Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Terra (LUNA) has been moving sideways during the past day but record impressive gains in the weekly chart with a 30.1% profit, at the time of writing. On the 1-year chart, the token has 8,794% in profits. The project has seen several partnerships. However, its core strength seems to be its tokenomics.

Researcher and investor Flood Capital have compared Terra’s stablecoin UST with Tether, USD Coin, DAI, to explained LUNA’s tokenomics. According to Flood Capital, part of the token’s supply must be burned with every UST minted on Terra’s ecosystem.

Tokens with burn mechanisms and deflationary pressure have seen tremendous appreciation during this cycle. Binance native token BNB and PancakeSwap’s CAKE amongst them. As the researcher said, $1 of UST minted equals $1 of LUNA burned.

With a market cap estimated at $1.87 billion, UST is in the top 5 stablecoins behind DAI, Binance USD, and USDC with Tether in the highest positions. Flood Capital expects UST to increase in adoption and demand. Therefore, the token’s supply will be reduced. The researcher said:

UST is currently the 5th largest stable coin with a mcap over $1.87b and ~$100m daily trading volume, it has done this with only 7 exchange listings. The Luna ecosystem has generated massive demand for UST with no major listings, this indicates clear product market fit.

UST Demand Leads To LUNA’s Appreciation

Further data from Flood Capital indicates demand for UST has skyrocketed from January 25th to April 25th. During this period, UST’s supply has gone from less than $500 million to the current levels. On average, the stablecoin has grown by $18 million per day. Flood Capital added:

Thus $18m worth of Luna being burned. I expect this to accelerate with more protocol releases and cross chain composability with Columbus-5.

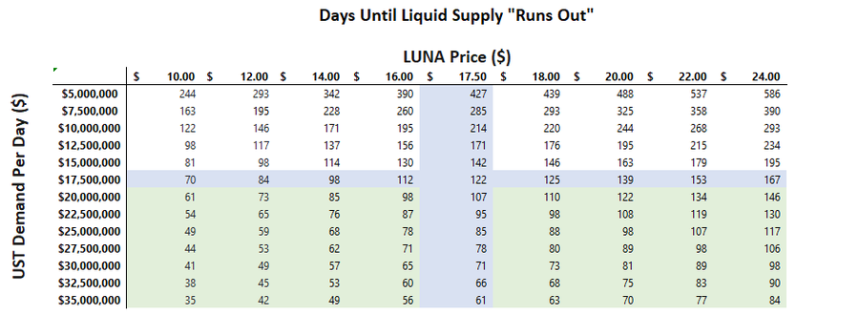

The token’s current circulating supply stands at 376 million with 254 million already staked. The researcher concluded there are only 122 million tokens available in the market. On average, the token’s supply is burned at .27% daily. Flood Capital said:

Companies like Apple and Exxon, renowned for their share buyback programs have bought back ~20-25% of their shares over 5-10 years! Luna is doing those same numbers in 100-125 days.

As shown in the chart below, the token could run out of “liquid coins” in around 122 days if UST demand continues to grow.

The researcher expects more projects to be launch on Terra’s ecosystem and possible further listings of UST in major exchanges. According to the co-founder of Terra Do Kwon, UST’s market cap could hit $10 billion by end of 2021. Flood Capital said:

The Luna ecosystem has just really started with only 2 major applications, yet this has caused the creation of over 1.5b UST in the past 3 months. As Luna continues to attract developers, new protocols and UST demand will explode, we are still early.