The cryptocurrency market is finally coming back to life in 2023. After a year of consistently falling prices caused by aggressive interest rate hikes and high inflation, it seems that the uncertainty regarding the Federal Reserve’s next move is starting to fade, with the majority of traders expecting a small 0.25% rate hike in the next meeting.

As a result of the reduced uncertainty, the cryptocurrency sector (and equities) started to surge, with Bitcoin climbing by 35% this month, Ethereum by 33%, and Dogecoin up 15%.

The revival in Bitcoin has now allowed the coin to reach 5-month highs – not seen since August 2022. However, despite the overwhelmingly optimistic outlook, there are some analysts that think traders might be getting too far ahead of themselves.

Nevertheless, with interest rate hikes slowing pace in 2023, we investigate which cryptos are worth buying over the coming months. In this article, we will take a look at BTC, ETH, AXS, and MEMAG.

Before we begin, it’s worth recapping the 2022 rising inflation and interest rate hikes that tipped the entire crypto market in the first place.

A Recap of 2022 Inflation and Interest Rates

To understand the cause of inflation experienced during 2022, it is essential to cast our minds back to the beginning of 2020 and the impact the COVID-19 pandemic had on the world.

Countries across the globe started to close their borders in the initial phases of the outbreak. Then, as if that wasn’t enough to spook the economy, companies began closing their doors, forcing employees to work from home. As a result, the US Federal Reserve needed to stimulate the economy and decided to print an overwhelming amount of money.

The process of printing money is known as quantitative easing (QE), which was first introduced in March 2009 to combat the impact of the 2008 stock market crash. The effort of QE is to encourage borrowing by dropping interest rates and stimulating spending to keep the economy afloat.

During 2020, the US Federal Reserve printed $3.3 trillion US Dollars, which is roughly one-fifth of all the US dollars in circulation. In fact, the US Federal Reserve printed more money in 2020 than they printed in the previous 100 years – combined. The following chart really puts this into perspective;

With so much money flowing into the economy, it’s no surprise that inflation started to creep higher. Inflation is a situation where prices in the economy begin to rise. As a result, the cost of your weekly shop starts to increase, alongside all of the goods and services that you consume.

Inflation is typically measured using economic reports, such as the Consumer Price Index (CPI). The CPI measures the change in the price of a basket of goods within an economy over a certain period of time.

As expected, inflation started to creep higher slowly during the latter half of 2020. By May 2021, the CPI had crossed the 5% level, which had not been seen since the 2008 market recession. However, it wasn’t until May 2022 that the CPI hit 8.6%, putting it at a 40-year high and causing investors across the globe to panic;

The situation of inflation can become somewhat dangerous if prices rise too quickly, which is why central banks then step in to combat inflation. One of the tools they use to curb inflation is increasing interest rates – and that is exactly what they did.

The US Federal Reserve, the central bank that dictates monetary and fiscal policy in the United States, started to increase interest rates. At first, they began to raise interest rates by a small 25 BPS in March 2022. Then, a 50 BPS increase came in May 2022.

However, despite the initial rate hikes, inflation did not start to settle. With the 40-year high inflation rate in May 2022, the US Federal Reserve took drastic measures and started to increase interest rates at the most aggressive single-meeting pace since 1994. In June 2022, the US Fed increased interest rates by 75 BPS and continued to increase by the same amount in the following four meetings.

The following table shows the breakdown of interest rate hikes by meetings;

| FOMC Meeting Date | Rate Change (bps) | Federal Funds Rate |

| December 2022 | +50 | 4.25% – 4.5% |

| Nov 2, 2022 | +75 | 3.75% to 4.00% |

| Sept 21, 2022 | +75 | 3.00% to 3.25% |

| July 27, 2022 | +75 | 2.25% to 2.5% |

| June 16, 2022 | +75 | 1.5% to 1.75% |

| May 5, 2022 | +50 | 0.75% to 1.00% |

| March 17, 2022 | +25 | 0.25% to 0.50% |

In the latest meeting, the US Fed decreased its aggressive pace of rate hikes, electing to go with a 50 BPS rise. This caused a market momentum shift as traders started to believe the worst of the aggressive interest rate hikes might be over.

Has Inflation Started to Cool?

Assets sensitive to interest rates, such as cryptocurrencies and equities, rely on a turnaround in monetary policy to provide the fundamental environment where they can recover.

