With both bulls and bears embroiled in a tug-of- war, the cryptocurrency market has adopted a tense holding pattern. A ray of optimism appears from an unanticipated source: stablecoins, while Bitcoin (BTC) struggles to recover momentum following its post-halved retracing and altcoins reflect its gloomy attitude.

Stablecoin Slump Hints At Investor Caution

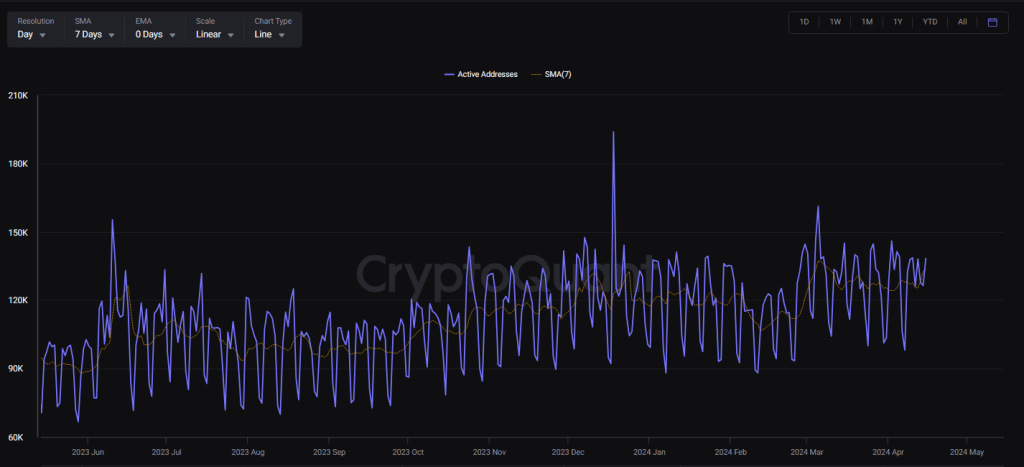

NewsBTC looked at the behaviour of stablecoins, sometimes considered as a safe refuge amid market crisis. Their research showed a concerning trend: active stablecoin addresses dropped significantly since April 16th.

Tracking the amount of distinct addresses involved in sending and receiving stablecoins this statistic points to less buying and selling activity.

This inaction fits another alarming statistic: the reserve for stablecoins. This statistic shows the total stablecoins deposited on exchanges, therefore serving as investors’ war chest for acquiring other cryptocurrencies.

Although the exchange reserve has experienced a consolidation over 2024, the image of declining buying power is shown by a clear decline between April 23rd and May 10th.

Stablecoins: Recent Inflow Offers A Beacon Of Hope

Still, a new development presents a possible counterweight to this story. On May 13, steadycoin deposits on exchanges clearly showed an increase. Although it is still too early to get clear answers, this flood could indicate investors’ fresh eagerness to participate in the market.

Some observers pointed out that this recent increase in stablecoin deposits is most certainly interesting. It implies that investors might be setting themselves for possible chances even though it does not ensure a positive reversal. Whether this is a passing blip or the beginning of a new trend will depend critically on the next several days.

Tether Dominance: A Canary In The Crypto Coal Mine

The Tether (USDT) dominance chart reveals still another insightful information. Tracking USDT’s market capitalisation as a % of the overall crypto market cap, this statistic measures change.

High USDT dominance indicates a cautious market by reflecting investor taste for stablecoins. On the other hand, a decline usually marks wider market rallies.

USDT domination almost reaches the 5% support level right now. Although analysts predict it to ascend towards the 5.50% barrier, a surprising decline below this level could indicate a positive indication.

Market In Limbo: Patience And Due Diligence Key

The market for cryptocurrencies finds itself at a juncturn. Although bearish patterns predominate in the current scene, bulls have some hope from the recent increase in stablecoin deposits and possible change in Tether supremacy.

Whether the market starts a brilliant comeback or stays trapped in its present wait-and-see phase will depend much on the next days and weeks.

Featured image from sciencefocus.com, chart from TradingView