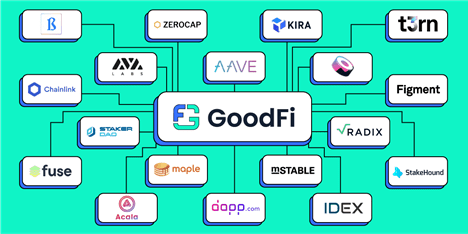

GoodFi, a not-for-profit organization created by Radix with the mission of getting 100 million people into DeFi by 2025, announced today the addition of 22 executives to its advisory board from DeFi industry leaders such as Chainlink, Aave, Sushiswap, Avalanche and mStable.

The addition of the Board of Advisors, who meet monthly to tackle the combined challenges facing the adoption of decentralized finance, marks an important step in the growth of GoodFi after its initial unveiling just a few months ago. The shared experience, knowledge and resources of the GoodFi Board of Advisors will enable initiatives that lower the barriers to entry into crypto and increase understanding and access to DeFi for new users. By lowering these barriers, GoodFi and its members aim to help more people benefit from the opportunities and innovation presented by the DeFi industry.

GoodFi’s Newly Established Board of Advisors Includes:

Michael Zacharski – Account Executive, Chainlink

Trent Barnes – Principal, ZeroCap

Clayton Menzel – Head of Marketing & Content, Figment.io

James Simpson – Co-Founder, mStable

Fauve Altman – Global Community Lead, mStable

Isaac Rodgin – Head of Business Development, Fuse.io

Amanda Joki – Business Development & Marketing Lead, SushiSwap

Rachel Chu – Project Management Lead, SushiSwap

Omakase – Core Developer, SushiSwap

Alex Wearn – CEO, IDEX

Piers Ridyard – CEO, Radix

Isa Kivlighan – Digital Marketing Manager, Aave

Jay Kurahashi-Sofue – VP of Marketing, Ava Labs

Adam Simmons – Head of Strategy, Radix

Kyle Lu – CEO, Dapp.com

Albert Castellana – CEO, StakeHound

Jonas Lamis – CEO, StakerDAO

Sid Powell – CEO, Maple Finance

Lawrence Till – Managing Director, NetZero Capital

Scott Trowbridge – Co-Founder, Blockswap Network

Jacob Kowalewski – Chief Strategy Officer, t3rn

Milana Valmont, Co-Founder & CEO, KIRA Network

Dan Reecer, VP of Growth, Acala Network

Jay Kurahashi-Sofue, member of the GoodFi advisory board, and Vice President of Marketing at Ava Labs, states, “Open, distributed systems allow for great speed and innovation. It’s no accident that there are so many projects with talented teams paving the way forward. What’s missing are unbiased groups that seek to create shared value for all builders and users. The decision to join GoodFi on behalf of Avalanche was a no-brainer.”

Alongside the new advisory board, the first version of goodfi.com’s user-focused site has gone live, providing the introductory material for someone looking to understand and get involved with DeFi. This initial launch is focused on explaining to a first-time user the value proposition of decentralized finance, where the yield comes from, and the various levels of risk/reward that exist. From there, users are guided through getting their first wallet and assets based on their preferred platform and how much they are looking to invest.

The introductory educational resources that have gone live today are only the first iteration of GoodFi’s efforts to demystify DeFi. The advisory board members are all working on producing content for GoodFi and work is already underway on new features such as a “matchmaker” feature of the website that helps users find beginner-friendly DeFi dApps, opportunities, and asset classes. The focus of this tool, due to be released next month, is to provide an unbiased view of different DeFi options and associated risks as well as give real-time data about yields across a range of proven platforms.

The DeFi opportunities that GoodFi are proposing adhere to three overarching approaches to DeFi investing for new users, based on their financial experience and individual risk tolerance:

- Safe & Stable: This approach primarily involves lending out stablecoins for annual returns of 5% – 15% through applications like Aave and Compound Finance or providing liquidity to stable-stable pairs on automated market makers like Uniswap or Sushiswap.

- Take Calculated Risks: A moderate approach, ideal for those willing to take on calculated risk for higher annual returns (10% – 20%). This looks primarily at having some exposure to high-cap volatile assets like ETH or WBTC paired with a stable coin in two-sided liquidity pools, or through using automated yield farming opportunities such as those offered by Yearn Finance.

- Opportunities for the Adventurous: A more aggressive approach can yield returns of 30% or higher and requires increased exposure to volatile assets. This will include opportunities such as lending out WBTC/ETH or adding to volatile/volatile pairs on automated market makers.

“While opening a new cryptocurrency wallet and interacting with various DeFi dApps is second-nature to crypto-natives, these processes will initially be intimidating to the uninitiated majority across the globe. To get 100m DeFi users by 2025, GoodFi needs to guide users at each step so they feel confident bringing assets into the ecosystem,” said Adam Simmons, Head of Strategy at Radix DLT.