A no-KYC crypto wallet is a must-have if you also care about anonymity and decentralization, arguably the main tenets of crypto.

Although KYC has legitimate applications to prevent money laundering and tax evasion, it strikes at the core of what makes crypto, well, crypto. And, unfortunately, KYC no longer applies just to exchanges, but to wallets as well.

If you’ve been looking for a fully decentralized wallet without luck, keep reading. We’ve reviewed the best no-KYC wallets for Bitcoin and other cryptocurrencies to help you trade and HODL securely and, most importantly, privately.

We’ve included both hot and cold wallets like Best Wallet, Zengo, Cypherock, and Ledger.

Top No-KYC Crypto Wallets at a Glance

Before we go on, here’s the overview of our favorite picks:

- Best Wallet — Leading Web3 Wallet with Crypto Presales and DEX Integration

- Zengo Wallet — Zero Hacks with over 1.5M Customers and Zero KYC

- Cypherock Wallet — No-KYC with World’s Safest Hardware Wallet

- Ledger Wallet — Versatile NFT & Crypto Management Hardware Wallet Line

- Tangem Wallet — Card-Sized Hardware Wallet with Bank-Level Security

- Ellipal Wallet — Air-Gapped Hardware Wallet with 10K+ Cryptos Supported

None of the above wallets require KYC to set up and use them. However, a few may require KYC for certain third-party integrations, such as buying crypto with a bank card.

Each provider will have its own rules depending on jurisdiction and compliance.

The Best Crypto Wallets Without KYC – Reviewed

When reviewing these wallets, we considered privacy, security, ease of use, and Web3 compatibility — all crucial if you’re looking for a no-KYC wallet. Here’s what we found.

1. Best Wallet – Leading Web3 Wallet with Crypto Presales and DEX Integration

Best Wallet is one of the easiest-to-use Web3 wallets, and it comes with top-flight security and a wide range of features.

As a non-custodial wallet, Best Wallet gives you full control over your private keys. On top of that, the app also uses Multi-Party Computation (MPC), so your key is split between an internal server and your own device to minimize risks in case of breaches or hacks. Note that you can always request your full key for backing up your wallet.

Best Wallet also employs Multi-Party Authentication (MPA) and biometric login to keep your crypto safe. And since there’s no need for verification, ID, or KYC, you can download the Best Wallet app and get started immediately.

Note that Best Wallet is mobile-only, with support for iOS and Android phones, but no desktop app.

The app supports multiple wallets. You can create and manage separate wallets for specific tokens, or even for specific blockchains, so you can better organize your crypto holdings. Beyond simple storage, Best Wallet also offers basic trading and swapping.

As for the Web3 part, you’ll find a number of integrated apps within Best Wallet, including industry staples like Rocket Pool and Lido for staking and earning more on your crypto.

There’s also a section for upcoming tokens, which highlights new crypto presales.

Each project listed includes all the information savvy investors need to know before investing: tokenomics, audits, project whitepaper, presale price, and an in-app ‘buy’ button. Thanks to this, you can readily buy new crypto, no KYC required.

Note that purchasing Bitcoin, Ethereum, and other non-presale tokens through Best Wallet might require basic verification, because you buy these through integrated centralized exchanges.

But Best Wallet’s core tools — like the upcoming tokens launchpad, sending, and receiving crypto — don’t require any verification. The direct integration with the PancakeSwap DEX further helps make Best Wallet one of the best no-KYC crypto wallets for low-cost swaps.

| Wallet Type | Software |

| No KYC | ✅ |

| Security | MPC, MFA, biometric login |

| Crypto and Blockchain Support | Ethereum, Bitcoin, BNB Smart Chain (BSC), and Polygon blockchains |

| Web3 Features | Staking, PancakeSwap integration |

| Platform Compatibility | Mobile-only (iOS and Android) |

2. Zengo Wallet – Zero Hacks with over 1.5M Customers and Zero KYC

No-KYC and top-level security often go hand-in-hand. Zengo Wallet is a prime example of that.

