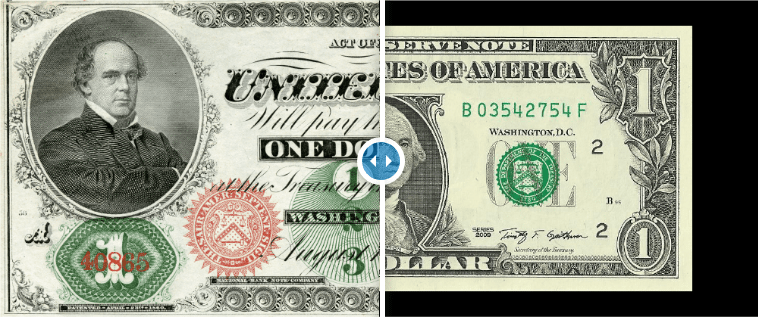

It’s no wonder that numismatics find the evolution of currency to be so enthralling – it most certainly is. The study of coin and paper money is truly fascinating. In the US, Congress authorized the first notes in 1861, and since then we have seen multiple changes taking place. The primary reason for the ever-changing nature of US currency is security considerations. Fraud remains a concern for the US mint, and for good reason. If currency is fraudulently manufactured, it undermines (degrades) the value of official fiat currency.

To better understand this concept, consider supply and demand. If there is excess supply of any commodity, the price naturally drops. If it is readily available on the market, and demand cannot clear the current supply then price must fall to clear excess capacity. This is precisely what happens with commodities like crude oil, iron ore, gold, copper, natural gas etc. However, if the reverse scenario takes place – demand exceeds supply – price rises.

With fake currency such as fraudulently manufactured USD, excess supply floods the markets and this undermines the value of the USD. Besides for legal considerations, only one authority is permitted to manufacture USD – the US mint. To counter the efforts of counterfeit currency producers, the US mint routinely upgrades security features in currency to prevent fraudsters from dominating the market.

While it is near impossible to remove all fraudulently produced currency, most of it can be removed by continually upgrading USD, and destroying stockpiles and plates used in the manufacture of fake currency. Over the years, the US mint has created several $1 bills, $5 bills, $10 bills, $20 bills, and $100 bills. Today, the largest bill in circulation is the $100 bill, but there are still several $500 bills, $1,000 bills, $5,000 bills and $10,000 bills from prior to 1969 available.

The Future of Currency

There can be no doubt that the digital currency age is upon us, and the US will likely move towards greater adoption of cryptocurrency in months and years to come. Already, non-traditional currency like BTC has made its mark on the markets.

Today, digital currency such as Bitcoin, Litecoin, Ethereum Classic, Ethereum, Dogecoin, DASH and Ripple are dominating the market in a big way. There are scores of cryptocurrencies like Bitcoin and Altcoin (anything other than Bitcoin) in circulation. What makes cryptocurrency so much more enticing than traditional currency is the blockchain technology it is based on.

It’s hard to grasp a concept that is not grounded in tangible assets. Bitcoin is decentralized, largely unregulated, anonymous, secure, and entirely online. To the unsuspecting eye, it is like owning real estate in space. It cannot be possessed, other than by way of a digital code, yet it has value because people give it value.

The advances in online security, encryption protocols and cryptography have allowed BTC to take the lead as far as technological wizardry is concerned. Nothing is immune to counterfeiters, but the level of expertise that is required to hack into a virtual Fort Knox-style cryptocurrency platform (blockchain technology) is sufficiently advanced to deter most cyber criminals.

Managing Money in a Digital Age

Our reliance on cash and cash systems (debit cards, credit cards, online banking accounts etc.) is slowly being replaced by a move towards a cashless society with mobile payment solutions, digital currencies, and the like. This affects a myriad of industries, including banks, nonbanks and other online financial institutions tasked with assisting clients with debt-related issues.

A paradigm shift is occurring, and we could soon find ourselves in a situation where debt consolidation options will be available for cryptocurrency-related debt. BTC-related lines of credit could be consolidated with low-interest lines of BTC credit loans. Already, countries like the Philippines and South Korea have moved swiftly towards regulating digital currency. China initially toyed with an outright ban on Bitcoin, but that may no longer be the case. The future is digital, but out technology and regulations will need to play catch-up before widespread adoption can take place.