Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

On-chain data shows a large portion of the Ethereum market cap was acquired near the current price, making ETH’s position potentially fragile.

$123 Billion In Ethereum Market Cap Sits Close To Cost Basis

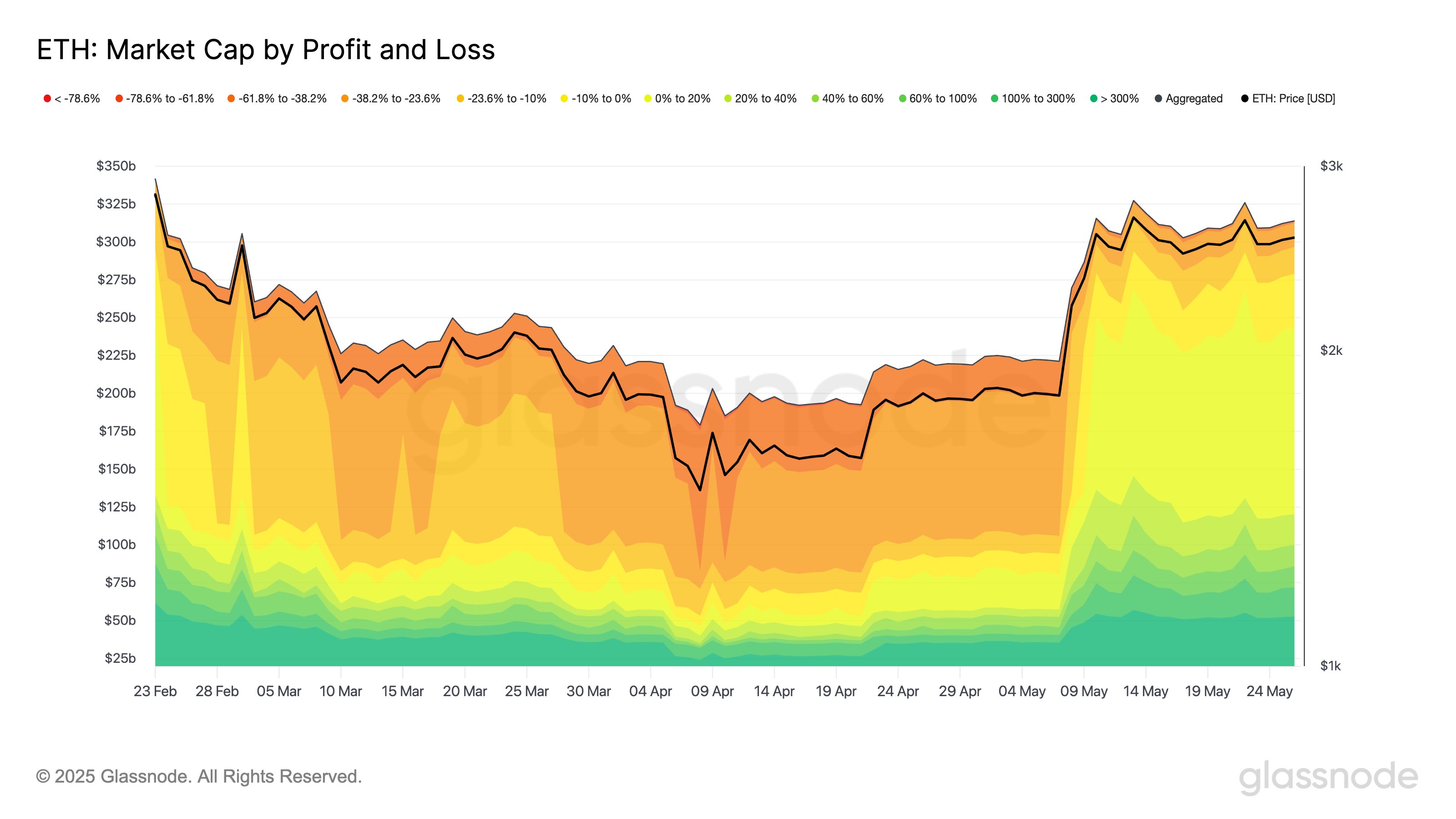

As explained by the on-chain analytics firm Glassnode in a new post on X, the largest share of the Ethereum market cap is currently above the spot price by just 0 to 20%.

The indicator of relevance here is the “Market Cap by Profit and Loss,” which tells us about how much of the ETH market cap has its cost basis sitting within what distance of the cryptocurrency’s price.

Formally, the market cap is defined as the total circulating supply of the asset multiplied by the latest spot value. As such, the market cap of a particular group of tokens would be just their number multiplied by the price.

The Market Cap by Profit and Loss refers to the last transaction price of these coins to determine whether the market cap held by them is in profit or loss right now. Naturally, the cost basis of the tokens being under the latest price suggests they are in profit, while the opposite case puts them in the loss category.

Now, here is the chart for the indicator shared by the analytics firm that shows the trend in its value for Ethereum over the past few months:

As displayed in the above graph, the largest share of the Ethereum market cap is currently contained within the 0 to 20% cohort. This group includes coins that currently have their value between 0 and 20% above their cost basis. Naturally, even the tokens on the higher end of the range wouldn’t be in that big a profit at the moment.

In total, about $123 billion of the ETH market cap, equivalent to almost 38%, falls under this category. Considering the delicate profit-loss balance that all this supply has, it’s possible that even an ordinary pullback could send a large number of tokens underwater. “Despite recent gains, ETH remains in a fragile position,” notes Glassnode.

In some other news, Ethereum has witnessed a buying push from the whales during the past month, as analyst Ali Martinez has pointed out in an X post.

“Whales” are defined as the investors carrying between 10,000 and 100,000 tokens of the cryptocurrency. From the chart, it’s apparent that the total Ethereum supply held by this cohort has registered a notable increase in the last few weeks.

More specifically, the whales have added around 1 million ETH (worth around $2.7 billion at the current exchange rate) to their holdings in this period.

ETH Price

Ethereum observed a decline below the $2,500 level earlier, but it seems the coin has found a rebound as it’s back at $2,700.