Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum has been woefully underperforming Bitcoin over the past few days, with the cryptocurrency’s USD pair fast approaching a crucial “last-ditch” support level could catalyze a massive downtrend – should it be broken below.

The weakness ETH has seen against both USD and BTC has come about despite it incurring massive fundamental growth.

The cryptocurrency has seen its daily transaction volume rocket to its 2017 highs, with the explosively popular DeFi trend directing massive user inflows to the ETH blockchain.

This has created a divergence between Ethereum’s technical and fundamental strength.

Analysts don’t believe that the fundamental growth seen in recent weeks will be enough to stop it from seeing further downside.

One analyst is now calling for a 20% decline against its Bitcoin trading pair.

This weakness could be compounded by a massive influx of tokens into exchange wallets, signaling that investors are prepared to offload their Ethereum holdings if it makes any big near-term movements.

Ethereum At Risk of Seeing Major Losses in Coming Days

At the time of writing, Ethereum is trading down roughly 1% at its current price of $224. This is around the price level at which it has been trading over the past day.

It has posted a similar loss against its Bitcoin trading pair, currently trading at 0.0245 BTC.

Its decline over the past couple of days has caused it to break firmly below the trading range that it has been caught within over the past several weeks.

This range exists between $230 and $250 on its USD trading pair, and the sustained decline beneath its lower boundary seems to indicate that it may be forming a mid-term downtrend.

Ethereum’s current weakness is also well-pronounced while looking towards its BTC trading pair.

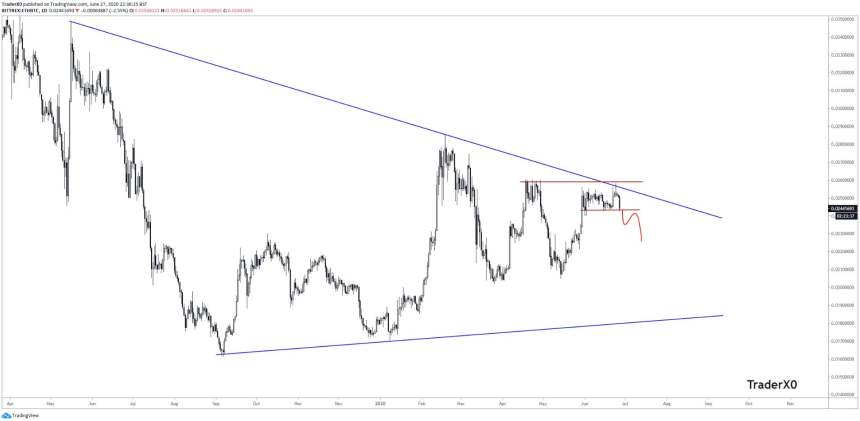

One analyst recently put forth a chart showing that it may soon decline by over 20% due to its posting a rejection at the upper boundary of a triangle formation.

“ETHBTC: Feel free to remind me why my bearish bias on ETH over the last several weeks will be wrong?”

Image Courtesy of TraderXO. Chart via TradingView

This Exchange Trend is Bearish for ETH

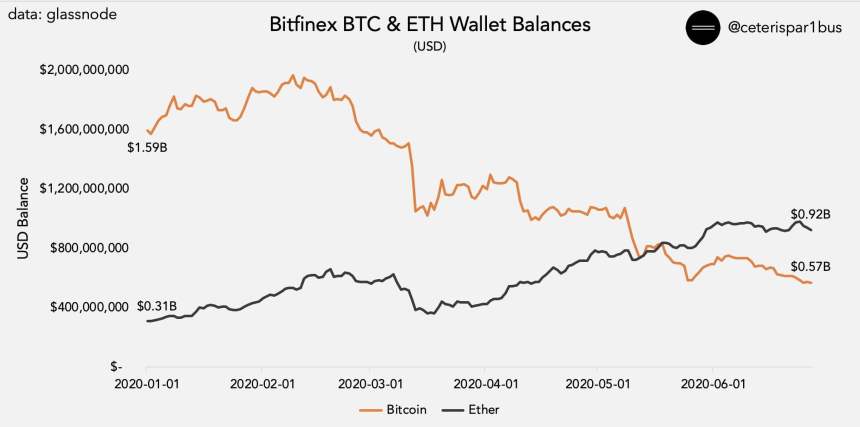

One data analyst recently observed that cryptocurrency exchange Bitfinex had seen a massive rise in the amount of Ethereum on the platform.

This seems to indicate that traders are taking short-term positions on ETH, with a goal of exiting their positions should it push any higher in the near-term.

“So Bitfinex now holds nearly double the USD balance of $ETH vs. $BTC. Two completely opposite trends this year. $1B of bitcoin outflow.”

Image Courtesy of Ceteris Paribus.

Featured image from Shutterstock. Charts from TradingView.