Bitcoin has been moving sideways in the past day after a 20% dropped at the start of the week. The first cryptocurrency by market was showing strong conviction to the upside, but ultimately the excessive greed in the market could have played against the bulls.

At the time of writing, Bitcoin trades at $46,875 with a 1.2% profit in the daily chart.

A recent report by QCP Capital confirmed that the flash crash was preceded by an increase in leverage positions on the derivatives sector. The firm previously warned about the potential downside risk as derivatives were signaling “nervousness” amongst investors.

When the price of Bitcoin broke the $52,000 barrier, the outlook “worsened”, the firm said. In addition, there was a sentiment of “disbelief” in the market that the rally that took Bitcoin into those levels was unable to “fail”.

In previous months, May, June, and July, a similar situation occurred with a “Buy the rumor, sell the news” catalyzer, in this case the implementation of the Bitcoin Law in El Salvador. In addition to an increase in fair and uncertainty due to the Securities and Exchange Commission (SEC) cracked down on crypto exchange Coinbase.

Related Reading | Bitcoin On-Chain Data Reveals Why This Selloff Is Different From May’s Crash

In that sense, investor Alex Wice took to Twitter to announced that he has “exited” his Bitcoin position. Wice believe the outlook in the market has changed with the recent crash.

The rally from near BTC’s price yearly open started driven by a fresh surge in institutional investment. Wice highlighted the participation of Alameda Research, the investment arm of crypto exchange FTX, as bullish factor previous to the crash. However, he added:

Since this nuke, longs are no longer cozy. We’ve changed from up only to ball game – we update for nukes to be much more likely now. Overleveraging is back. Post bounce, longs are low edge. We could even goblin town.

Bitcoin Data Speaks, Will The Bears Take Back Control?

In that sense, Bitcoin follow two scenarios, more “crab like” price action in the coming days, as it did during May, and June, or a straight dropped most likely back into the $30,000 levels.

Analyst Ben Lilly has found a correlation with the recent price action to the downside and a cool off in the non-fungible tokens (NFT) sector. As Ben Lilly pointed out, the EIP-1559 update as made Ethereum more susceptible to variations in on-chain activity.

Related Reading | New To Bitcoin? Learn To Trade Crypto With The NewsBTC Trading Course

Similarly, Ethereum was one of the cryptocurrencies leading the market during the rally. In addition, Bitcoin fundamentals and other indicators turned bearish suggesting a pullback, Ben Lilly added:

(…) even the morning of the drop we witnessed a transaction that tends to take place when a “by the dip” opportunity is likely to happen. This is what I mean when I saw a few odd transactions took place onchain that led us to believe some of this was premeditated.

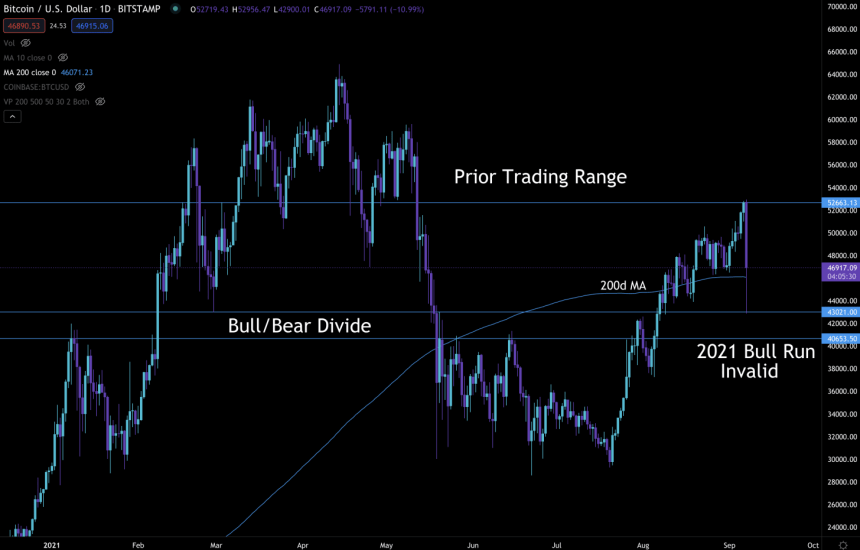

Bitcoin could be at a turning point, according to the analyst. In the coming days, the fate of the bull-run could be decided if BTC’s price continues to trend to the downside to form a “Bull/Bear Divide”, as seen below.

In that context, long term BTC holders will become importance. Their activity, as measured by the Spent Output Age Bands (In pink below), could indicate a “liquidity exit”.

With that in mind, the analyst doesn’t rule out a potential short squeeze and more continuation if that holds, Ben Lilly added:

With a quick change in sentiment the market will sometimes prey on overly bearish behavior. Meaning price can quickly squeeze out shorts who entered late. Once this easy pickings scenario plays out we’ll see how the structure looks. If it’s a big squeeze then maybe we can get another attempt at $53k.