Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In January 2023, CoinEx and ViaBTC Capital co-published the 2022 CRYPTO ANNUAL REPORT to offer data analysis and insights into sectors spanning Bitcoin, Ethereum, stablecoins, NFT, public chains, DeFi, SocialFi, GameFi, and regulatory policies. Moreover, the report also predicted the trends of the crypto market in 2023. Today, we will dive into the report, with a focus on the major crypto categories.

I. Bitcoin and Ethereum

In 2022, Bitcoin and Ethereum, the two most important categories for crypto investors, were both affected by multiple factors, including sluggish market conditions. That said, the two presented us with different track records.

In 2022, the overall performance of Bitcoin remained sluggish. The price trend of Bitcoin throughout the year is obviously influenced by the pace of US interest rate hikes, but as the US continues to raise interest rates, the impact on the Bitcoin price is dwindling, which indicates the resemblance between Bitcoin and risky assets. Besides, after several adjustments, Bitcoin’s network difficulty clearly trended upward, despite the continued price slump. BTC miners, the ones most affected by the soaring difficulty, saw huge drops in their profits. Meanwhile, as some small mining pools suffered a crowding-out effect, many small-scale mining farms went bust.

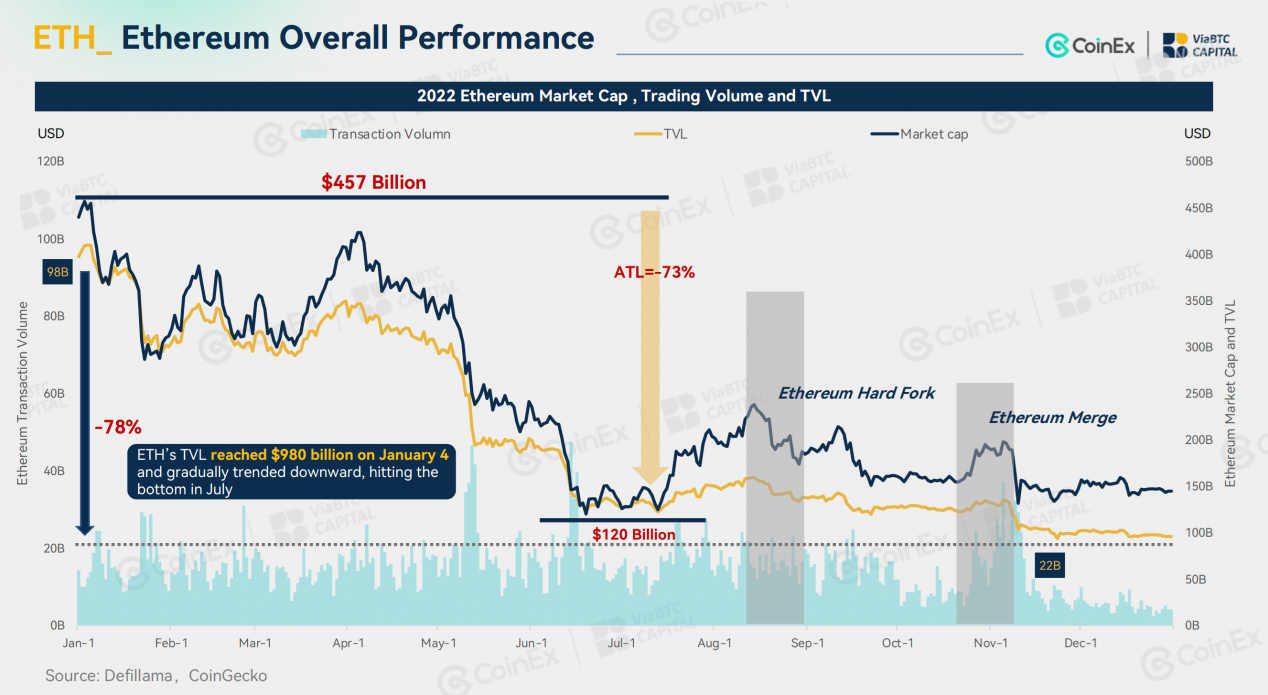

Although primary statistics of Ethereum were hit by the crypto bear, the network did manage to shift from PoW to PoS, a major progress yielding fruitful results. After the Merge, the energy consumption of Ethereum was reduced by about 99.95%, which means that the maintenance of the network no longer requires massive energy. Instead, it employs the ETH staked to protect itself and provide improved scalability, security, and sustainability for the mainnet. It is noteworthy that Lido has now become a top project in the field of ETH staking. Additionally, though the ETH price plunged from around $5,000 at its peak to about $1,200, Ethereum still dominates the market, with an expanding L2 user base.