Zengo Wallet doesn’t skimp on utility, either. It supports thousands of EVM-compatible cryptos and dozens of blockchains, including Solana, Ethereum, Bitcoin, and even Doge.

Basic features include buying, selling, and swapping crypto in-app. Zengo supports staking for Ethereum as well (offering 3.36% APY).

As a software wallet, Zengo also integrates with key players across the crypto ecosystem. You can withdraw assets from ByBit, BlockFi, Binance, and more to your Zengo Wallet, keeping your bag away from centralization risks.

Zengo Pro, a paid upgrade to the free version, further beefs up privacy with features like a Private Transaction Mode – where the app creates a new wallet address every time you send and receive Bitcoin – and Theft Protection.

Going Pro also unlocks a multi-wallet feature, letting you create up to 5 separate wallets to better organize and manage your assets.

Other security features like advanced biometrics don’t require KYC, but do access more of your personal information — something worth considering when deciding whether to enable this option. That core biometric info provides the necessary authorization to approve transactions.

Even without Pro features, though, Zengo remains one of the safest no-KYC wallets. Besides, both versions of Zengo — available on mobile and desktop — are highly versatile and compatible with various dApps.

You can readily use the free Zengo version to store and trade NFTs on Opensea, connect to Uniswap, and earn through Lido. This combination of a broad range of features, Web3 compatibility, and advanced security makes Zengo a no-KYC crypto wallet worth a closer look.

| Wallet Type | Software |

| No KYC | ✅ |

| Security | MPC, 3FA, Recovery Kit |

| Crypto and Blockchain Support | 13 blockchains from Polygon to Ethereum and Base.

Full token support for Ethereum, Polygon, Base, and more. |

| Web3 Features | Integrates with CEXes, DEXes, and various Web3 platforms;

Zengo Pro supports Private Transaction Mode and Web3 Firewall |

| Platform Compatibility | Desktop, iOS, and Android |

VISIT ZENGO’S OFFICIAL WEBSITE

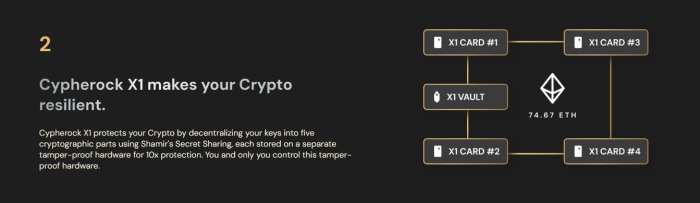

3. Cypherock – No-KYC with World’s Safest Hardware Wallet

Any wallet that bills itself as ‘the world’s safest’ needs to live up to its word. With an EAL 6+ chip (one of the highest security standards), Cypherock Wallet does just that.

Its hardware provides bank-level security and relies on Shamir’s Secret Sharing to split your private keys into five cryptographic parts. Lose one part, and you won’t lose your crypto.

This method addresses one of the biggest hurdles of cold wallets. Storing a single private key in a single place (for example, on an ordinary piece of paper) gives only a single point of failure. Lose that single key, and say goodbye to potentially thousands of dollars in digital assets.

Cypherock splits the key into five parts, storing four of them on its own X1 cards, and one on the X1 Vault – the crypto wallet itself. Lose even three of the five parts, and you’ll still be able to access your assets.

This security applies even if the X1 Vault is stolen; purchase a replacement, use two of the four cards, and your assets are safe and sound.

That covers the hardware and security side of things. For active portfolio management, Cypherock includes a software wallet — the cySync desktop app — to interface with the hardware.

It’s not just for Cypherock, though. You can also connect other hardware wallets to the Cypherock app (e.g., Ledger and Trezor wallets).

