Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The cryptocurrency market is notoriously volatile, with some cryptocurrencies experiencing more volatility in a single day than many traditional financial instruments experience in a whole week.

While this volatility has made cryptocurrencies some of the most lucrative assets for speculators and investors, it also brings with it significant risks — since the market can experience significant adverse price swings, which can quickly wipe out investors in a down market.

But while some investors struggle to turn a profit when the market turns red, others are well-prepared, and already leverage a range of platforms and strategies to maintain value or even turn a profit regardless of how the market performs.

Here’s how they do it.

Decentralized Options Trading

Cryptocurrency trades can be broadly separated into two types: long and short. Individuals that are trading long are looking to turn a profit when a cryptocurrency asset appreciates in value, while those that are trading short are looking to profit on its decline.

But while the vast majority of traders know how to speculate on the upside, comparatively few are able to speculate on the downside — largely due to the limitations of spot exchange platforms, since these do not usually provide the ability to short an asset.

This is why experienced traders instead prefer to trade options — which are a type of derivative contract that gives the holder the right to buy or sell a specific asset at a specific price if it moves beyond a certain threshold during a given window. These can be used to easily speculate on whether an asset will appreciate (e.g. by buying call options) or decline (e.g. by buying put options).

Until recently, the vast majority of options trading occurred on centralized platforms. But due to limitations in the types and variety of options available, many of the more sophisticated options traders now prefer decentralized options trading platforms — including Premia.

What’s this?

Interest yielding vaults in a completely new UI for the Premia options AMM

All will be revealed June 11 @ 18:00 UTC

👉 https://t.co/M80YQUi0UB 👈 pic.twitter.com/p1Gs0pgmEo

— Premia Blue 💎 🦉 | DeFi Options (@PremiaFinance) June 5, 2021

The reasons behind this are several, but mostly stem from the increased flexibility provided by decentralized options. For example, traders are able to create their own personalized options contracts and then source liquidity for these using Premia’s option creation tool and decentralized marketplace.

This allows traders to go long or short on their assets of choice, rather than relying on the potentially restrictive range of options contracts available on centralized platforms. As a result, experts are increasingly leveraging platforms like Premia to hedge their positions and net a profit when the market enters a downturn.

Arbitrage Trading

The most common way traders make (or attempt to make) a profit in most markets is by speculating on the direction of a price movement, such as through swing or day trading.

While many traders are incredibly successful at this, the vast majority of traders are unable to turn a profit through speculative trading. Instead, most end up making a loss. This is doubly the case in a bear market, where opportunities to profit are more scarce, since most assets are on a strong decline.

However, there is a way to turn a more reliable profit, regardless of the surrounding market conditions by engaging in a practice known as arbitrage. This is essentially the process of extracting profit by buying an asset on one platform, before immediately selling it on another to lock in the difference in value as profit.

Arbitrage opportunities present when an asset is trading with a large spread across two or more platforms — e.g. if Bitcoin was trading at $30,000 on one platform and $35,000 on another, you could buy 1 BTC from the first platform, transfer it to the second, and sell it to lock in $5,000 in profit (minus fees).

Due to the volatility of most cryptocurrencies, these opportunities are fairly common and are not too challenging to execute on. However, it should be noted that these opportunities are generally extremely transient, while those capable of executing large orders (in terms of absolute value) will fare best since the fees can cut deep into profits.

As with everything, there is still some risk with arbitrage, but with the right tools, timing, and skills, it can be a secure way to profit in any market.

Providing Liquidity

If you’ve ever traded on a cryptocurrency exchange, then you may have already worked out one simple truth — regardless of how the market moves, the cryptocurrency exchanges always win.

This is because these exchanges always get a cut on trades, regardless if the individual is winning or losing. But while this revenue stream was largely restricted to the shareholders of centralized exchanges, the advent of decentralized exchanges and permissionless liquidity pools has democratized access to trading fee revenue.

Right now, there are more than a handful of decentralized exchange protocols that allow users to provide liquidity to pools and share in the fee revenue they generate — some of the most popular options include Uniswap and Curve on Ethereum, and PancakeSwap on Binance Smart Chain.

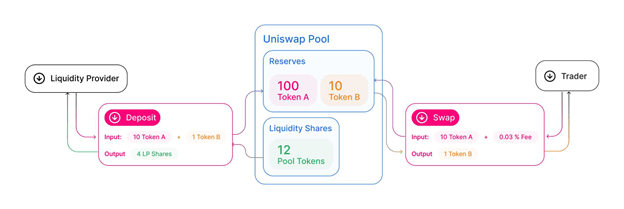

A schematic of Uniswap liquidity pools. (Image: Uniswap)

The way it works is simple. By contributing to a liquidity pool, such as USDT/USDC, the investor then owns a share of that pool. Whenever liquidity is added or taken from the pool, the trader is charged a fee (e.g. 0.3% of the trade size on Uniswap or 0.2% on PancakeSwap). This revenue is then distributed proportionally to all liquidity providers.

Due to the intricacies of automated market makers (AMMs) and the constant product formula, volatile assets added to a liquidity pool (e.g. ETH/WBTC) can be subject to impermanent losses (ILs). In many cases, the revenue from fees outweighs any potential ILs, but many liquidity providers tend to almost completely avoid the issue by contributing only the pure stablecoin pools — which suffer from little to no volatility related losses.