II. Stablecoins and public chains

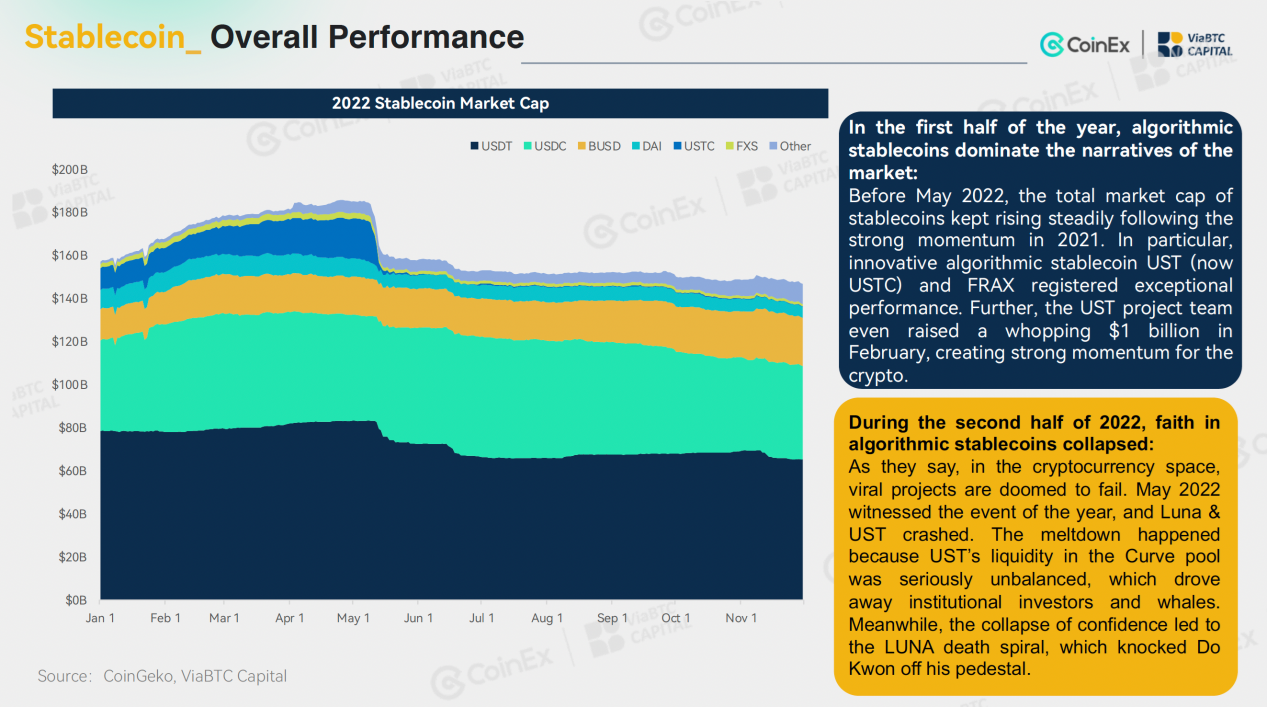

Before May 2022, the total market cap of stablecoins kept rising steadily following the strong momentum in 2021; following the LUNA/UST meltdown in May, however, decentralized stablecoins were trapped in a terminal decline. In terms of centralized stablecoins, USDT remains the absolute leader; BUSD, which recorded strong growth in 2022, failed to overtake USDT and USDC; algorithmic stablecoins were hit hard by the fall of LUNA, which shattered the faith of users. Good news is that centralized stablecoins surviving the market reshuffle are more compliant, with strong investor confidence.