The reverse is also true; you can connect other software wallets (like Metamask) to the Cypherock hardware to freely interact with DeFi platforms for staking, NFT trading, and more. Not to mention, the wallet itself supports thousands of tokens on 15+ chains.

That gives Cypherock tremendous flexibility and versatility for crypto security and portfolio diversification. And that, without compromising on DeFi compatibility.

| Wallet Type | Hardware (with cySync software interface) |

| No KYC | ✅ |

| Security | MPC (through Shamir’s Secret Sharing) |

| Crypto and Blockchain Support | 15+ chains, 18,000+ tokens |

| Web3 Features | Integrates with software wallets for dApp compatibility, DeFi staking, secure NFT transactions, etc. |

| Platform Compatibility | Desktop computers, Android, iOS |

VISIT CYPHEROCK’S OFFICIAL WEBSITE

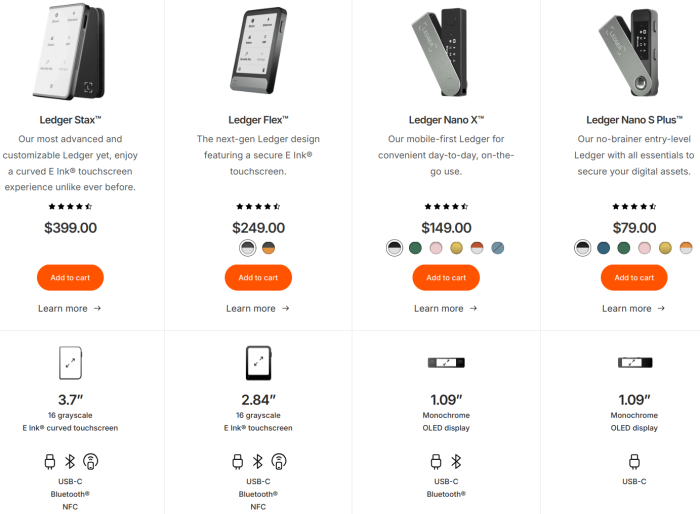

4. Ledger Wallet – Versatile NFT & Crypto Management Hardware Wallet Line

There’s not one single Ledger Wallet. Instead, the company, a leader in the hardware wallet industry, offers a range of private crypto hardware wallets with Web3 support.

Ledger Nano X and Nano X Plus are the mobile-first hardware wallets, roughly the size and shape of an old USB stick.

These are great if you’re looking for an affordable, easy-to-use hardware wallet. You can verify transactions with the push of a button, and the hardware relies on a secure EAL5+ chip.

The Ledger Flex provides a touchscreen interface in a handheld package, allowing you to sign and verify transactions easily. The addition of E-Ink to display your favorite NFT as a homescreen is an added bonus.

Each of Ledger’s products offers the same core security — robust hardware for offline storage with EAL5+ and EAL6+ chips — but with different levels of portability and added features. Like with most hardware wallets, there’s no KYC for any of Ledger’s products.

Ledger’s Recover service, however, does require identity verification. This is an opt-in, paid subscription that creates a digital copy of your 24-word private key, accessible only with proof of identity.

As for usability, the Ledger Live app incorporates the hardware and software sides, and it’s easy to use to manage transactions and monitor your assets. The app also supports thousands of coins and tokens across all the major blockchains: Ethereum, Bitcoin, Solana, and more.

Keep your keys on your Ledger wallet for safety and privacy, connect it to a DEX or CEX wallet when needed (through the Ledger Live app), and you’ve got full crypto control.

| Wallet Type | Hardware (with a Ledger Live app) |

| No KYC | ✅ |

| Security | Ledger Recover subscription; Wallets are secured with CC EAL5+ chips for Nano X, EAL6+ for Nano S, Flex, and Stax. |

| Crypto and Blockchain Support | 15,000+ supported cryptos |

| Web3 Features | Compatible with dApps and DeFi platforms by connecting with software wallets |

| Platform Compatibility | Android, macOS, Linux, iOS, Windows |

VISIT LEDGER’S OFFICIAL WEBSITE

5. Tangem Wallet – Card-Sized Hardware Wallet with Bank-Level Security

Bank card size, bank vault security. That’s the idea behind Tangem Wallet’s hardware solution.

