filed applications for the spot Bitcoin ETF.

The hype behind its approval is intense as it would allow institutional investors to have a compliant vehicle to enter the Bitcoin market through an ETF.

As a result, Bitcoin holders believe its approval would help the price skyrocket as billions of dollars enter the market.

Now, with Bitcoin ETF, investors can gain direct exposure to the spot Bitcoin ETF approval ahead of time, with growth directly linked to real-world milestones.

Unique Burning Mechanism Tied to Bitcoin ETF Approval

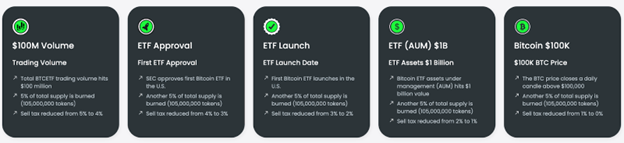

Bitcoin ETF introduces a unique burning mechanism tied to milestones related to the Bitcoin ETF approval.

Therefore, the token supply is directly linked to the Bitcoin ETF approval, with more tokens being burnt the closer the ETF gets to being approved.

Five pre-determined milestones will execute the burning mechanism, causing the smart contract to burn 5% of the token supply when hit.

These include;

- The 24-hour trading volume of $BTCETF reaching $100 million.

- The SEC approving the first Bitcoin ETF in the US.

- The first Bitcoin ETF launching in the US.

- The assets under management in Bitcoin ETFs reaching $1 billion.

- Bitcoin’s closing a daily candlestick above $100,000.

As each milestone is reached, 5% of the total supply will be burnt – creating upward pressure on the price as it seeks to reach demand.

Furthermore, $BTCETF also introduces a burn sale tax to incentivize long-term holding and create more deflation.

The sales tax will start at 5% and be reduced by 1% at each $BTCETF milestone listed above.

Once all the milestones are reached, the sales tax will completely disappear.

Therefore, those holding long enough can sell $BTCETF without incurring a tax.

Staking System to Incentivize Long-Term Holding

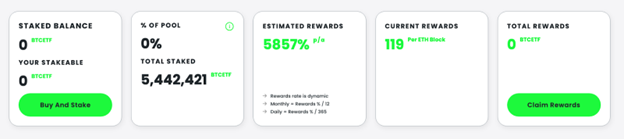

In addition to the burning mechanism, $BTCETF introduces a staking system to incentivize long-term holding.

The staking system provides passive rewards for those locking their assets into the platform.

It currently provides an impressive 5,800% APY;

This return is expected to drop as more users enter the staking system but is still considerably higher than every other staking protocol.

Furthermore, the act of staking continues to reduce circulating supply – shrinking the number of $BTCMTX available to buy for newcomers following the presale.

As a result, the combination of these two mechanisms has experts believing that $BTCETF will provide a 10x return following its presale;

Early Adopter Prices Underway, Get Positioned Before Price Hikes

Given its speedy rise and growing momentum, it’s clear that the $BTCETF is a strong contender in the Bitcoin derivatives market. The sector yielded substantial profits for projects like $BTC20, which provided early adopters 7x returns immediately following its launch.

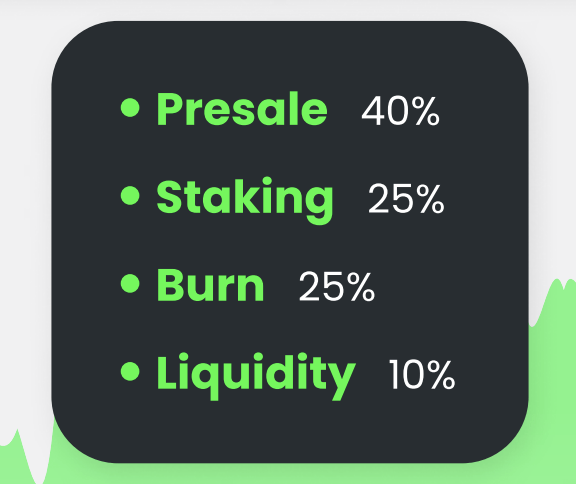

$BTCETF will have a total of 2.1 billion supply, with 100% of the supply in the hands of the community.

40% of the total supply will be sold in the presale, with the price starting at $0.005.

There is a rising pricing strategy that means those buying earlier benefit from the early adopter prices with lower entries.

The following price hike is scheduled in four days, so you must act quickly to get positioned.

Of the remaining supply, 25% is reserved for community rewards, 25% for the burning protocol, and 10% to add liquidity to exchanges to ensure a stable trading environment.

Overall, with its growing hype, Bitcoin ETF has the potential to provide 10x rewards for early adopters with its unique staking and burning strategy tied to the approval of the highly anticipated Bitcoin ETF.