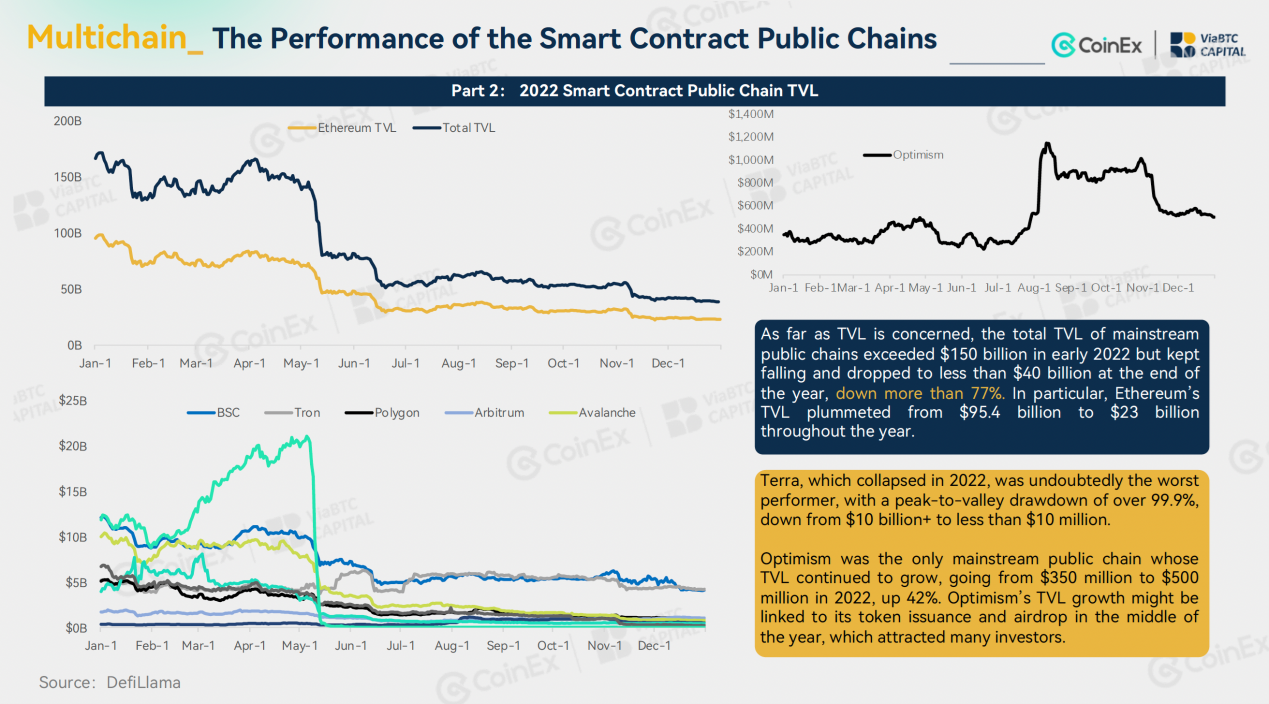

With respect to public chains, the category has been highly competitive, and the remaining market shares continued to shrink. Since 2021, Ethereum’s rivals, including BSC, TRON, Polygon, and Terra, have grown rapidly, shattering the absolute dominance of the network. In addition, Meta-related public chains have also captured market attention as emerging chains.