The Swiss-based company incorporates EAL6+ chips, which generate a random private key offline during the initial wallet setup. This ensures your private key is never sent to any external server, not even Tangem’s. You’re the only one to ever have access to this data.

The wallet also employs biometrics and an access code to add further layers of security for your private keys.

Tangem’s card-style format lets you choose between a two- or three-card set. Permissions are set up so that you can use any of the cards interchangeably to authorize transactions; just tap the card on your phone to authorize.

With the three-card set, you also get a lite form of MPC, with the key split across all three pieces of hardware. Lose one card, and you can restore wallet access using the other two. That also applies to the two-card set, but you’ll need to connect to Tangem’s app.

Tangem also offers a Tangem Ring wallet. It is, quite literally, a ring – but one with the same bank-level security as the cards (just a lot more portable and inconspicuous).

All Tangem wallets come with a wallet app as well, one that allows you to buy, swap, sell, and even stake select cryptos, such as Tron and Ethereum.

Tangem also received a formal audit from Kudelski. The verdict? Tangem’s code shows no backdoors, cloning vulnerabilities, or security issues predisposing you to a private key breach.

| Wallet Type | Hardware wallet (with a Tangem app interface) |

| No KYC | ✅ |

| Security | MPC, EAL6+ chips |

| Crypto and Blockchain Support | 3,000+ cryptos across 50+ blockchains |

| Web3 Features | Supports WalletConnect, bridging to DeFi platforms like Aave, Uniswap, OpenSea, and more |

| Platform Compatibility | Mobile-only (iOS and Android) |

VISIT TANGEM’S OFFICIAL WEBSITE

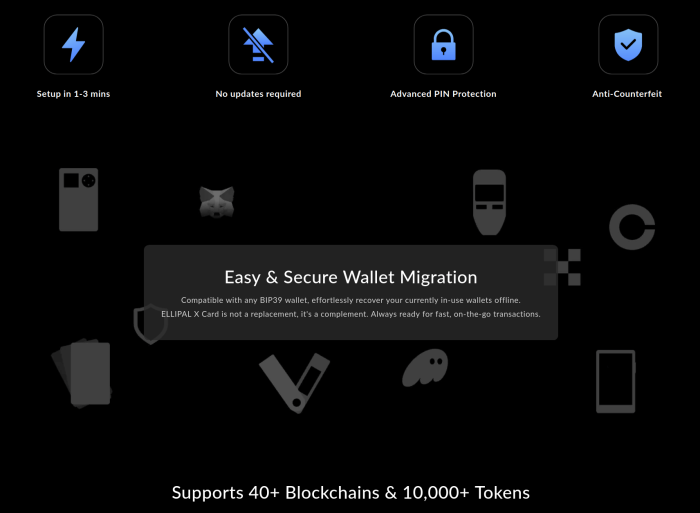

6. Ellipal Wallet – Air-Gapped Hardware Wallet with 10K+ Cryptos Supported

Metal-framed, air-gapped, and secured with an EAL6+ chip. Ellipal Wallet is another noteworthy entry to check out. Or rather, several entries. The Ellipal Titan 2.0, Titan Mini, and X Card form the backbone of Ellipal’s line of crypto hardware wallets:

- The Titan 2.0 can connect to MetaMask and other Web3 wallets, supports over 10K coins, and features a touchscreen on a roughly phone-sized device. It’s the top-line Ellipal hardware wallet, perfect for investors looking for a comprehensive solution.