The hawkish monetary policy through 2022 caused the worst bear market in crypto and equities. Crypto fell as much as 80% from its highs, with Bitcoin reaching a bottom of $15,480 in November 2022. The S&P 500 fell as much as 30% before hitting a bottom of 3500 in October 2022.

The CPI report released on January 12th, 2023, showed a 0.1% decrease in overall inflation – the largest drop since April 2020

As a result, the market became more optimistic after learning that inflation had fallen consistently over the past six consecutive months. Furthermore, the pace of inflation in the US fell to its lowest level in more than a year in December 2022, a sign that price pressures may have peaked.

To put this into perspective, over the past 6-months, the US CPI fell from 9.1% to 6.5%;

This resulted in market traders becoming optimistic that the aggressive rate hikes might finally start to slow down – with some getting ahead of themselves by expecting rate cuts as early as the next meeting.

What are Traders Expecting from the February Fed Meeting?

The recent data from the CPI suggests that the US Fed might further slow its pace of monetary tightening. As a result, many traders expect the US Fed to continue slowing the pace of higher interest rates by enacting a 25 BPS interest rate hike.

The announcement will come from the FOMC on Wednesday, Feb 1st, at 2 PM ET.

However, although the US Fed might be reducing the pace of rate hikes, they are still a long way away from cutting interest rates. As a result, many analysts are stating that traders might be getting ahead of themselves too soon.

Are Traders Getting Ahead of Themselves? “Wen Pivot?”

With central banks showing signs of easing – it could set the stage for a strong year. However, if crypto is to sustain the new price rises, the central banks need to shift from increasing interest rates to cutting interest rates.

Even with a small 25 BPS interest rate hike in February, interest rates are still going higher – which isn’t a pivot.

Fed chairman, Jerome Powell, has been adamant that rates will not taper until inflation is firmly under control, and still a long way away from the 2% target as they currently sit above 6%.

Although the Fed tightening seems to be getting lighter, it is more likely that they will choose to keep interest rates at the current levels for an extended period of time. As a result, this means that the economy could sit at interest rates above 5% for the majority of 2023 before the Fed starts to cut – which is the move that traders are waiting for. Therefore, traders could be getting a little too excited too early, which could result in another Bitcoin price fall beneath $20,000.

What Cryptos to Buy If We See 25 BPS Rate Hike?

If we do see a 25 BPS interest rate hike in February, we are likely to see price surges in the biggest cryptocurrencies on the market. In particular, Bitcoin and Ethereum are the top two candidates to buy in this situation.

Bitcoin is currently sitting near the $23,000 level after witnessing a strong 35% price hike over the past month of trading. This has allowed Bitcoin to hit highs not seen since August 2022;

At the same time, Ethereum is currently sitting at a price of $1,600 after witnessing a surge of 33% over the past month of trading;

The top two cryptocurrencies are most certainly the safest option to invest in. However, they typically won’t provide the highest returns.

If you are accustomed to taking a little more risk, other sectors within the market might provide higher returns. Specifically, the play-to-earn industry is seeing somewhat of a strong comeback.

Return of the Play-to-Earn Sector?

The play-to-earn sector took one of the most severe hits in 2022, as heavyweights such as Axie Infinity and The Sandbox plummeted by well over 90%. However, it seems that play-to-earn might be making a return as some of the prominent projects are seeing significant price hikes this month during the cryptocurrency revival.

The total market capitalization for the play-to-earn sector is now trading close to $11 billion, with heavyweights such as APE, SAND, and ENJ seeing substantial gains. However, the stand-out project in this sector of the market is undoubtedly Axie Infinity (AXS).

Over the past 30 days, AXS managed to surge by an incredible 75%, providing some of the highest returns in the top-100 ranked coins in the crypto market;

The recent price hike allowed the market cap for Axie to break back above $1.4 billion as investors started to re-enter the gaming token.

Although AXS is providing strong returns for investors, other tokens are still yet to follow in its footsteps, which could result in substantial gains for brave investors.

One of the stand-out projects to consider investing in during the play-to-earn sector revival is Meta Masters Guild.

Meta Masters Guild – Changing the Dynamics of Play-to-Earn

The entire idea behind the Meta Masters Guild project is to create fun and addictive games with playable NFTs that allow players to earn rewards, stake, and trade. However, Meta Masters Guild isn’t seeking to become just another play-to-earn project. Instead, it aims to become the future of Web3 gaming by introducing a new concept called play-and-earn.