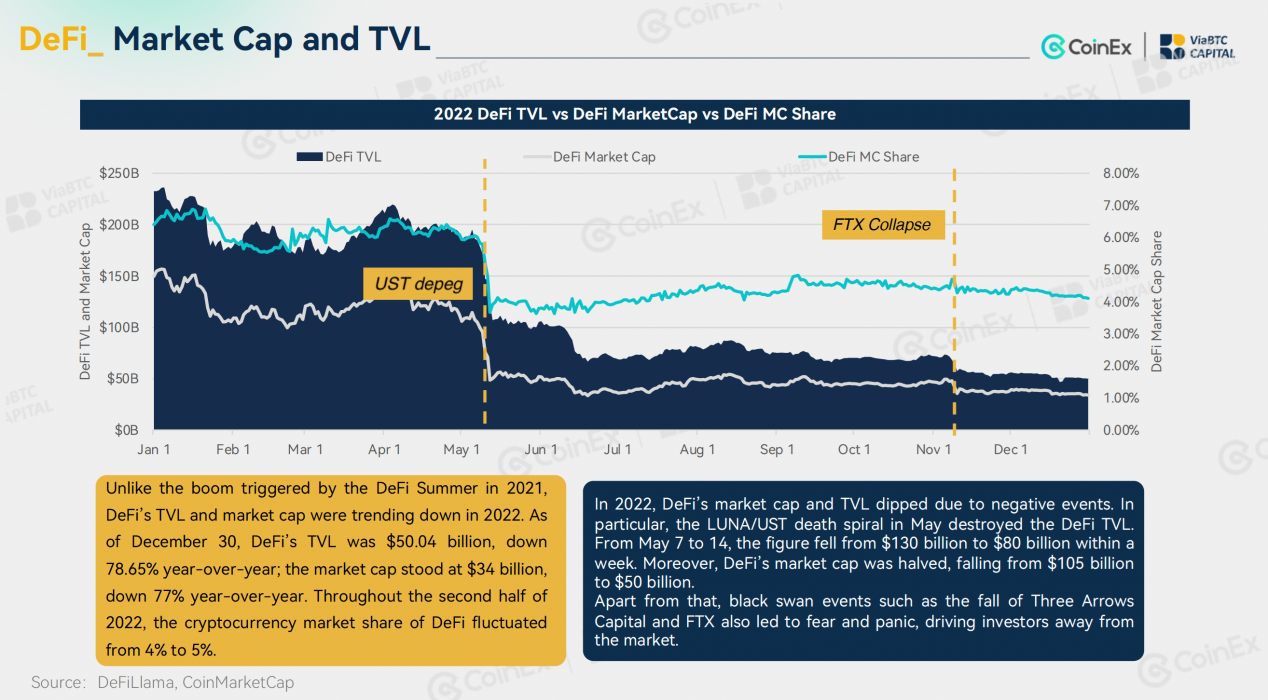

III. DeFi and regulation

Unlike the boom triggered by the DeFi Summer in 2021, almost all market statistics of DeFi were trending down in 2022. Throughout the year, DeFi’s market cap and TVL dipped multiple times due to negative events, which were exacerbated by the LUNA/UST death spiral in May and the massive FTX fraud in November. Although DeFi was at its lowest ebb in 2022, the crisis of confidence in CeFi has brought new hope to DeFi. At the same time, regulators gained a panoramic picture of DeFi and crypto ecosystems in 2022. Moreover, the year also saw frequent regulatory oversight.

In 2022, there was a clear trend towards more proactive regulatory policies, particularly in Europe and the US. The industry saw a number of bankruptcies, thus prompting regulators and law enforcement departments to intensify their investigations and research into the crypto industry. Regulators in the US have also taken action, and Ethereum may come within the purview of the SEC. Overall, 2022 was a tumultuous year for the crypto industry, but it also witnessed the proactive trend of regulatory policies. The report argues that regulators are likely to respond to crypto risks with stricter regulatory measures in the future.

Apart from that, when it comes to market forecasts, ViaBTC Capital suggests that Bitcoin will remain volatile in 2023 amid global economic and geopolitical uncertainty. Still, new opportunities will also arise in this market environment. For example, countries facing high inflation may adopt Bitcoin as their legal tender. Ethereum’s Shanghai Upgrade in Q2 2023 will allow users to withdraw their ETH staked in 2020. Although the selling pressure may affect the ETH price in the short term, Ethereum will beat the market with innovative staking projects and greater staking demand in the long run.

In 2023, the stablecoin market will continue to be dominated by centralized projects and the US dollar, but new types of fiat currencies will be adopted. As for public chains, Ethereum mainnet Layer 2 will remain the most anticipated ecosystem for 2023, but Meta-related public chains and modular public chains led by Cosmos are also likely to stand out.

Finally, as regulations such as the Digital Commodities Consumer Protection Act (DCCPA) are enforced, the report expects to see more compliant DeFi projects in 2023, which will draw in more users (especially institutional users). Meanwhile, ViaBTC Capital argues that with the establishment of the top-level framework design in Europe and the US, 2023 may see the implementation of laws and policies more applicable to the crypto industry. These regulations will no longer take a vague or completely negative approach to crypto; instead, they will serve as guidance and the legal bottom line to facilitate the mass adoption of crypto finance, especially CeFi.