- The X Card is just that: a simple wallet the size and shape of a bank card. Touch it to your phone to connect X Card with a Web3 wallet, or insert it into the Ellipal Mini to view balances. The X Card provides an easy and secure way to manage crypto transactions.

- The Titan Mini features a smaller version of Titan 2.0’s touchscreen, and can be easily transported wherever you go. Never lose access to your crypto assets. The Mini gives you a mobile-first solution for secure crypto storage and Web3 access.

Each of these wallets boasts the same secure chipsets commonly found in banks and financial institutions, explaining why Ellipal has suffered no breaches or hacks.

Furthermore, Ellipal’s air-gapped security ensures that the wallets are fully offline, immune to hacks from dodgy DeFi platforms and phishing attempts.

All Ellipal crypto hardware wallets connect to the Ellipal Mobile app, which supports over 10,000 tokens across dozens of blockchains. The app is also directly compatible with platforms like Changelly and Swifst, allowing for quick and private crypto swaps with no additional setup.

However, the hardware wallet itself is compatible with plenty of other software wallets. This gives you a lot of flexibility when choosing the best interface to connect to dApps for swapping, staking, or trading any crypto you choose.

Air-gapped safety ensures you don’t need to connect your wallet to the internet to generate your initial crypto keys or verify transactions.

The entire family of Ellipal wallets is intuitive and easy to use, regardless of the app you choose to interface with. No KYC also means no extra steps for registration.

These factors make it one of the best crypto wallets for those who don’t want to compromise between security and flexibility.

| Wallet Type | Hardware (with an Ellipal app interface) |

| No KYC | ✅ |

| Security | Air-gapped key generation, CC EAL 6+ |

| Crypto and Blockchain Support | 40 blockchains and 10,000+ tokens supported |

| Web3 Features | Ellipal app supports multichain swapping with Changelly and Swift;

The hardware wallet is compatible with various Web3 wallets for broad DeFi and dApp support; |

| Platform Compatibility | Mobile-only (iOS and Android) |

VISIT ELLIPAL’S OFFICIAL WEBSITE

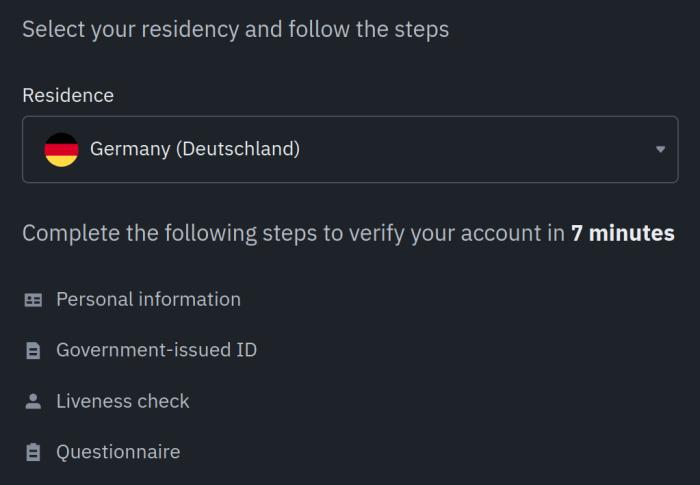

What is KYC in Crypto?

Know Your Customer (KYC) in crypto refers to a set of identity verification procedures that cryptocurrency exchanges, wallets, and other service providers implement to confirm the identity of their users.

Governments and regulatory agencies often require these KYC procedures to help combat fraud, money laundering, tax evasion, and terrorist financing by ensuring the transparency of user transactions.