Meta Masters Guild Built on Stable Economics

Meta Masters Guild is the world’s first mobile-focused Web3 gaming guild on a mission to build high-quality, blockchain-based mobile games to form a completely decentralized ecosystem. The ecosystem is designed to allow members to earn sustainable rewards in exchange for their gaming time and contributions to the ecosystem.

The team behind Meta Masters Guild believes the concept of play-to-earn is fundamentally flawed. So instead of play-to-earn, they prefer a new description they’ve coined called “Play-and-Earn.”

The team doesn’t want people to play their games with the specific goal of just making money. If the entire player base is seeking to solely profit from the game, they know the earning mechanics can’t be sustainable over the long run. So instead, they want to create high-quality games that players can spend money on and then allow them to earn their money back and be compensated for the value they put into the ecosystem.

This is the fundamental concept behind play-and-earn. Players can play the games for free, with the option of purchasing upgrades, and then are rewarded for their time spent on the game.

Players earn GEMs in all titles under the Meta Masters Guild umbrella and have complete autonomy on what to do with their rewards. For example, players can swap their GEMs for MEMAG and stake the MEMAG into the platform for additional rewards. Alternatively, they could use the GEMs to purchase in-game NFTs or cash them out to ETH to bank their earnings.

Overall, the entire ecosystem is designed to incentivize engagement and reward those adding value to the ecosystem through gameplay or building the online community.

Three AAA Games Already Lined Up

One of the great things about the Meta Masters Guild is that they already have three separate gaming titles under varying stages of development – even without the presale being concluded.

In a partnership with Gamearound, a Web3 gaming developer, Meta Masters Guild has the following games in development;

- Meta Kart Racers

- Raid NFT

- Meta Masters World

Meta Kart Racers is the flagship offering from the platform and will be the first game to be released. In this player-vs-player racing game, players have to compete with each other in a championship structure while escaping the evil Meta overlords. In addition, they can earn tokens by collecting GEMs for their performance on the track. It’s a skill-based game where the best players make the highest rewards.

The other two games cover separate genres, so all members of the Meta Masters Guild have something to choose from. Raid NFT is a turn-based fantasy fighting game, and Meta Masters World is an open-world game with less structure, allowing players to explore an expansive universe.

The great thing about these games is that they all incorporate the MEMAG token, giving it significant utility.

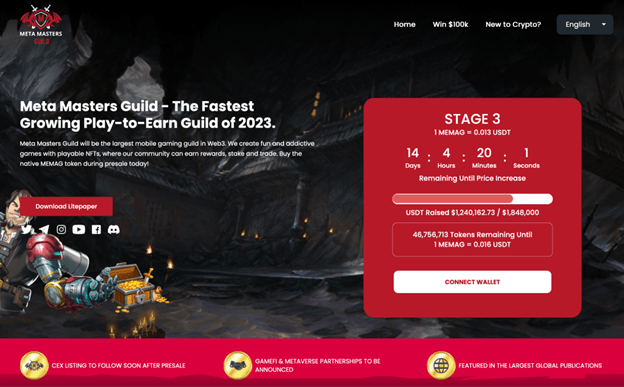

Presale Bursts Past $1 Million Funding Milestone

The presale for the MEMAG token crossed the $1 million milestone at the start of the week, then raised another $200,000 just 24 hours later. The traction behind the presale is quickly building, especially with the play-to-earn sector returning to life.

Investors are quickly piling into this presale due to play-and-earn’s impact on the overall Web3 gaming sector. With sustainable economic rewards at the forefront of the project, investors expect huge returns when the MEMAG token finally hits centralized exchanges.

The presale is now in stage 3, selling the token for $0.013 per MEMAG. In total, there will be seven stages in the presale, which will see increasing prices during each consecutive stage. For example, phase four will commence once the presale hits the $1.8 million funding milestone, and the price will increase to $0.016 per MEMAG.

Therefore, the earlier you get involved, the higher profits you will have when the token finally hits exchanges. The team has stated that the token will list on centralized exchanges with a price of $0.023, ensuring most investors come out of the presale with substantial profits.

Overall, the slowing down of interest rate hikes has put the entire crypto market in a very optimistic mood. Presales such as Meta Masters Guild provide fantastic opportunities to get into new projects at the lowest possible prices. If the US Fed continues to slow the rate hikes, MEMAG should be set for significant gains once the presale ends later in Q1 2023.