Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

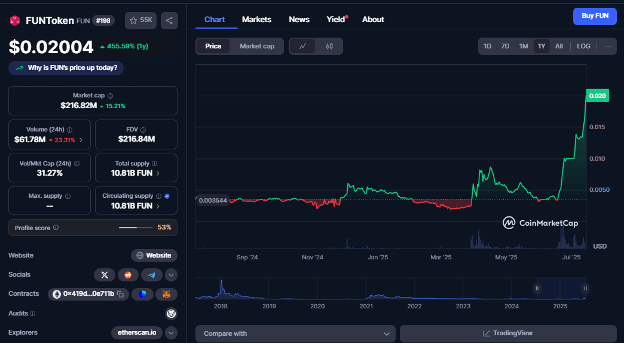

As FUNToken ($FUN) prices continue to climb, the key question on every investor’s mind is whether the ecosystem’s supply-side engineering can sustain – and even accelerate – this momentum as we move into Q3 and Q4.

Trading around $0.02004 at the time of writing, FUNToken has already achieved a milestone by crossing the $0.02 threshold, reflecting growing confidence among holders and traders alike. This rise is not purely speculative; it is the product of a deliberate, disciplined strategy designed to build lasting value rather than short-lived spikes.

In this article, let’s understand how the 25M token burn is going to have a long-lasting impact, and propel the token’s price in Q3/Q4.

First, to put things in context, let’s understand why the burn matters.

Why the 25 M Burn Matters

Unlike many crypto projects that announce token burns as one-time marketing stunts, FUNToken’s recent 25 million token burn is part of a consistent, revenue-backed deflationary strategy. The tokens were sent to a verified burn address on-chain, and the event was documented publicly for full community transparency. This approach makes each burn structurally reliable and easy for investors to verify independently.

By linking burns to real platform revenue rather than reserves, FUNToken demonstrates that scarcity is an intentional, repeatable part of its economic design, not just a reaction to market trends. This is a major reason why confidence in the project has grown steadily throughout 2025.

The immediate impact on market sentiment was unmistakable. Following the burn announcement, FUNToken rallied by approximately 41% in under 24 hours, rising from around $0.0045 to nearly $0.0064. This surge showed that traders and holders alike recognized the burn as a signal of both discipline and long-term commitment to reducing circulating supply. It also sent a clear message to the broader market: FUNToken’s team is executing on promises with measurable results.

How Deflation Drives Q3/Q4 Momentum

1. Consistent Quarterly Burns

FUNToken’s deflation isn’t a one-off event. Scheduled burns occur every quarter, with the size of each burn tied directly to ecosystem revenue generated by games, missions, and in-platform spending. This model ensures that as adoption expands and transaction volumes grow, the burn pool grows as well.

The outcome is a compounding reduction in available supply over time, which strengthens the foundation for price appreciation. As Q3 and Q4 unfold – with more staking, more daily activity, and more revenue sources – the scale of these burns is expected to increase, creating stronger scarcity quarter by quarter.

2. Trust Reinforced by Audits and On-Chain Transparency

A key element underpinning FUNToken’s deflationary credibility is its rigorous focus on security and transparency. The contract has been audited by CertiK, confirming it is immutable, with no hidden functions that could remit or manipulate supply. CertiK Skynet continues to monitor the contract 24/7, providing ongoing assurances that every burn is final and verifiable.

This security framework helps protect both existing holders and new participants, and it reinforces the perception that FUNToken is serious about creating a transparent, deflationary environment investors can trust.

3. Revenue from Daily Utility

The deflationary engine is only possible because FUNToken generates real, recurring revenue from its daily utility. The project’s AI-powered Telegram bot, now a daily destination for over 105,000 users, is the heartbeat of this system.

Each time a player spins for rewards, completes a mission, or plays a game, a small transaction fee is collected. These fees accumulate to fund quarterly burns and create a direct link between user engagement and token scarcity. This means every new player or returning user contributes to strengthening the deflationary model – an important distinction from projects that rely on speculative buying alone.

What This Means for Q3/Q4 and Beyond

Looking ahead, several milestones will reinforce and accelerate FUNToken’s deflationary mechanics:

FUN Wallet (Q3–Q4):

The launch of the FUN Wallet app will integrate staking, yield tracking, and in-app token swaps. This frictionless experience will encourage more users to hold and stake their tokens. Higher wallet activity will also generate more transaction revenue, funding larger burns in subsequent quarters.

Expansion to 30 Games (Q4):

Growing the game catalog means more engagement and more microtransactions. Each transaction supports burn volume, creating a self-sustaining loop where ecosystem growth naturally tightens supply.

Ongoing Burns Into 2026:

FUNToken has committed to keeping quarterly burns as a core economic pillar. This consistency gives investors clarity and confidence that supply will continue to shrink as adoption scales, rather than plateauing after early successes.

Why This Matters for Price Outlook

By combining real adoption with predictable and transparent burns, FUNToken is creating a supply-and-demand dynamic that historically supports higher valuations:

- As the number of users grows, so does the base level of demand for tokens to use in gameplay and staking.

- As burns and staking continue, fewer tokens remain in circulation, creating measurable scarcity.

- CertiK audits and visible on-chain burn records provide the credibility investors increasingly expect in a crowded market.

Many analysts are now modeling a potential Q4 trading range between $0.09 and $0.15, depending on the speed of game launches and user growth. While no target is guaranteed, FUNToken’s disciplined approach to deflation gives it an advantage over competitors still relying on hype alone.

Final Take

The 25 million token burn is a milestone, but not an end. It signals the beginning of a disciplined economic model designed to support higher prices in Q3 and Q4. With ongoing burns backed by real revenue, trusted security audits, expanding usage via Telegram, games, and staking, FUNToken is showing how structural deflation can fuel sustainable growth.

Watch for the FUN Wallet launch, game expansions, and automated burns in upcoming roadmap milestones. If these roll out as planned, the savvy use of supply control could propel FUNToken far beyond its recent gains.

Note: The price mentioned was accurate at the time of writing (July 14, 2025) and may have changed since