Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

- The size of the Ethereum options market on Friday equaled the size of the Bitcoin options market in December 2018, according to data provided by Skew.

- Ethereum’s growth in the derivatives market pointed to its increasing institutionalization like Bitcoin.

- It further hinted at a breakout price rally ahead for the second-largest cryptocurrency.

Ethereum is tailing Bitcoin in terms of institutional adoption.

The second-largest cryptocurrency by market capitalization achieved new mettle in its derivatives market. According to data fetched by Skew, the size of the Ethereum options market on Friday touched levels that Bitcoin reached back in December 2018.

Ethereum open interest across multiple derivatives exchanged touched Bitcoin's 2018 levels. Source: Skew

The Skew chart showed the total number of outstanding options contracts nearing $150 million-mark, its highest since its launch. Meanwhile, the current open interest in Bitcoin options was about six times larger than that of Etheruem – at around $1 billion.

Capital Injection Grows

In retrospect, outstanding contracts represent unsettled deals in the derivatives market. They equal the total number of purchased and sold cryptocurrency options. An increasing number of open interest means more money is coming into the options market – and vice versa.

Nevertheless, the capital that enters the market could be for both bearish and bullish contracts. Therefore, the only way to gauge investors’ sentiment is to measure the total number of “put” options (bearish) against “call” options (bullish).

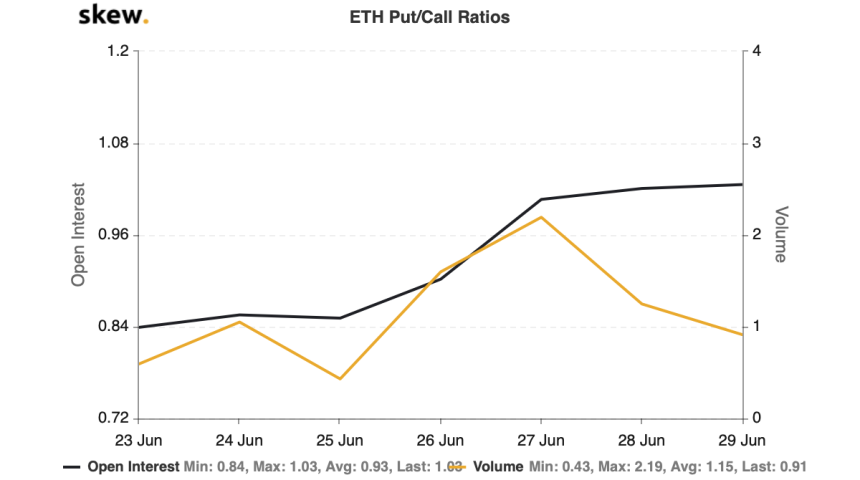

If the so-called Put/Call ratio is above 1, then it means a majority of investors expect the options contracts to fall. Nevertheless, the rate is prone to fluctuating as the new contracts with polar-opposite bias get opened or closed regularly.

Ethereum Put/Call ratio recorded until Monday. Source: Skew

That said, an increasing open interest does not confirm a spot price trend. But it represents a growing interest of prominent traders and institutional investors in the underlying asset. Therefore, Ethereum is visibly winning in terms of its options market growth.

Taking Cues from Bitcoin

Part of the reason why Ethereum is looking at a rising institutional interest is its involvement in a string of growth-based projects. The cryptocurrency’s underlying blockchain network supports the world’s leading stablecoins (USDT, USDX, PAX, etc.) and decentralized finance projects (Maker, Sythentix, dYdX, Compound).

While not the same, but a similar set of fundamentals helped grow Bitcoin in the conscience of larger institutions. The cryptocurrency crashed to near $3,100 in December 2018 but rose back at the heights of the U.S.-China trade war, yuan devaluation, and Facebook’s foray into the digital currency space with Libra.

That partially helped institutional traders to start exposing their portfolios to the Bitcoin derivatives market, including both options and futures. Just recently, billionaire hedge fund manager Paul Tudor Jones invested an undisclosed sum into bitcoin futures.

Ethereum price chart showings it recovering from March 2020 crash. Source: TradingView.com

Ethereum is looking at similar opportunities due to its technological growth. The cryptocurrency could witness its derivatives market swell in size as more and more institutions look for higher-yield alternatives. As a result, its open interest may keep rising while helping its spot sentiment grew bullish as well.