Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In recent years, the landscape of digital transactions has undergone a remarkable transformation, a trend that has continued to accelerate in 2023. This surge in the popularity of cryptocurrency payments and Google searches such as ‘Pay with BTC’ can be attributed to four key developments.

Firstly, the increased adoption and awareness of cryptocurrencies among the general public and businesses have led to a wider acceptance as a viable payment method.

Technological advancements have significantly enhanced the efficiency, security, and speed of crypto transactions, overcoming many of the initial challenges.

The expansion of use cases has seen cryptocurrencies evolve from mere investment assets to practical tools for diverse transactions, ranging from online shopping to remittances.

Finally, regulatory clarity has emerged as various countries and regulatory bodies have begun to provide more defined guidelines for cryptocurrency usage. These factors collectively have paved the way for a more secure and mainstream integration of cryptocurrencies like Bitcoin into everyday financial transactions.

Benefits of the Bitcoin Payment Method

Accepting cryptocurrencies, such as Bitcoin, for payments brings a multitude of benefits to businesses and their customers. Here’s an overview highlighting these advantages:

Broader Customer Base: By accepting crypto payments, including Bitcoin, businesses can tap into a growing demographic of tech-savvy customers who prefer using digital currencies. This adoption not only caters to current customers but also attracts a new audience that values the innovation and flexibility that cryptocurrencies offer.

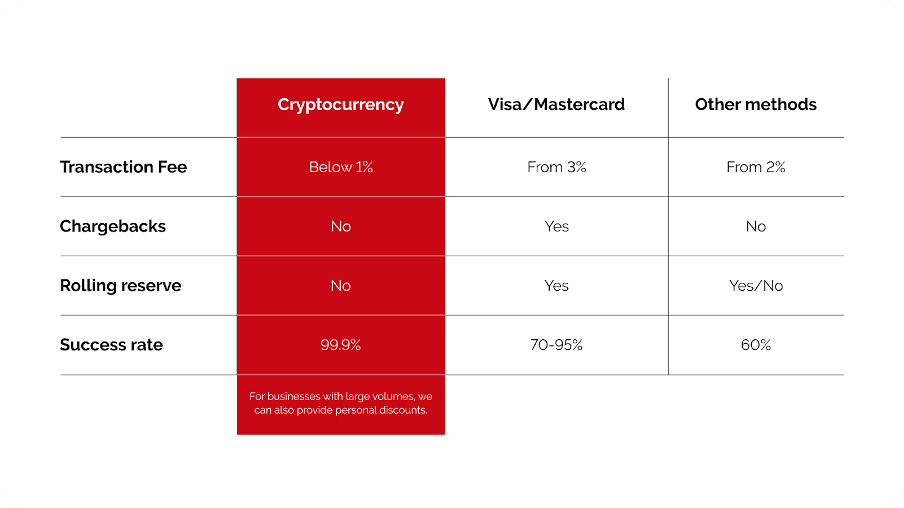

Lower Transaction Fees: Traditional payment methods often come with significant fees, especially for cross-border transactions. In contrast, crypto payments, including Bitcoin, typically have lower transaction fees. In accepting crypto, both businesses and customers can benefit from reduced operational costs.

Enhanced Security: Cryptocurrencies such as Bitcoin offer robust security features to merchants intent on accepting them, minimising the risk of fraud and chargebacks. The blockchain technology underlying Bitcoin and other cryptocurrencies ensures that each transaction is encrypted and immutable, providing a higher level of security compared to traditional payments.

Faster Transactions: For businesses accepting crypto payments an uptick in speed when compared to traditional bank transfers will be noticed, especially for international transactions. This speed enhances the customer experience by providing immediate transaction confirmations, making it ideal for both online and in-person purchases.

Global Reach: Cryptocurrencies are not bound by national borders. This global reach allows businesses to easily accept payments from customers anywhere in the world without the need for currency conversions or dealing with local banking regulations.

Indeed, accepting cryptocurrencies like Bitcoin for payments is not just a trend but a strategic move that aligns with the evolving demands of customers and the global market. It offers businesses a competitive edge through enhanced security, reduced costs, faster transactions, and an expanded customer base.

How to Pay with Bitcoin

Invoice Payments in Crypto

Many businesses are now offering the option to pay invoices with cryptocurrencies such as Bitcoin. This process typically involves the company generating an invoice with a QR code or a crypto wallet address. The customer can then use this information to transfer the crypto amount equivalent to the invoice value from their wallet. This method is particularly popular among businesses accepting crypto as a means to operate internationally, as it bypasses traditional banking fees and exchange rate issues.

