Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

When the Square mastermind declared hyperinflation was coming to the US, the world shook. With a single tweet, Jack Dorsey lit a fire that keeps on burning. In that first article, NewsBTC compiled the first reactions to this dangerous idea. Then, we told you about Peter Schiff’s unimaginative response. Now, it’s time for the big guns. Ark Invest’s Cathie Wood answered with her deflationary theory, and Elon Musk, MicroStrategy’s Michael Saylor, and notorious financial podcaster Preston Pysh answered.

Related Reading | Michael Saylor Brings The Thunder To Venezuelan Bitcoin-Only Podcast

Also, entrepreneur and former Coinbase CTO, Balaji Srinivasan, threw extra logs to the fire. He was one of the first responders, offering a reward for the design of a decentralized inflation dashboard. Besides them, Wired columnist Virginia Heffernan provided the 1984-like response, and Reason magazine answered her promptly.

This article is full of knowledge and interesting theories for you to ponder. Make some popcorn and enjoy the show.

Hyperinflation And Cathie Wood’s Theory Of Deflation

This woman doesn’t mince words. “In 2008-09, when the Fed started quantitative easing, I thought that inflation would take off. I was wrong. Instead, velocity – the rate at which money turns over per year – declined, taking away its inflationary sting. Velocity still is falling.” Is she right? Isn’t purchasing power the real victim of the rampant money printing that all governments are engaging in?

In 2008-09, when the Fed started quantitative easing, I thought that inflation would take off. I was wrong. Instead, velocity – the rate at which money turns over per year – declined, taking away its inflationary sting. Velocity still is falling. https://t.co/tFaXSaCKqS

— Cathie Wood (@CathieDWood) October 25, 2021

Let’s read her whole theory before jumping to conclusions. According to Wood, “three sources of deflation will overcome the supply chain-induced inflation that is wreaking havoc on the global economy.” Those are:

1– “Artificial intelligence (AI) training costs, for example, are dropping 40-70% at an annual rate, a record-breaking deflationary force.”

When costs and prices decline, velocity and disinflation – if not deflation – follow. If consumers and businesses believe that prices will fall in the future, they will wait to buy buy goods and services, pushing the velocity of money down.

— Cathie Wood (@CathieDWood) October 25, 2021

2.- ”Creative destruction, thanks to disruptive innovation. They have not invested enough in innovation and probably will be forced to service their debts by selling increasingly obsolete goods at discounts: deflation.”

They leveraged their balance sheets to pay dividends and buy back shares, “manufacturing” earnings per share. They have not invested enough in innovation and probably will be forced to service their debts by selling increasingly obsolete goods at discounts: deflation.

— Cathie Wood (@CathieDWood) October 25, 2021

3.- “Businesses shut down and were caught flat-footed as goods consumption took off during the coronavirus crisis, they still are scrambling to catch up, probably double- and triple-ordering beyond their needs.” + “As a result, once the holiday season passes and companies face excess supplies, prices should unwind.”

As a result, once the holiday season passes and companies face excess supplies, prices should unwind. Some commodity prices – lumber and iron ore – already have dropped 50%, China’s crackdowns are one of the reasons. The oil price is an outlier and psychologically important.

— Cathie Wood (@CathieDWood) October 25, 2021

She ends her Twitter thread with an unironical “Truth always wins!” Well, Cathy, the truth is that governments everywhere are printing money non-stop. They’re literally inflating the monetary supply. We’re not talking hyperinflation yet, but still…

In any case, let’s invite other celebrities to chip in.

Elon, Saylor, Pysh, And Balaji Respond To Wood

Bitcoin-denier Elon Musk provides a practical answer, “I don’t know about long-term, but short-term we are seeing strong inflationary pressure.” Wood’s theory has some teeth to it, but there’s no denying that the prices are rising. And that the money printer goes brrrrrrrr. Musk also links to this satirical article. No mention of hyperinflation here.

Then, it’s time for Bitcoin maximalist extraordinaire Michael Saylor. “Inflation is a vector, and it is clearly evident in an array of products, services, & assets not currently measured by CPI or PCE. Bitcoin is the most practical solution for a consumer, investor, or corporation seeking inflation protection over the long term.” Inflation is clearly evident and that’s that. No mention of hyperinflation either.

