Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

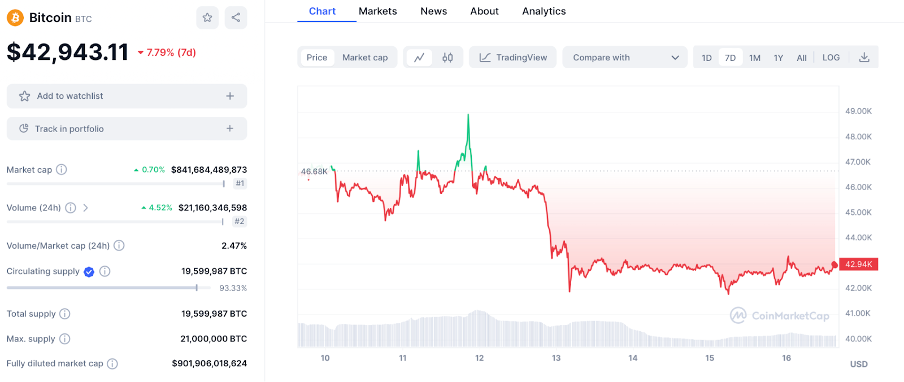

The BTC price has been moving dramatically over the last few days, in response to the approval of spot ETFs. While BTC rose to touch $49K on 11 January, it has slipped to $42K now.

Will market fear drag down BTC below $35K by month-end? Or, will it bounce back into action, coinciding with the Bitcoin Minetrix pump? Here is an analysis.

Market Sentiments Don’t Reflect the Real Picture

The prevailing sentiments in the crypto market do not reflect the current landscape. The approval of BTC ETFs is a positive development in crypto history. While the ongoing downturn was expected, it is primarily driven by short-term traders.

As their trading strategies are closely tied to specific market events, a violent bear market that followed the news is not a surprise.

BTC 7-day price action, CoinMarketCap

But the long-term trajectory of BTC won’t be influenced by these volatile social sentiments. Long-term traders are sturdy in their BTC positions. Like all assets, BTC’s road ahead will be determined by their confidence and commitment, despite the disruptions caused by short-term traders.

The decision of long-term investors is aligned with historical patterns, where years that feature Bitcoin halving events host substantial price surges. With the next Bitcoin halving scheduled for April, BTC is expected to ascend the price charts this year. It could surpass the current all-time high of $68K if broader market conditions favor the asset.

ETF Developments Have Yet to Unfold

The bear market that raged post-ETF approval says little about the significance of the recent developments. These assets that closely track Bitcoin’s price movements represent a substantial milestone for the industry. They give exposure to the digital asset without the need for its direct acquisition and storage.

It will pave the path for institutional recognition and wider adoption of digital assets. Their relevance is further underscored by the fact that they give a fresh avenue of investment for traditional investors navigating economic uncertainty.

Uncertainty in traditional markets often leads to positive crypto market trends. With events like the 2024 US elections and prevailing macroeconomic conditions, we can expect more investors to seek refuge in digital assets in the coming months. The inflow of capital is capable of triggering noticeable price dynamics in the crypto market as a whole.

But the real impact of the ETF market will depend on the magnitude and consistency of inflows into the market over the next months and years. It will be kindled by institutions restructuring their portfolios to include BTC as well as retail products that promote digital asset adoption.

Bold Predictions Are Surfacing

While crypto influencers on Twitter, Telegram, and YouTube are known for making wild price predictions from time to time, that’s not the case now. Leading institutions have come forward with bold BTC price predictions, which notably include Standard Chartered Bank.

Geoffrey Kendrick, the head of financial research at Standard Chartered Bank, notes that “If ETF-related inflows materialize as we expect, we think an end-2025 level closer to [$200,000] is possible”.

BREAKING‼️Global banking giant Standard Chartered says $50-$100 BILLION could flow into #Bitcoin ETFs in 2024 pic.twitter.com/yQobJcs6EA

— Bitcoin Archive (@BTC_Archive) January 8, 2024

The current crypto landscape supports the price prediction. The increasing adoption of digital assets across different sectors will have a positive impact on the price of BTC. More than a utility currency, BTC is seen as a storage of value and a digital collectible at this point.

Investors Are Buying $BTCMTX Alongside

The Bitcoin Minetrix ($BTCMTX) presale crossed the $8.5M milestone amid the chaos that the crypto market played venue to. The token has been taking advantage of the dynamic movements in the BTC market and the evolving ETF landscape. But for good reasons.

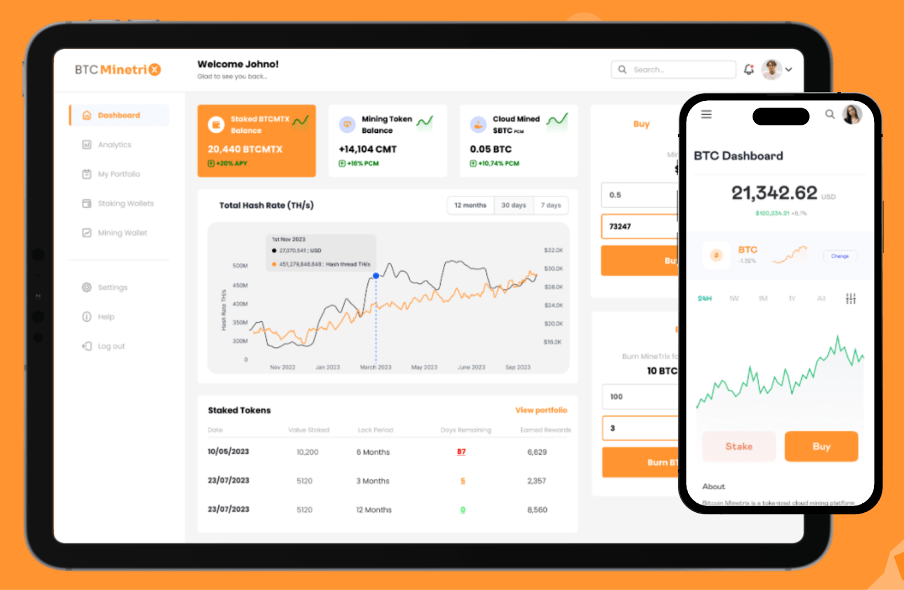

As a new stake-to-mine project that simplifies BTC mining for the masses, $BTCMTX is firmly rooted in its utility. The dashboard allows users to stake their $BTCMTX tokens and earn BTC mining credits in exchange, which are distributed as non-transferable ERC20 credits to prevent thefts and hacks.

Although mining is a lucrative sector, it is confined to a few people who can afford high investment capital and technical expertise. It doesn’t parallel the decentralized vision of the market. To bring the benefits of mining to everyone, the entry barrier to the sector has to be lowered. This is the vision that drives Bitcoin Minetrix.

Despite the surge of cloud mining platforms, retail investors looking for a passive source of income find it hard to break in. They are also known for their share of scams and deceptive schemes. In addition, many of these platforms require an initial investment in hardware and contractual obligations.

Bitcoin Minetrix, on the other hand, just requires users to stake $BTCMTX tokens, which are selling for just $0.0129 now.

Top crypto analysts, including Austin Hilton and Michael Wrubel, have featured the project on their social media channels for its growth potential. If the presale progress is any sign, the project is looking at a bright road ahead. It has the potential to register anywhere from a modest 10X to a wild 50X surge depending on the broader market conditions.

BUY $BTCMTX TOKENS FOR THE PRESALE PRICE