Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

According to Fundstrat research, Ether could climb much higher before the end of 2025, with price targets ranging from $10,000 to as high as $15,000.

Reports show Ether jumped about 60% over the past 30 days and hit a four-year high near $4,770 in early trading, while other coverage put the token at $4,694 and noted a 78% surge over an eight-week stretch.

Those moves have pushed Ether close to its all-time peak, and fund managers are taking notice.

Fundstrat Targets And Rationale

According to Fundstrat’s chief information officer Tom Lee and head of digital asset research Sean Farrell, institutional forces and new rules are key drivers.

They point to stablecoin work and tokenized projects being built mostly on Ethereum, and they cite regulatory efforts such as the GENIUS Act and the SEC’s so-called Project Crypto as factors that could speed Wall Street’s move onto blockchain rails.

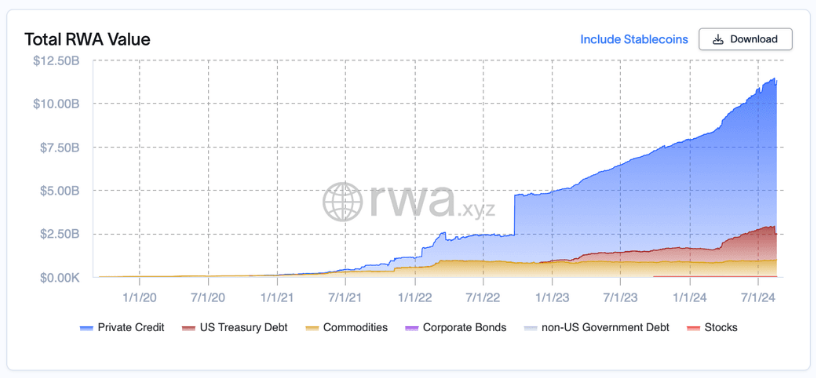

Based on data, Ethereum holds a commanding 55% share of the $25 billion real-world asset tokenization sector, a stat that Fundstrat uses to argue for broader institutional adoption.

Institutional Demand And Big Buyers

Reports have disclosed large-scale corporate accumulation that several analysts say is taking supply off the market.

BitMine Immersion Technologies has reportedly added about 1.2 million ETH since early July, leaving the company with roughly $5.5 billion worth of Ether on its books. Company stock (BMNR) has been volatile, with some coverage pointing to a 1,300% jump over a short period.

Fundstrat and other observers say those kinds of corporate treasuries, combined with fresh ETF flows, could create a structural bid for ETH if the buying is sustained.

Rachael Lucas, a crypto analyst at BTC Markets, described these positions as strategic and long-term, saying they remove “substantial liquidity” from trading pools.

Market Momentum And Price Claims

According to Fundstrat, Ether is outperforming Bitcoin this year. One set of figures put ETH’s year-to-date gain at 28% against Bitcoin’s 18%, while other reports more recently showed ETH up 41% YTD and Bitcoin up 30% YTD, with BTC trading near $121,000 in that snapshot.

Based on reports, Fundstrat’s analysts view ETH as a major macro trade for the next 10 to 15 years if institutional and regulatory trends continue to push demand higher.

Analysts caution that lofty targets will need sustained, large inflows to become reality. Watch for the pace and consistency of ETF flows, corporate treasury disclosures, and any regulatory moves around stablecoins and custody rules.

There’s also a practical concern: big, concentrated buys can tighten markets quickly but may also reverse if sentiment shifts or liquidity needs change.

According to analysis and public comments from Fundstrat, the bullish case for Ether is clear and backed by specific numbers: $10,000 to $15,000 targets, corporate treasuries holding millions of ETH, and rapid recent gains.

Featured image from Meta, chart from TradingView