Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Highly volatile cryptocurrencies like Bitcoin, Ethereum, and other altcoins can behave irrationally at any given moment, especially when turbulence strikes. But what happened this morning on the US branch of Binance, was shocking for even those who have seen flash crashes happen in real time.

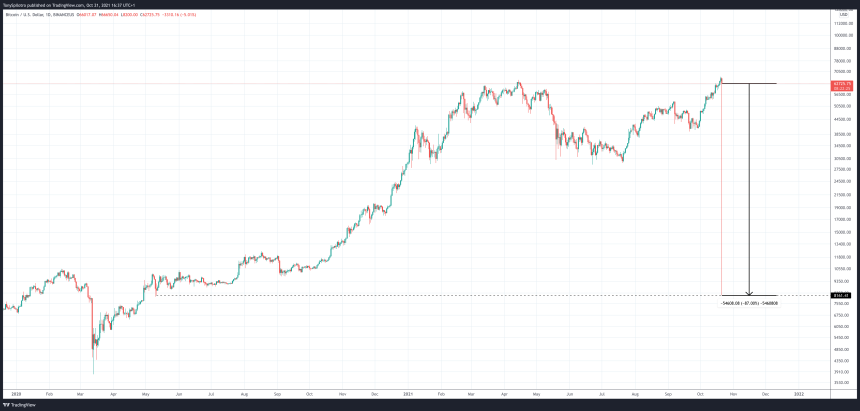

The result of a massive wick left on the BTCUSD chart was a violent trip to $8,000 where coins were potentially exchanged for prices that are currently 87% lower than where Bitcoin is trading at right now. Here is a closer look at what went down, and what might have happened as a result.

Flash Crash On Binance US Takes BTC Back To $8,200

If you’ve been in crypto for some time, chances are you’ve heard some horror stories. Other users have lost funds due to hacks, sent funds to the wrong address, or worse. What few ever experience, however, is getting caught up in a flash crash.

Related Reading | Bitcoin Price Sets New All-Time High Above $65,000

We don’t mean a particular strong selloff, but a “flash crash” that sends the price of an asset diving so deep, it can often bring them back to close to zero.

While this morning Bitcoin price didn’t fall back to nothing, it did get a digit knocked off its price tag, and about 87% of the value per coin, according to the Binance US BTCUSD price chart.

The wick left behind on Binance US reached August 2020 levels | Source: BTCUSD on TradingView.com

The flash crash took the cost per BTC back to pre-bull market breakout levels from back in August 2020. It also was roughly an 87% fall from current prices, which was a larger drawdown percentage wise than the bear market from $20,000 to $3,200 at the low.

Bloody Bitcoin Wick Leaves Shock And Awe Behind

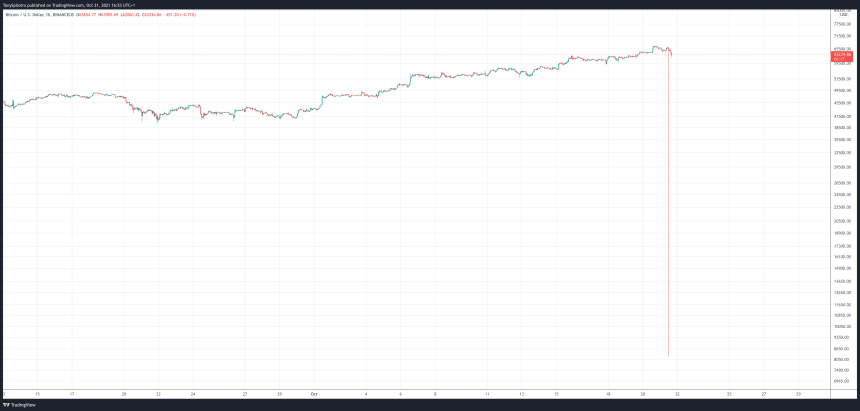

The hourly chart below is a better demonstration of how ridiculous the wick looked on lower timeframes as it was happening. The wick reached as low as around $8,200.

The hourly chart shows how deadline the wick was | Source: BTCUSD on TradingView.com

Any lucky Binance US users with a limit order ready to go could have gotten filled during the madness, which also means that some poor pleb could have sold their coins at a cost of $8,200 – significantly lower than the current price per Bitcoin, which just yesterday reached a new all-time high.

Related Reading | Bitcoin Price Prepares To Blast Off Back Into RSI “Bull Zone”

In the past, assets like Chainlink and even Ethereum have flash crashed down to nearly zero. Keeping orders ready on an exchange can take advantage of situations like the above. But these rare events aren’t predictable and can strike at any moment.

https://twitter.com/scoinaldo/status/1451173736560971779?s=12

Follow @TonySpilotroBTC on Twitter or join the TonyTradesBTC Telegram for exclusive daily market insights and technical analysis education. Please note: Content is educational and should not be considered investment advice.

Featured image from iStockPhoto, Charts from TradingView.com