Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Key Highlights

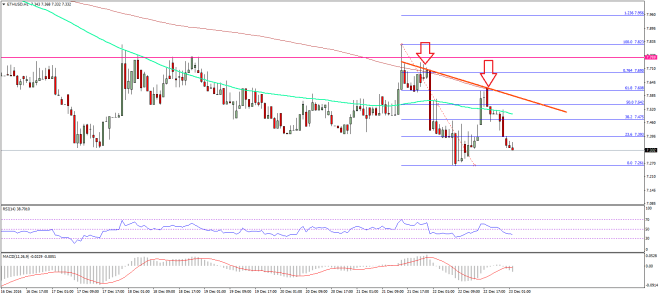

- ETH price after recovering a few points against the US Dollar, failed and moved down towards $7.25.

- Yesterday’s highlighted bullish trend line on the hourly chart (data feed via SimpleFX) of ETH/USD was broken to ignite a new intraday low.

- The pair is once again heading lower, and looks set to challenge the recent low.

Ethereum price remained under a bearish pressure against the US Dollar and Bitcoin. Is the main reason for ETH/USD decline rising BTC?

Ethereum Price Decline

Every time there is a minor correction in ETH price versus the US Dollar sellers appear and take the price down. One of the main reasons of a decline in ETH/USD is the rising Bitcoin price. The BTC/USD pair recently surged above $860 and looking set for more gains. This kept pressure on the ETH/BTC pair and in turn ETH price. The ETH/USD pair fell further recently, and even broke yesterday’s highlighted bullish trend line on the hourly chart (data feed via SimpleFX).

A new Intraday low of $7.26 was formed before the price started recovering once again. There was a move above the 38.2% Fib retracement level of the last decline from the $7.82 high to $7.26 low. However, the upside move was stopped by a bearish trend line on the hourly chart. Moreover, the 61.8% Fib retracement level of the last decline from the $7.82 high to $7.26 low also acted as a resistance.

The ETH/USD pair is once again heading lower, and remains below the 100 hourly simple moving average. There is a high chance of the price retesting the recent low of $7.26, where buyers may appear.

Hourly MACD – The MACD is back in the bearish slope, and suggesting more losses in the near term.

Hourly RSI – The RSI recently moved below the 50 level, and heading north.

Major Support Level – $7.40

Major Resistance Level – $7.60

Charts courtesy – SimpleFX