AVAX has pumped over 100% in the last 30 days and 30% in the last 24 hours, so it’s now trading around the $18 level.

Looking at the technicals, AVAX has an RSI of 58 on the daily chart. This indicates the token is neither overbought nor oversold at current prices, and further upside could be ahead. Traders aiming to ride the uptrend may look for RSI to stay above 50.

As noted by crypto analyst Hitesh.eth on X (former Twitter), there are several bullish developments and fundamentals fueling the price rise:

- 116 new validators have joined the Avalanche network, each needing to stake a minimum 2,000 AVAX. This creates at least 232,000 AVAX in locked up demand from validators alone.

- Usage is surging on Avalanche’s subnets like DEXALOT and DFK, processing more transactions than Avalanche’s main C chain. More gaming subnets like Sharpnel and Loco Legends will further drive activity.

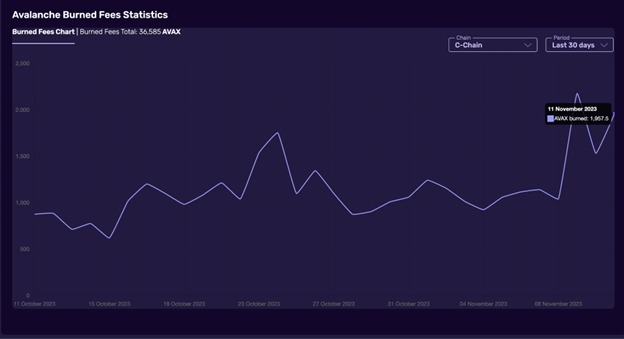

- Avalanche’s tokenomics include burning 100% of fees, removing 36,500 AVAX from circulation in the past 30 days.

- With over 1,700 subnets testing on the network requiring 2,000 AVAX each, this will likely spur major AVAX purchases as they migrate to mainnet soon.

- Overall, it appears Avalanche’s growth in DeFi, gaming, and other key sectors will continue fueling AVAX demand. The technicals support further near-term upside as long as bullish momentum persists.

This analysis indicates there are strong fundamentals behind the recent AVAX price surge. Increased staking activity, high transaction volumes on gaming subnets, and token burning are all driving demand.

This analysis indicates there are strong fundamentals behind the recent AVAX price surge. Increased staking activity, high transaction volumes on gaming subnets, and token burning are all driving demand.

FTT Spikes 300% After Comments from SEC Chairman

The FTT token pumped over 300% this week from $1.13 to $4.8 levels following comments from U.S. Securities and Exchange Commission (SEC) chairman Gary Gensler, who warned that anyone wanting to get involved in crypto must “do it within the law” amid bids to reboot FTX.

In response to questions over whether Tom Farley, former president of the New York Stock Exchange, was looking to buy FTX, Gensler said: “If Tom or anybody else wanted to be in this field, I would say, ‘Do it within the law.'”

Gensler continued: “Build the trust of investors in what you’re doing and ensure that you’re doing the proper disclosures, and also that you’re not commingling all these functions, trading against your customers, or using their crypto assets for your own purposes.”

However, this rapid surge in FTT price seems unsustainable given the token already retraced to $2.8 the next day before pumping again to $3.8. This volatility probably means FTT is still unstable and risky for investors. Also, the coin’s RSI on the daily timeframe is 73, indicating overbought conditions.

Hot New Cryptos – Bitcoin ETF and Bitcoin Minetrix

While AVAX and FTT have dominated headlines with their recent rallies, savvy investors may want to shift focus to Bitcoin ETF and Bitcoin Minetrix – two emerging altcoins poised to deliver even more substantial returns in the months ahead.

Bitcoin ETF Presale Building Hype

The Bitcoin ETF coin raised $437,000 in the first week of its ICO phase. The price has already increased once from $0.005 to the current price of $0.0052, and the next price increase is scheduled in just 3 days.

The narrative behind Bitcoin ETF is familiar in crypto circles: major asset managers like BlackRock and Fidelity are actively pursuing approval for a spot Bitcoin ETF in the US.

Despite past reluctance from the SEC, experts believe there is a 90% chance of a spot Bitcoin ETF being approved in the US by January 2024.

Even though BTCETF is not yet on public exchanges, creators are running a presale, offering 40% of total supply to early investors. This presale aims to build community awareness of Bitcoin ETF’s value proposition aligned to major ETF milestones.

BitcoinETF has implemented an innovative tokenomics structure including a 5% burn tax on each transaction. This deflationary mechanism continually decreases the total token supply over time, with the goal of burning 25% of tokens as major project milestones are achieved.

By rewarding long-term holders and reducing sell pressure, this burn strategy aims to benefit the BitcoinETF community as adoption increases. The deflationary tokenomics make BitcoinETF an appealing long-term investment in the crypto space.

The presale has a tier-based structure across ten stages, each with 84 million tokens priced progressively higher. This rewards early believers with the best prices. Currently, the only place to buy is https://btcetftoken.io/. It’s an ERC-20 token, so a wallet like MetaMask is needed.

Payments are accepted in ETH, USDT, and cards. As the presale spreads on social media, the Telegram and Twitter communities are growing.

Bitcoin Minetrix Utilizes Staking for Cloud Mining

One of the hottest ICOs right now, Bitcoin Minetrix is approaching a $4 million raise. With the current price at $0.0116, a scheduled price increase looms when the presale enters stage 8 in four days.

Bitcoin Minetrix is gaining traction for integrating staking on Ethereum with cloud mining of Bitcoin. The upcoming presale price bump and launch of the next phase explains the spike in interest. Here’s what to know:

The goal is revolutionizing cloud mining via a unique ecosystem around the BTCMTX token. Holders can stake tokens to generate passive income. By leveraging existing cloud mining infrastructure, costs are reduced for individual miners.

When staking BTCMTX, holders earn non-tradable ERC-20 credits to redeem for Bitcoin cloud mining hashpower through the platform. After redeeming credits, users get allotted cloud mining time and earn mining revenues. This streamlines and optimizes profits.

With the current low price of $0.0116 per token, plus the unique staking-to-mining model growing more popular ahead of the Bitcoin halving, investors see strong potential for Bitcoin Minetrix to establish itself this year. For miners seeking sustainability, Bitcoin Minetrix offers an attractive option. Stakers also enjoy yields up to 161% annually on their tokens.