Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

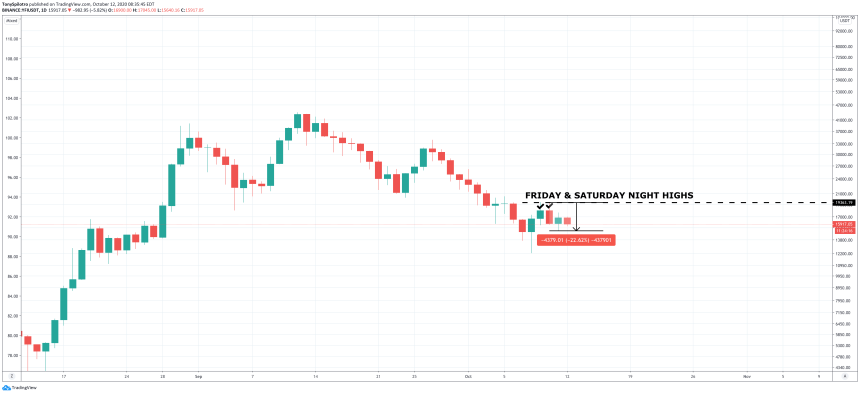

Yearn.Finance closed last week with a strong rebound that left DeFi investors hopeful a bottom was in. However, from this weekend’s high notes set on Friday and Saturday night, YFI has fallen over 20% and is now at risk of an even deeper decline. Here’s why.

Yearn.Finance Falls Over 20% From Weekend High Hangover

Due to Yearn.Finance’s finite, 30,000 token supply, the crypto asset is far more volatile than Bitcoin, or most other altcoins for that matter.

Related Reading | DeFi Token Yearn.Finance (YFI) Breaks Massive Pattern Neckline, What’s Next?

The asset rises and falls tens of thousands of dollars per week, as a result. The same volatility and scarce supply are responsible for YFI’s rise to its all-time high above $40,000, making it four times the price per BTC.

Yearn.Finance YFIUSDT Weekend DeFi Hangover Down 20% From Friday and Saturday Night Highs | Source: TradingView

That top was set when Yearn.Finance began trading on Coinbase, and early investors had a fiat gateway to cash out of. The fall and push and pull that’s followed, formed a massive head and shoulders pattern that has since broken downward.

And although a recovery did indeed look likely after a 60% rise from lows in less than a week, the pattern’s target was never reached, so more downside is still likely.

Average Directional Index Says DeFi and YFI Bear Trend Is Only Just Beginning

YFI could drop as deep as $10,000 or below, according to the target. Making matters worse, it could kick off an extended bear trend in Yearn.Finance, and through extension, potentially the greater DeFi space.

Related Reading | Coinbase Users Lose $25K On Yearn.Finance Since DeFi Token’s Debut

Crypto assets typically rise and fall together. For example, if Bitcoin suddenly tanked, it would bring down Ethereum and the rest of DeFi tokens down with it. Bitcoin “playing nice” would have kept YFI at higher prices, but the breakdown from $12,000 triggered the initial selloff.

Yearn.Finance YFIUSDT Average Direction Index Bear Trend Just Beginning | Source: TradingView

If the rest of the crypto market falls now, it could be the final push the Average Directional Index needs to confirm a bearish trend in YFI.

According to the tool, a reading of 20 or higher suggests a trend is growing in strength and likely to sustain higher. The trend is also likely to be bearish, as the red Directional Movement Indicator on the ADX is higher than the green, signaling negative price action ahead.

If bears can confirm the trend on the ADX, the head and shoulders pattern’s targets below $10,000 could be next.

Featured image from Deposit Photos, Chats from TradingView