Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Fidelity has secured Canada’s selection from regulators to become the country’s first-ever bitcoin custodian. The move will allow the financial services firm to operate bitcoin custody and trading in the country, geared towards institutional investors. Additionally, the move will likely open the door for more Canadian institutions to invest in crypto.

First-Mover Fidelity

Fidelity Clearing Canada (FCC) unveiled a press release on Wednesday showcasing the announcement. The release quickly notes that FCC is “Canada’s first Investment Industry Regulatory Organization of Canada (IIROC) regulated entity to offer this digital currency trading and custody solution dedicated for institutional investors, including mutual funds and exchange-traded funds.”

FCC President Scott Mackenzie stated in the release that “the demand for investing in digital assets is growing considerably and institutional investors have been looking for a regulated dealer platform to access this asset class.” This announcement opens that door for investors. To date, Canadian investors had to resort to mutual funds and ETFs for crypto exposure. Additionally, bitcoin funds available in Canada thus far have been offered from U.S.-based custodians.

FCC holds north of $200B in AUM (assets under management). The firm also provides services to over 100 investment companies in Canada. Reports state that based on the U.S. precedent, Fidelity expects a four-year runway to set up services in the cryptocurrency market. The full scale and scope of how those services are rolled out is yet to be disclosed.

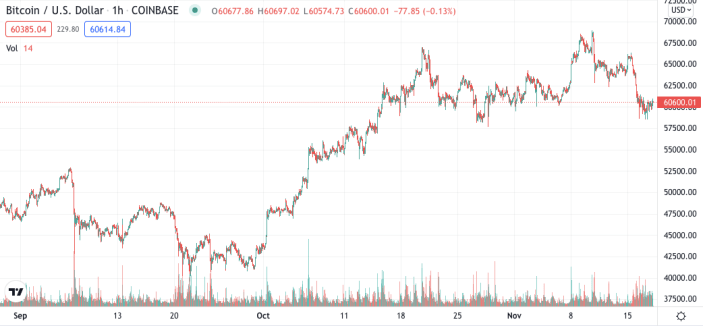

Bitcoin's exceptional performance has resulted in increased global demand for crypto support amongst institutional investment firms. | Source: BTC-USD on TradingView.com

Related Reading | Preview Of The Peak: November Rains Red For Bitcoin Holders

Fidelity’s Perspective

The financial services firm is seemingly bullish on crypto in the big picture. At the very least, the firm recognizes the staying power and understands that it needs to carve out it’s role in crypto. Last month, a Fidelity analyst showed cautious optimism in bitcoin’s “diamond hand” owners. Despite this, the analyst also believed that bitcoin was a ways away from the psychological benchmark of $100,000. To date, the analysts expectations have seemingly been about on par.

The firm first launched U.S.-based crypto services in 2018. By May of this year, Fidelity opened it’s first bitcoin fund in the U.S., raising over $100M from around 80 accredited investors.

Fidelity in recent months also released their annual Fidelity Digital report. That report had a lot of interesting finds, including that nine of ten surveyed investors found digital assets appealing. With just the past few months of activity alone, it’s clear that Fidelity understands the importance of what’s at stake – and today’s announcement in Canada will position them quite well in the country to take advantage of that knowledge.

Related Reading | Lone Bitcoin Bitfinex Whale Wants More Blood, Buyers Beware?

Featured image from Pexels, Charts from TradingView.com