Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

According to recent hedge fund Ark Invest data, a historical amount of the Bitcoin supply has remained dormant for at least a year, with roughly 70% of the circulating supply unmoved in June 2023. Despite looming economic uncertainty, this dynamic occurs alongside a surge in institutional interest in the cryptocurrency.

In June, several factors contributed to the increased robustness of the Bitcoin price action. Ark Invest, a renowned asset management firm, highlighted this trend in its recent Bitcoin report. Their data sheds light on the risen support from steadfast holders and a noticeable shift in institutional sentiment towards Bitcoin.

Bitcoin Holder Base Strength

According to Ark Invest’s analysis, around 70% of Bitcoin’s circulating supply has not changed hands for at least one year. This statistic signifies an increase in the confidence of long-term Bitcoin investors, contributing to a sturdier holder base.

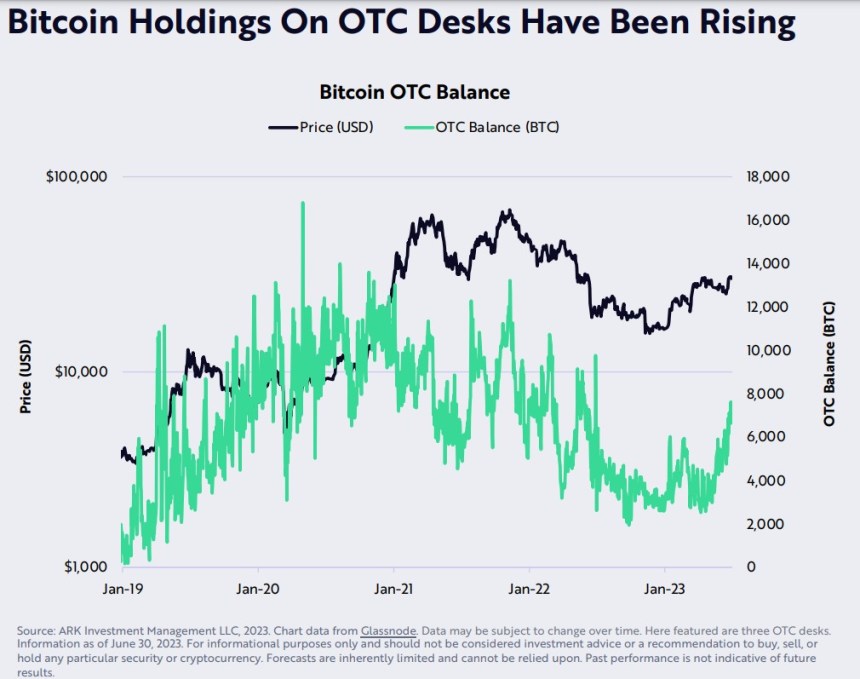

As seen in the chart below, there has been a spike in Over-the-Counter Transactions (OTC) that hint at growing institutional demand. A one-year high was seen in the balance of BTC held on over-the-counter (OTC) trading desks, typically used as a gauge for institutional activity.

The 60% increase in the OTC Bitcoin balance by quarter-end insinuates that institutions and capital allocators are concentrating more on Bitcoin as an investment avenue.

The report stated the following:

In our view, increased balances on OTC desks suggest that institutions and other large capital allocators are focused increasingly on bitcoin.

Meanwhile, diverging trends were noted between USDC and Tether, two prominent stablecoins. While USDC’s supply shrunk by 37% year-to-date, Tether’s supply increased by 25%, hitting a record high in June. Ark Invest attributes this divergence to the uncertain U.S. regulatory climate, which might drive some crypto activity overseas.

Rising Institutional Activity Amid Market Dynamics

An interesting development in June was the Grayscale Bitcoin Trust (GBTC) discount reduction went from 42% to 30% following BlackRock’s Bitcoin spot Exchange Traded Fund (ETF) filing. According to Ark Invest’s report, this lower discount implies market anticipation for a Bitcoin spot ETF approval, subsequently enhancing the possibility of GBTC transitioning into an ETF.

Ark Invest’s report cautioned about potential economic challenges despite these positive indications. According to the Purchasing Managers ‘ Index, manufacturing sector data suggests a plunge in new orders. Concurrently, the U.S. Gross Domestic Income (GDI) shows signs of contraction, indicating the possibility of an impending recession.

BTC is trading above $30,000, following its recovery from last month when its value dipped below that. The asset’s downturn was largely spurred by a legal challenge launched by the U.S. Securities and Exchange Commission (SEC) against Binance and Coinbase, the two foremost crypto exchanges.

Nonetheless, Bitcoin’s recent rally comes on the heels of endorsement from heavyweight financial institutions such as BlackRock. This embrace of the digital currency market has injected a dose of optimism, driving Bitcoin’s substantial growth.

Yesterday, the asset reclaimed its $31,000 mark. However, over the past 24 hours, BTC has retraced and currently trades for $30,400 at the time of writing.

Featured image from iStock, Chart from TradingView