Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

SWRV, the native token of the newly-launched decentralized finance platform, Swerve Finance, surged 33 percent in the last 24 hours.

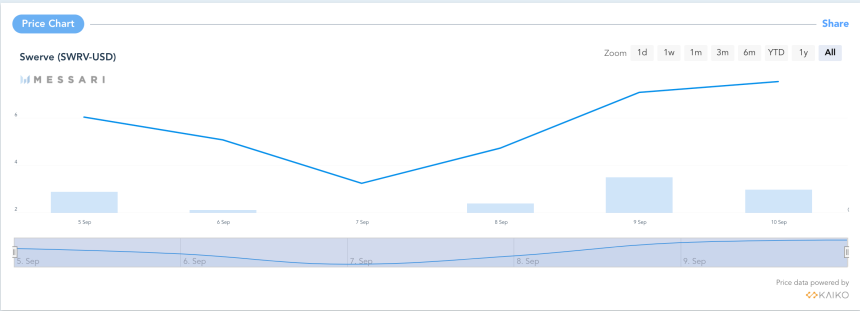

The SWRV/USD exchange rate changed hands for $7.53 per token as of 1100 GMT Thursday. It was now trading above $6.026, its previous record high established on its first day of trading on September 5. As of this Monday, SWRV had even fallen to as low as $3.221, according to data fetched by Messari.

New DeFi token SWRV in a pumping phase. Source: Messari

The enormously volatile price moves illustrated a higher-risk-higher-reward sentiment in the SWRV market. Traders, who have earlier missed/experienced similar explosive price moves in the tokens of newly-launched DeFi projects, jumped into SWRV to earn volcanic profits.

Meanwhile, the jumps today also came as Huobi Global added an SWRV deposit option to its trading platform.

🚀LAUNCH TIME!

🔥#Huobi adds $BOT, $SWRV and $CVP!

Deposit open -Trading starts soon!

Details 👇 #InnoHub

— HTX (@HTX_Global) September 10, 2020

Other than that, nothing else would explain the incredible price rise of the Swerve Finance token.

The Project

Swerve Finance is a clone project, a liquidity pool on Ethereum for efficient stablecoin trading with full token distribution among liquidity providers. That is the exact thing Curve Finance–another DeFi project–does.

The twinning continues with ySWRV, a token the Swerve Finance awards its liquidity providers, further stake-able in its homegrown DAO to earn SWRV. In the first two weeks, Swerve will distribute a total of 9 million SWRV tokens out of its 33 million total supply.

This whole economics is similar to that offered by Curve. But the Swerve Finance backers argue:

“We have written an independent Solidity code that interacts with Curve’s contracts essentially as an on-chain API via delegation. Any reused software in Swerve is MIT licensed.”

The Swerve Finance has already attracted about $35 million worth of stablecoin into its pool. The money has surfaced despite an independent audit of the smart contracts, which points to higher speculation among stakers and traders alike.

“As always, there are risks in using these contracts,” said DeFi expert Nick C. “From what I’ve seen thus far, it’s almost a perfect fork of Curve, but Swerve’s contracts remain unaudited. It will be worth watching audits moving forward.”

SWRV Dump Ahead?

Despite positive responses initially, nothing stops whales from artificially pumping SWRV to an all-time high, and later dump it on traders who joined the bullish bandwagon at a later stage.

Following the pump-and-dump of Sushi, Kimchi, and the recently failed Hotdog, it would be safer to say that these DeFi-clone projects could pose severe investment risks.