Inflation is a vector, and it is clearly evident in an array of products, services, & assets not currently measured by CPI or PCE. #Bitcoin is the most practical solution for a consumer, investor, or corporation seeking inflation protection over the long term.

— Michael Saylor⚡️ (@saylor) October 26, 2021

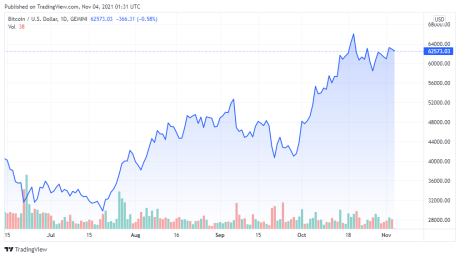

BTC price chart for 11/03/2021 on Gemini | Source: BTC/USD on TradingView.com

Investor and podcaster Preston Pysh goes even further, “That’s because all the debasement keeps nesting itself into the cap rates of anything equity based AND the prices of Fixed Income. It should all make total sense when the market they are manipulating IS the fixed income market.” Market manipulation. Total control of the data. Those are factors to consider.

That’s because all the debasement keeps nesting itself into the cap rates of anything equity based AND the prices of Fixed Income. It should all make total sense when the market they are manipulating IS the fixed income market.

— Preston Pysh (@PrestonPysh) October 26, 2021

Contributing to the conversation for the second time, Balajis plays peacemaker and says that both Dorsey and Wood are “right in different ways.” According to him, “Everything technology disrupts will see prices fall. Everything the state subsidizes will see prices rise.” That’s because “The state actively prevents automation in the sectors it controls.” So, the current scenario is “a race between technological hyperdeflation & state-caused inflation, possibly hyperinflation.”

Both @jack and @CathieDWood are right in different ways.

Everything technology disrupts will see prices fall. Everything the state subsidizes will see prices rise. Like the graph below, but even more extreme. https://t.co/KDIGBH9iZp pic.twitter.com/JYTlw4xF55

— Balaji (@balajis) October 25, 2021

Manifesting Hyperinflation Into Existence

There’s an old wives’ tale that says that by only mentioning hyperinflation, one could generate a chain of unfortunate events that end up causing it. Cathie Wood brushed on the subject by saying “If consumers and businesses believe that prices will fall in the future, they will wait to buy goods and services, pushing the velocity of money down.”

Taking it to another level, Wired columnist Virginia Heffernan brings 1984 vibes to the discussion. “Like “divorce” in a marriage this word Jack tweeted should not be uttered unless you’re trying to bring it into being. No one shd take investment advice from someone who sees himself as making markets.”

Like “divorce” in a marriage this word @jack tweeted should not be uttered unless you’re trying to bring it into being.

No one shd take investment advice from someone who sees himself as making markets.

How insanely reckless to tweet this. Immoral. Jack, ban thyself. pic.twitter.com/fl7CWRXdN8

— Virginia Heffernan (@page88) October 24, 2021

Could Jack Dorsey bring hyperinflation with a tweet? Maybe. However, isn’t the main suspect the relentless money printing the governments are engaged in? That seems to be a determinating factor, since that’s exactly what inflation means. There are no two ways about it, the governments are inflating the money supply with their constant money printing. And Jack Dorsey’s tweet is just a comment on the situation.

Related Reading | Is Evergrande Defaulting? Is This The Reason For China’s War Against Bitcoin?

In any case, Reason magazine has another interpretation for Heffernan’s bizarre behavior. Apparently, historically speaking, when hyperinflation happens the next move by the money printers is to prohibit people from even mentioning hyperinflation.

“It is true that expectations do affect behavior and therefore prices. But any brouhaha Dorsey could stir up with his monetary shitpost obviously pales in comparison to the potent macroeconomics factors—spending and printing bonanzas, high debt overhangs, lockdown policies, and the current situation with the supply chain, to name a few—that are truly driving the “transitory” inflation that our widely respected experts do admit.”

Still, the USA is far from hyperinflation and the Dollar is still the reserve currency of the world, which gives them leeway.

Featured Image by jggrz from Pixabay - Charts by TradingView