Ethereum has been closely tracking Bitcoin’s price action throughout the past several days and weeks, which exposed it to some intense downwards pressure yesterday.

It has been able to post a swift recovery from its daily lows, and has remained firmly within its long-held consolidation phase within the $230 to $250 range.

Although it is outperforming Bitcoin slightly at the moment, ETH still remains closely correlated to the benchmark crypto, and where it goes next will likely depend on how BTC reacts to its newly formed resistance around $9,700.

Analysts are noting that ETH was able to defend against a sustained dip below a key support level. This could bolster how it trades in the hours and days ahead.

Another factor that could play into how it trends in the coming hours is the massive rise in options trading volume Ethereum has seen as of late.

These options contracts could contribute to future volatility.

Ethereum Posts Strong Rebound from Recent Lows as Bulls Defend Key Support

At the time of writing, Ethereum is trading up marginally at its current price of $235.

The crypto is currently up from daily lows of $230, although it still has a way to go before it reaches its multi-day highs of $250.

The visit to these highs is what caused it to lose its stability, as the rejection it faced here sparked a sharp selloff that caused it to plunge.

This turbulence came about in tandem with Bitcoin’s volatility, as the benchmark crypto rallied to highs of $10,050 before facing a harsh selloff that sent it down to lows of $9,000.

ETH’s correlation with BTC still remains strong, and it rebounded overnight alongside Bitcoin.

Analysts are claiming that Ethereum has recaptured a key support level against its USD trading pair, leading one analyst to note that it “doesn’t look bad at all.”

Whether or not it holds above this level will likely depend on whether Bitcoin can stabilize within the mid-$9,000 region.

ETH Options Open Interest Rockets to All-Time Highs

Ethereum’s price may also see some volatility in the near-future due to heightened options trading activity.

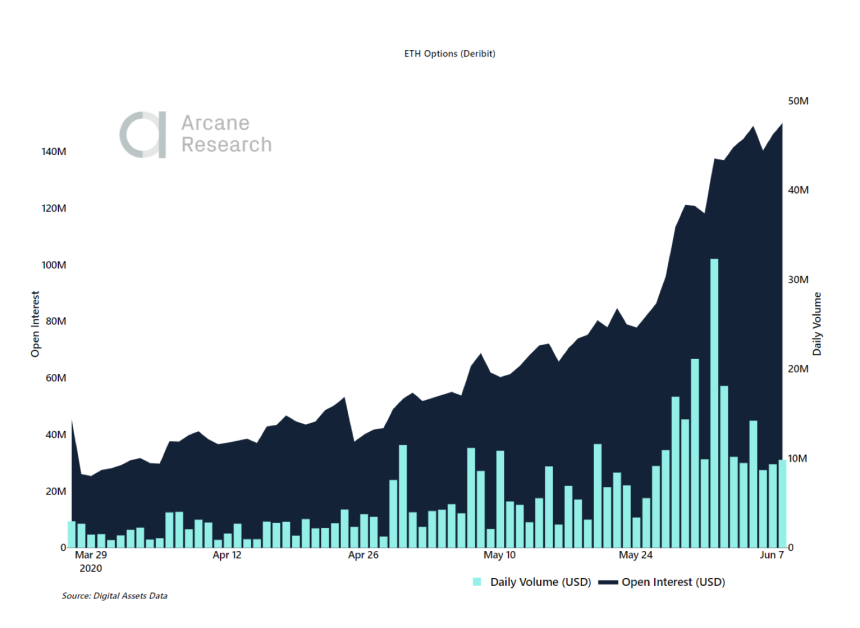

Arcane Research spoke about this within a recently released report, noting that OI for the crypto’s options now sits around $150 million.

“The Open Interest is now approx. $150 million, an all-time high. Much higher than the previous high around $90 million from last summer.”

They also offered a chart clearly showing the massive growth in both OI and trading volume that the cryptocurrency’s options have seen over the past couple of weeks.

This number may continue ballooning in the near-term, as OKEx recently launched contracts for the crypto. Previously, Deribit was the only provider of Ethereum options contracts.

Featured image from Shutterstock. Charts from TradingView.