Cameron and Tyler Winklevoss are at it again. The twins, both huge advocates of bitcoin, have launched the Winklevoss Index, otherwise known as the ‘Winkdex‘. Yes, that’s really what it’s called.

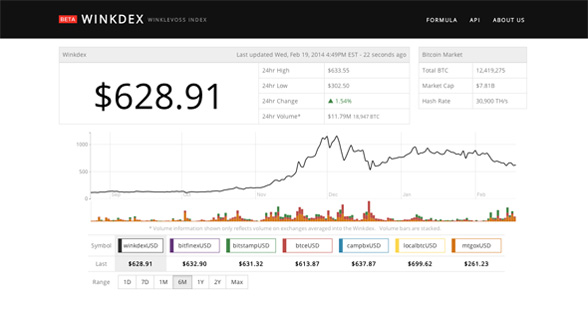

It’s a blended price index that aims to “reflect the true price of bitcoin”, but also to serve as the official index used to value the bitcoins in the brothers’ yet-to-be-approved ETF (exchange-traded fund).

Winkdex is calculated by blending the trading prices in U.S. dollars for the top three (by volume) qualified Bitcoin Exchanges* during the previous two hour period using a volume-weighted exponential moving average.

Missing from the index is Tokyo-based Mt. Gox, which has been have a tremendous amount of issues getting withdrawals up and running due to issues with their internal software.

The index will draw from three of five potential exchanges, which may include CampBX, of Georgia, USA, according to Forbes. Users can see pricing from seven exchanges, which include LocalBitcoins and Bitfinex.

More in-depth explanation:

Math-Based Asset Index, LLC (“Index Provider”) [the twins’ firm — ed.] developed, calculates and publishes Winkdex on a continuous basis using a patent-pending mathematical formula developed for such purpose. The formula provides a volume-weighted, exponential moving average market price by blending trading data from the largest Bitcoin Exchanges by volume on a list of Sponsor-approved Bitcoin Exchanges. Bitcoin Exchange criteria for inclusion as a Winkdex constituent include (i) trading denominated in US Dollar, (ii) availability of trading data, (iii) volume criteria and (iv) lack of recent trading halts. The Index Provider maintains a monitoring system that tests for these criteria on an ongoing basis.

What do you think? Could it be the community’s go-to bitcoin price resource?