Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

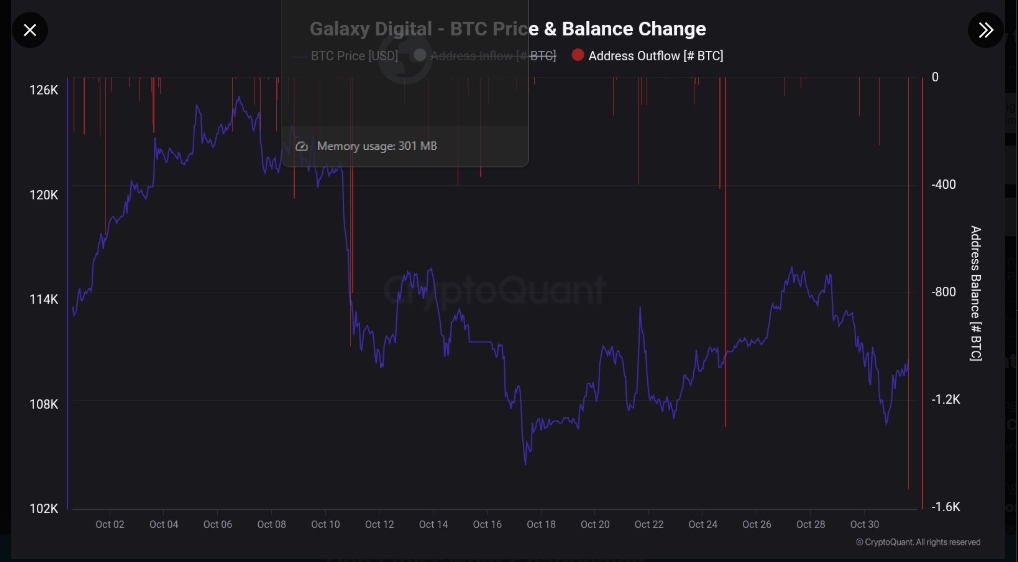

Mike Novogratz’s Galaxy Digital has moved more Bitcoin out of its wallets, stirring fresh debate about whether big players are selling or just handling client business.

According to on-chain trackers and posts shared by analytics firm CryptoQuant, a total of 1,531 BTC was recently transferred out of wallets linked to Galaxy.

Galaxy’s Client Trades

Galaxy acts as both a merchant bank and a trading desk for institutions, so large transfers don’t always mean the firm is cutting its own exposure.

Reports have pointed out that Galaxy has executed major client orders before — including a notional sale of over 80,000 BTC in the past quarter — and many of those trades are handled off-exchange via OTC channels.

Those facts make it hard to read short-term outflows as pure profit-taking by Novogratz’s firm.

Galaxy Digital Outflow Spikes 🚨

Over 1,531 BTC moved out of Galaxy Digital wallets — a clear sign of rising short-term selling pressure in the market. 📉 pic.twitter.com/6BdsOZFatM

— Maartunn (@JA_Maartun) October 31, 2025

On-Chain Pattern Adds Detail

The 1,531 BTC movement follows a string of recorded outflows. For example, trackers logged an outflow of 411 BTC on Oct. 24, suggesting this isn’t an isolated blip but part of several recent transfers tied to the firm’s wallets.

Some analysts say the pattern looks like growing selling pressure. Other market watchers say the sums are consistent with client execution and rebalancing.

Market Sentiment Split

Sentiment indicators show a split mood. Social measures and the so-called Fear and Greed gauge have dipped into fear territory lately. Yet heads of some asset managers argue the opposite.

Bitwise CEO Hunter Horsley has said institutions are “rushing in,” and he points to growing institutional interest as a signal that demand is building at higher levels.

Those two views sit at odds: visible outflows and rocky short-term flows on one side, and growing institutional allocation on the other.

Price Context And What It Means

Bitcoin has been trading just a little over $110,000 as these moves happen. That price level matters because traders watch it as a barrier for bulls.

When big transfers land near key price points, they get extra attention; some see them as profit-taking, others as routine client service. Either way, the net effect on price depends on whether buyers step in to absorb the supply.

Signals Traders Are Watching

Keep an eye on three items: ETF flows, OTC activity, and on-chain outflows from known custodians. Spot crypto ETFs have shown net withdrawals in recent weeks, which can sap demand even if big institutions are slowly buying elsewhere.

If ETF outflows persist while wallets tied to major brokers keep moving coins out, price pressure may rise. But if inflows return to spot ETFs or large buyers match the OTC sales, that pressure can ease quickly.

Featured image from Unsplash, chart from TradingView