Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Since the rules on regulation and investor protection within the Web3/crypto industry are still not perfectly defined, numerous malicious parties have taken advantage of this to the detriment of the private token holders.

As a result, it has become ever clearer that, as the gateway to wider distribution for many blockchain protocols, launchpads need to do more than just coordinate IDOs.

By conducting reasonable due diligence and employing proper buyer protection measures, these platforms play a massive role in expanding the markets past early adopters and investors, and inspiring mass adoption within the whole industry.

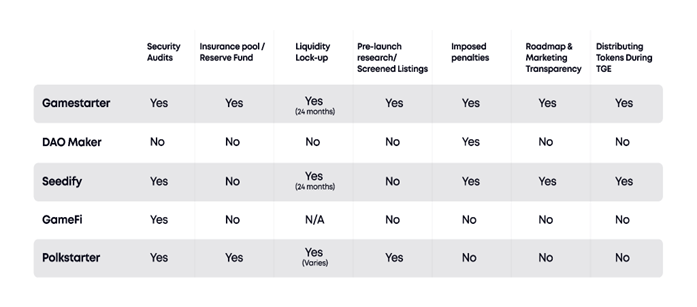

As for the launchpad market security, this article aims to discover the safety mechanisms that four of the leading pads are implementing to protect their respective communities.

Seedify

Seedify doubles as an incubator and IDO launchpad focused on blockchain games.

The launchpad runs on the Binance Smart Chain and allows $SFUND holders to earn tokens from successfully incubated projects as a source of additional passive income.

Seedify has implemented several clauses to protect its community from malicious projects.

One feature worth noting is its Seedify Protected Launch, which was recently announced to cover every token launch on the platform.

According to this new protocol, Seedify’s projects must comply with their distribution times and penalize other parties offering tradeable tokens before the Seedify community’s claim time.

In addition, Seedify will require a minimum amount of liquidity to be locked for at least 24 months, to protect its community from rug-pulls and other possible negative events

Another way the launchpad separates quality projects from untrustworthy projects is by enforcing the completion of token security audits, ensuring no evidence of blacklisting or ‘honeypot‘ is detected in the project’s token contract.

Every project is also accountable for its pre-launch and post-launch marketing strategy and initial roadmap.

GameFi

GameFi is a play-to-earn yield guild and IGO launchpad, allowing its users to participate in purchasing IGO tokens.

GameFi also grants their community access to in-game assets.

BSC/Polygon holders can use the guild token to finance gameplay through scholarships.

GameFi’s investor-first approach is nested within its one-hour refund policy, which allows investors to cancel their support for a project if they so choose.

Here, the rules are simple.

Once a member participates in a public token sale on the GameFi launchpad, they can make a claim request (on their purchased tokens) or refund if they made a mistake or notice a detail within the project that makes them feel uneasy.

DAO Maker

Through community funding, Dao Maker mitigates investor risk while providing protocols and cryptocurrencies with opportunities for incubation and growth.

Dao Maker has a structured financial product named Venture Bonds, which benefits investors in three ways:

- Buyers receive bonds directly from the startups.

- Funds generate interest, which buyers can swap for early-stage equity or tokens.

- Buyers receive their principal at the maturity of the bond.

While these Venture Bonds only generate between 8 to 10% interest, they work well as a way to protect investors.

Through its Yield Protocol, DAO Maker users can access an open-source toolkit for building yield farming products, called YieldShield.

Users can employ algorithmic DeFi strategies in profit-taking yield farms, deposited currency functions, and stop-loss yield farms to shield themselves against losses.

In this way, token holders can still profit even if the underlying asset doesn’t perform as expected.

DAO Maker also has a safe ‘Token Sales’ program that refunds participants whenever the price of their invested token goes down below its IDO levels during the initial two months.

Polkastarter

Polkastarter is a decentralized exchange based on Polkadot that allows projects to conduct cross-chain token pools and auctions.

Ever since Polkastarter went live in 2020, the DEX has enacted multiple features, such as password-protected pools and counter-measures to safeguard against malicious pools and bots, in order to protect its users.

Covalent‘s partnership with the platform enhances its anti-scam features by providing rich data about projects, transactions, and even historical data on tokens and wallets.

Smart contract information and verification reports help token pool creators and potential buyers to evaluate information such as token contract age, proxy patterns (used to detect potential rug-pulls), contract verification, and more.

This helps determine the trustworthiness of each token before anyone buys.

Users also benefit from anti-slippage measures, which borrow from DIA’s technology for a built-in price alert system to warn users when current prices are too high, or if a particular trade will incur significant slippage.

Gamestarter

Gamestarter has established itself as one of the most innovative layer-2 solutions, with audited smart contracts (ETH, BSC, SOL and Polygon), fractionalized NFTs, and liquidity pooling solutions.

What makes Gamestarter unique is that it provides an immersive complete Web3 ecosystem:

- Token launchpad with an NFT-based marketplace to help raise funding.

- A project incubator and accelerator for the successful product launch of other projects.

- An in-house game development studio, GS Studio.

So far, Gamestarter’s newly launched Protection Protocol appears the most comprehensive in covering its community and ensuring it doesn’t incur malicious actions.

To guarantee legitimacy, Gamestarter has a listing team that conducts extensive research on projects looking to join its launchpad or incubation, to ensure every launch is compliant, viable, and fully audited.

Some of the updated protection protocols will only help enhance Gamestarter’s community security when participating in IDOs:

- To avoid pump and dump activities and delayed vesting, new projects are requested to send all of their tokens to Gamestarter at least 24 hours before the IDO for Gamestarter to distribute during the TGE and the following vesting period.

- Gamestarter will issue a refund to token buyers in the case of poor performance between the token generation and the following weeks (for a full detailed explanation, see here).

- In order to guarantee an added extra layer of safety, and avoid fluctuations in the price of the token, token listing will not be allowed to take place later than 7 days after the last day of the IDO on Gamestarter.

The thorough vetting process that every project has to go through, coupled with the launch of its updated protection policy, makes Gamestarter a safe choice for potential buyers.

The stakes are only getting higher…

Even in such a crippling bear market, facets of the blockchain, such as the gaming niche, are experiencing a bullish run, and doubts about whether blockchain can inevitably disrupt traditional industries are diminishing.

However, for blockchain projects to flourish, projects must demonstrate that they are sustainable to the entire communities to which they are committed, and launchpads, as we have seen, are playing and will play a huge role in this narrative.

Insights from this article demonstrate how current industry leaders are implementing a community-first approach to protecting their members.

Still, as the number of projects continues to surge, more will need to be done to further safeguard buyers and communities from the effects of this overexposure.

Image by David Mark from Pixabay