On April 22, MakerDAO, known as the DeFi world’s ‘central bank’, in partnership with the financial supply chain project Centrifuge, completed the first real-world asset loan in DeFi (decentralized finance). Centrifuge helped New Silver, a loan pool to set up a real estate repayment and transfer loan pool in its Centrifuge Tinlake protocol. They have just financed their first loan using MakerDAO as a credit facility.

It is a major breakthrough and milestone for DeFi. With the help of DeFi, real-world financial institutions can operate 24 hours a day on smart contracts without trust issues, and provide low-interest rates on loans and access instant liquidity with minimum capital costs. This opens the door to a new trillion-dollar market for DeFi.

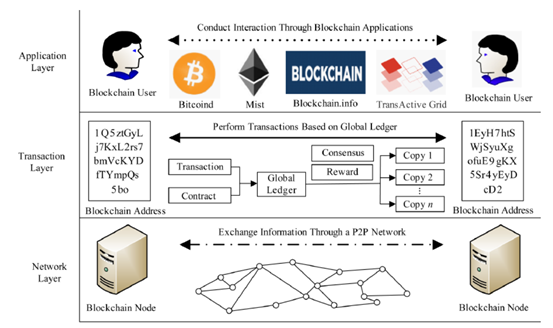

DeFi is widely considered as the second large-scale application of blockchain, which has attracted the attention of mainstream financial institutions. Bank of America previously released a report suggesting that it is more optimistic about Ethereum than Bitcoin because of the existence of DeFi.

However, the DeFi in its current form is not ready yet for traditional finance. Take Ethereum, the most widely adopted project of the DeFi ecosystem, as an example. Disadvantages such as high transaction fees, performance inefficiencies and the lack of privacy protection still abound.

Privacy Protection Becomes a Hindrance in the Development of DeFi

Privacy protection is a major bottleneck but also offers up a good opportunity for DeFi. Traditional investors, institutions and banks attach great importance to privacy protection. It is hard to imagine that they will put their assets on a completely open platform.

Privacy protection can make DeFi lending more widely applied and make credit lending on the chain come about faster. The current DeFi lending is usually over-collateralized, because there is not enough information about the users. If privacy can be protected, then users can provide sensitive data, such as financial data and other behavioral data, to generate their own credit evaluation without openly disclosing it. The credit calculated can then be used to provide credit loans to users.

Privacy protection can also protect investors better from attackers. At present, all the information on the DeFi protocol is public. Everyone can see what the user wants to do, so can the attacker. Many attackers will use this information to attack users for profit. If the users’ transaction information is protected, they will not be attacked or arbitraged.

Current Status Quo of Blockchain Privacy Protection

As a financial application, it is urgent for DeFi to strengthen its privacy protection. Only in this way can DeFi become more secure and reach a broader market in the real world.

There are already privacy-focused solutions on the blockchain, such as cryptocurrency Zcash, centralized ‘coin mixing’ service providers like MixerTombler and Bestmixer.io, and the decentralized ‘coin mixing’ protocol Tornado Cash, amongst others.

However, centralized coin mixing services are plagued with security problems. Coin mixing technology can prevent transaction information leakage on blockchain to a large extent, but there are still some efficiency bottlenecks and security risks. Besides, it does not support customized programming, which means it cannot support secondary functions.

The problem with cryptocurrency and privacy public chains is that they are unable to enhance the support for smart contracts while at the same time ensuring private transactions. Ekiden has tried to do this based on Oasis Labs, but due to its immature products and lack of sufficient developer support, it is difficult for them to exert a strong influence.

Secret Network is currently designing a privacy computing model in general smart contracts. However, only on-chain exchanges have been published, and the liquidity is very poor. Besides, Secret Network needs to use Rust for development, while there are only a few Rust developers, and they are mainly focused on the Polkadot ecosystem.

The above projects also face other shared problems such as the poor on-chain ecosystem design and cross-chain transaction issues. Even if the privacy-focused solutions are mature, it is useless if they don’t have sound ecosystems.

