Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

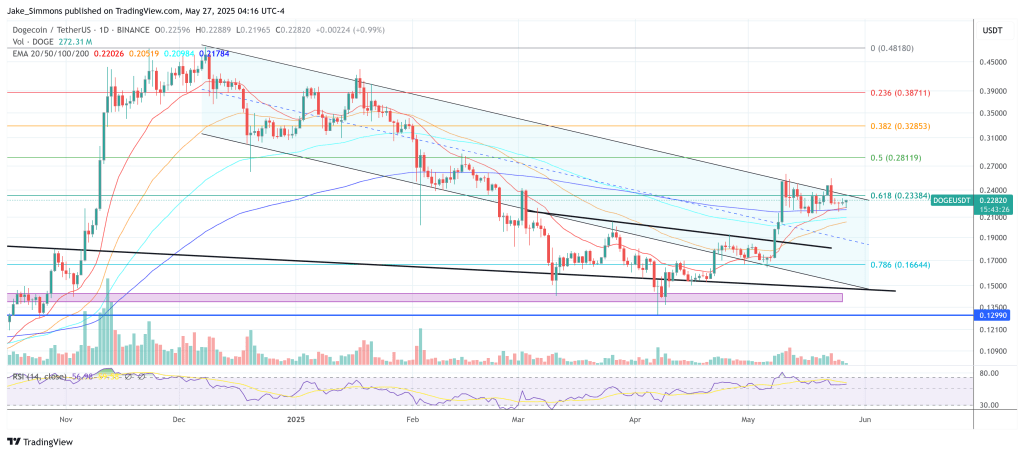

Dogecoin slipped toward the lower end of its month-long range on Tuesday as independent chartist Quantum Ascent delivered a granular breakdown of why he believes the meme-coin is part-way through a corrective cascade that could end in the high-teen-cent zone. At mid-afternoon in Europe the token hovered at $0.228, nearly 12% below its May 11 peak and nursing modest intraday losses.

Dogecoin Enters Danger Zone

Reviewing the daily chart, the analyst rewound to the explosive move that began on May 8 and produced a 50% three-session surge: “Last time we checked in over here on May 8, when we got this big green candle, we said, guys, looks like we’re kicking off our fifth microwave here,” he reminded viewers. His initial upside projection had been a modest 2.36 Fibonacci extension, yet Dogecoin “actually went up much higher,” a sign, he added, of strong retail momentum but also of a pattern that now looks finished.

Quantum Ascent has since migrated his wave counts to show that the thrust was merely the fifth sub-wave inside a larger first-wave advance. “We’re in the middle of an ABC as we speak… these blue waves are going to move over to here,” he said, redrawing the labels to mark the ongoing retracement. In Elliott-wave parlance the C-leg must at least equal the A-leg, and the presenter converted that rule into arithmetic: “Eighteen-point-eight per cent from there… that’s one of our targets, right around 20.5 cents.”

Deeper penetration is not only possible but statistically common, he argued, because “oftentimes it makes it down into this third or fourth wave.” Measuring from the early-May low to the mid-May top, he plotted the 0.500, 0.618 and 0.702 retracements — a band stretching roughly from 19.5 cents to 17 cents — and called it “the logical zone for a first-and-second-wave reset.” A shallower halt at the 0.382, around 21.8 cents, would in his view be “a pretty shallow correction.”

One attempt to break higher has already stalled in what he labelled the “danger zone” between the 0.618 and 0.786 retracements: “We took a stab to break through, but we didn’t close… we wicked above it, ended up right there at the 702, the rejection, and now it’s kind of rolling over again.” That failure leaves a nearby trigger level: “We break this low here at 21 cents, then we’re for sure seeing 20.5 cents.”

The tape action, he added, resembles a Wyckoff re-accumulation structure: “Looks like honestly a form of Wyckoff and we’re building the sign of strength right here before we take off.” Yet the bullish pay-off, if it comes, likely lies several weeks ahead. The correction underway marks “a macro two that we’re working on right now,” he said, emphasising that the subsequent third wave would be decisive: “Macro wave threes — those are the daddies. Those are the big ones. That’s where we’re really going to get some juice.”

Macro context tempers any near-term enthusiasm. Bitcoin — whose own fifth-wave top arrived sooner and overshot its prior cycle high — has already rolled into an ABC of its own, and Quantum Ascent expects altcoins to “settle down” alongside the bellwether. “Whether it goes quickly in a C-wave or we just kind of keep meandering, we’re going to have to wait and see,” he concluded, urging followers to watch volume profiles and closing levels rather than intraday wicks.

As always, Elliott-wave counts remain interpretative rather than predictive, and traders should align any positioning with their personal risk limits. Dogecoin retains the eighth-largest market capitalisation in crypto, but elevated volatility means even minor price gaps can translate into double-digit percentage swings.

At press time, DOGE traded at $0.228.