Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

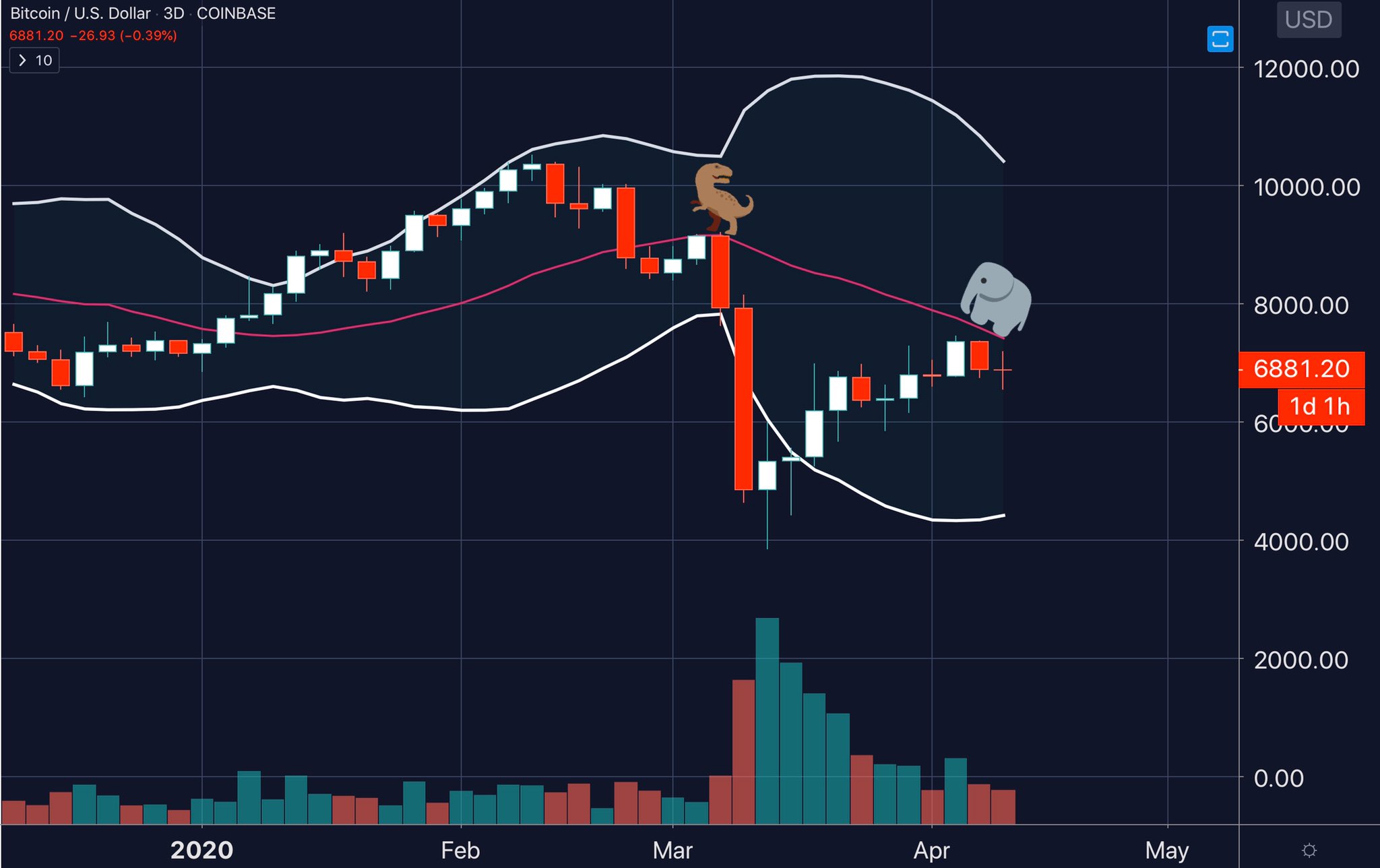

Bitcoin may seem as though it moves without rhyme or rhythm, but like all markets, the cryptocurrency’s key levels and directionality can be shown with technical analysis, too. Unfortunately for bulls, the cryptocurrency remains below a key technical analysis level that marked the start of Bitcoin’s 50% crash at the beginning of March.

Bitcoin Remains Below Key Technical Level

According to a popular crypto trader, Bitcoin was recently rejected from the middle Bollinger Band (likely the 20-period simple moving average) on the three-day chart, which is notable in that the level is a “pivot point” for markets.

Indeed, the cryptocurrency rallied 40% from the mid-$7,000s to $10,500 when it was last broken above at the start of 2020, then crashed from it to $3,700 when it was rejected by the Bollinger Band in March.

The cryptocurrency seems poised to test the level, around $7,200, again, as the price of Bitcoin has crept higher from $6,600 to $6,900 as of the time of this article’s writing.

Can BTC Surmount It?

Unfortunately, while the cryptocurrency seemingly had a shot at overtaking this key trend level over the course of last week, it is unlikely to play out as traders currently believe Bitcoin is set to head back toward the lows in the $5,000s.

Per previous reports from NewsBTC, trader Eric Thies believes that Bitcoin’s “macro RSI [time] frames [are] looking bearish overall, suggesting an incoming drop after one last potential surge higher in the coming week.”

Backing this sentiment, he pointed to the fact that despite Bitcoin rallying just over 100 percent from the $3,700 bottom to the local highs of $7,470, it failed to push the RSI, an indicator of trend strength, over historical resistance levels.

Interesting RSI analysis on #BTC

Summary — Macro RSI frames looking bearish overall, suggesting an incoming drop after one last potential surge up in the coming week(ish).

Expecting it it to be in sync with potential stock market dump

(Photos best if read in TF order) pic.twitter.com/fbXoCg52Vy

— Crypto Thies (@kingthies) April 11, 2020

To add to this, another prominent crypto analyst, Mayne, revealed in a recent tweet that Bitcoin is in the midst of printing the exact same bearish chart structure that marked the $10,500 top in February of this year.

The structure is a rising wedge on falling volumes, and BTC has been in the midst of breaking below this wedge over the past few days.

Should the wedge play out as it did in February, the cryptocurrency market could soon be subject to yet another drop lower, which would likely coincide with a return to the $5,000s at the very least.

Related Reading: Crypto Tidbits: Bitcoin Loses $7k, Blockchain Layoffs, Ethereum DeFi Explodes

There’s Hope for Bitcoin

Alas, there is hope for Bitcoin. In spite of these bearish technical signs, there are some fundamentals that may override the bearish outlook of the Bollinger Band rejection, rising wedge, and RSI correction.

Over the past few days, multiple data sets within the crypto industry have registered a strong increase over the past few days, indicating an increased demand for Bitcoin, which could render the technical analyses above moot.

Data sets that have seen lots of growth recent are as follows: downloads and rankings of crypto-focused mobile apps, the “Alexa” rankings of Bitcoin exchanges, simple market volumes, and exchange-specific indicators.

Retail:

– 81% of IG's Bitcoin traders are long.

– 70% of Coinbase users are buying BTC. It's been higher over the last week.

– @decryptmedia reports Kraken, OKEx, Bitfinex, Paxful, and Luno have seen user sign-ups increase dramatically, some by 300%. pic.twitter.com/Il7dCdqMLB

— Nick Chong (@n1ckchong) April 9, 2020

Photo by Andy Beales on Unsplash