Peer-to-Peer (P2P) Transactions

Peer-to-peer transactions are one of the most direct ways a business accepting cryptocurrencies can operate. In a P2P transaction, the buyer transfers crypto directly to the seller’s wallet without the need for an intermediary. This method is appreciated for its simplicity and lower transaction costs. P2P platforms have grown in popularity, facilitating these transactions by connecting buyers and sellers and providing an escrow service to ensure the security of the trade.

Using Payment Gateways on Websites

For online businesses, integrating payments gateways accepting cryptocurrencies is an efficient way to cater to customers who prefer to use digital currencies. These payment gateways convert the price of goods or services into the equivalent cryptocurrency amount and process the transaction. They may also offer the option to convert the cryptocurrency into fiat currency immediately, mitigating the risk of volatility for the business. This method has become increasingly popular for e-commerce websites, providing a seamless and secure checkout process for customers.

For prospective merchants exploring crypto payments, it’s crucial to choose a provider adept in all these payment methods — invoice payments, P2P transactions, and payment gateways for websites. This comprehensive expertise, as exemplified by CryptoProcessing.com, ensures that as your business grows and diversifies, you won’t face the inconvenience of switching payment gateways to accommodate different transaction types.

The Top Crypto Payments Providers for Your Business

CryptoProcessing.com, is a leader in providing cryptocurrency payments solutions, adeptly catering to a wide range of businesses intent on accepting Bitcoin. This platform offers an efficient and cost-effective way to handle cryptocurrency transactions. Serving over 800 merchants and supporting major cryptocurrencies such as Bitcoin, it also enables instant exchange across 40 fiat currencies. Operating under a license from Estonia, it adheres to European AML regulations, ensuring transparent and compliant transactions. Unique in their pricing, they avoid initial or monthly fees, opting instead for a minimal transaction fee. With these features, CryptoProcessing.com stands out as a top choice in the global crypto processing arena, as evidenced by their transaction metrics.

Coinbase Commerce has carved out a prominent position. It simplifies integrating various cryptocurrencies into business operations, extending beyond just Bitcoin. This platform supports a range of digital currencies and offers effortless conversion into fiat or stablecoins. Coinbase provides a comprehensive set of tools for merchants, including customised checkout experiences and in-depth transaction analytics. This flexibility allows merchants to either manage their wallets independently or leverage Coinbase’s expertise in the field.

Crypto.com Pay positions itself as an accessible and cost-effective gateway for businesses seeking to establish or expand their footprint in the crypto market. Its compatibility with a plethora of ERC20 wallets and its integration with essential e-commerce systems render it an appealing choice for merchants who wish to offer greater payment flexibility to their customers.

BitPay offers a streamlined integration experience featuring user-friendly payment buttons, seamless hosted checkout services, and easily embeddable invoices. This platform provides financial security by protecting businesses from the fluctuating prices of cryptocurrencies, guaranteeing the receipt of the precise billed amount. Additionally, BitPay facilitates rapid bank settlements, enhancing transaction efficiency. Esteemed by top-tier companies such as Microsoft and Shopify, BitPay stands out as a complete solution for contemporary transaction needs.

Final thoughts

The versatility of crypto payments, encompassing methods like invoice payments, P2P transactions, and website payment gateways, underscores the adaptability and convenience offered to both businesses and consumers looking to prepare for the future of Web3. Selecting a provider with expertise in these diverse payment methods, such as CryptoProcessing.com, ensures businesses are well-equipped to handle their growth and diversification without the hassle of switching payments systems.

Additional providers like Coinbase Commerce, Crypto.com Pay, and BitPay demonstrate the dynamic range of solutions available for businesses looking to integrate crypto payments. Each offers unique features—from cost efficiency and regulatory compliance to seamless integration with e-commerce platforms and user-friendly interfaces. This variety ensures that businesses of all sizes and types can find a solution that aligns with their specific needs and goals.

In conclusion, the integration of Bitcoin and other cryptocurrencies into the payments landscape is not just a fleeting trend but a strategic evolution in how we conduct transactions. By embracing these technologies, businesses position themselves at the forefront of a financial revolution, offering enhanced security, efficiency, and convenience to their customers. As the world continues to shift towards digital and decentralised modes of payment, those who adapt early stand to gain the most, paving the way for a more inclusive, innovative, and secure economic future.