Among the decentralized solutions, the most famous is the Tornado.Cash project, which is built on the Ethereum chain. It uses the zk-SNARK (Zero-Knowledge Succinct Non-Interactive Argument of Knowledge) technology, and can send ETH and ERC-20 tokens to any address in an untraceable way. However, it can only support ETH and DAI, cDAI,USDC, USDT, WBTC. Another important shortcoming of Tornado is that it consumes too much gas. One private operation of 1 ETH may require at least 20% extra gas (on a conservative estimate), which greatly hinders users from adopting the project.

In general, all those projects lack a one-stop privacy solution but it is important to realize that in the blockchain space, only projects that can ensure full privacy are actually meaningful.

Privacy Protection of DeFi and Onion Mixer

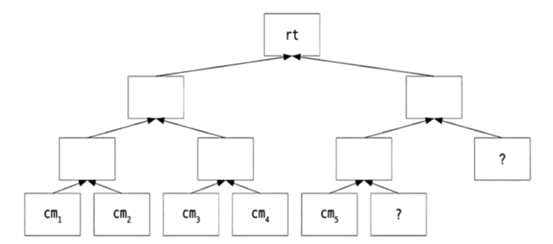

Onion Mixer proposes an efficient and secure solution for coin mixing. It is a decentralized protocol for cross-chain private transactions, which can support DeFi transactions on multiple heterogeneous chains. It follows CoinJoin’s “coin mixing” idea but also incorporates the zkSNARK zero-knowledge proof technology, which can break the connection between the user’s deposit address and withdrawal address, so as to realize a private transaction for all DeFi components.

Decentralization and heterogeneous chain crossing are the development trend and market demand of DeFi currently. The mechanism of Onion Mixer technology makes it more compatible with DeFi, that is, it has more use cases.

Nowadays, the interoperability of DeFi projects is increasing, and all kinds of assets can be used in the DeFi protocol. The Defi space also shows a trend of synchronous development of multiple chains, and the cross-chain asset transfer is gradually increasing. On top of this, users’ demand for privacy has become more urgent. The multiple chain deployment and cross-chain transaction technology of Onion Mixer provide privacy services to more assets, which distinguishes it from projects like Tornado.

As DeFi is becoming more widespread and attracting more traditional institutions, mainstream requirements need to be addressed and Onion Mixer has the capacity to do that. Due to the large transaction volumes in traditional institutions, there is a strong requirement for anonymity in coin mixing protocols. If there are not enough coin mixing transactions, there will be a limit on anonymity. To solve this issue, Onion Mixer designs sustainable tokenomics, which provides users with enough incentive to participate, thus increasing the total volume of anonymous transactions. The anonymous collection of Onion Mixer protocol is called “mixer”. The mixer allows users to conduct private transactions at any time. The “mixer” is different from the “pools” of Tornado. The “pool” only includes one type of token, while the “mixer” supports multiple kinds of tokens, which contributes to better privacy protection.

To open up new markets, DeFi needs to upgrade privacy protection comprehensively. Traditional institutions already have strict risk prevention measures prepared, such as futures, options, swaps, etc. They do not want their investment practices on the chain to be exposed or monitored, because it may help their opponents attack them. Therefore, they urgently need privacy protocols to protect their transactions, a need that will bring more users to DeFi. Onion Mixer can connect multiple mixers together to form a cascade mixer to enhance its privacy protection capacity.

Due to the decentralization of blockchain, data is no longer controlled by a single center. Privacy protection will ensure the value of this feature stands out. When the value of personal data is further explored, developed and utilized in the future, users can not only use privacy protection to protect themselves but also control access to the data, by authorizing users. Onion Mixer is in line with this trend in demand.

Undoubtedly, DeFi has been revolutionary and widespread. The future demands of DeFi will force the development and upgrading of privacy protection, which in turn will actually benefit DeFi. The privacy protection demands and DeFi are mutually reinforcing and will bring better financial services to users.

Image by Thomas Breher from Pixabay