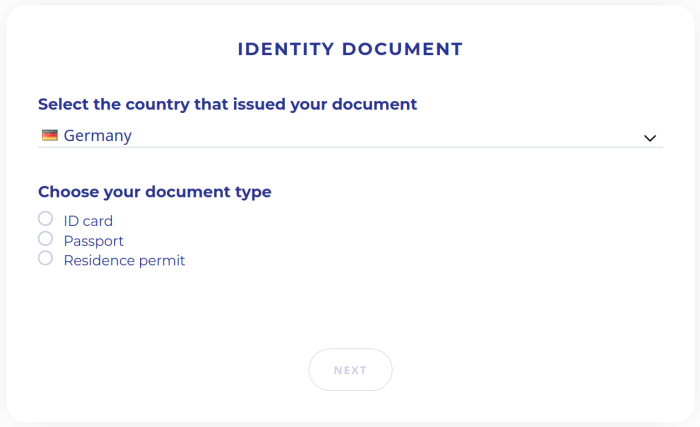

The KYC process involves submitting one’s personal identification documents, such as government-issued IDs, passports, driver’s licenses, proof of address, and often selfies for facial recognition.

There are three common tiers of KYC verification in cryptocurrency and financial platforms, and the amount of documentation required differs across them:

Tier 1: Basic Verification

The first tier of KYC requires simply an email address and mobile number. It’s one step past the simple ‘enter an email address and verify’ that many anonymous crypto wallets require.

With Tier 1 KYC, users can enable basic account creation, limited deposits, and small-volume trading.

Tier 2: Intermediate Verification

Tier 2 is where KYC really begins to kick in. It typically requires a government-issued ID (passport, driver’s license, national ID), date of birth, and proof of a user’s residential address (e.g., a utility bill or bank statement).

Tier 2 often allows higher trading limits, increased withdrawal capacities, and access to additional platform features like advanced trading, lending, or staking.

Tier 3: Advanced Verification

The highest level of KYC requires proof of income or source of funds (think bank statements, pay stubs, and/or tax returns).

It may also require Enhanced Due Diligence (EDD) forms, questionnaires, or even potential video verification.

Each higher tier provides broader access to services and higher transaction limits, balanced against reduced privacy and increased documentation requirements.

Should I Avoid KYC?

Whether you should avoid KYC depends on your priorities. Avoid KYC if privacy is your paramount concern, even above ease of use or added features. Just know that choosing to forego KYC could limit your trading and withdrawal limits on most crypto platforms.

KYC is important for legal compliance and anti money-laundering efforts. But it also represents a risk to your data security and privacy. The more information a platform requires and retains, the greater the risk if that information is compromised in a breach.

For many crypto users who value decentralization and privacy, that risk simply isn’t worth it. Especially when alternatives like no-KYC wallets and decentralized exchanges offer:

- Greater privacy: Using a hardware wallet and a DEX means no central party sees your data.

- Instant access: No need to wait for ID verification; just connect, trade, and receive funds straight into your wallet.

- Less risk to your private data: Nobody can steal your personal information if you never give it out in the first place. This, in turn, protects you from potential phishing attempts.

- Fully non-custodial asset management: No-KYC wallets are almost invariably non-custodial. This means you’re in full control of your assets, and nobody can ever freeze your funds.

- Lower fees and faster transactions: No centralization means you cut out the middleman. This gets things moving faster, and nobody imposes extra taxes on you to get their cut.

Also, remember that, since the requirements for KYC often come from government regulators, it isn’t just the wallets or exchanges that gain access to your data.

With KYC, the assumption is that governments will also be able to see whatever information you provide; after all, that’s the whole point of KYC.

The only question for crypto investors is whether the tradeoff is worth it. For many people who simply want to buy crypto in peace, opting for no verification apps or no-KYC wallets simply makes sense.

Are No-KYC Wallets Safe?

It’s not a black-or-white situation. KYC-free wallets prioritize decentralization, and this comes with specific safety perks, but also some noteworthy considerations.

On the positive side, you have:

- Privacy – You maintain anonymity since no personal identification details are shared.

- Control – No-KYC wallets are almost always non-custodial, ensuring complete control over your private keys (or the MPC equivalent) and significantly reducing your reliance on third parties.

- Resistance to Data Breaches – With no KYC data stored, there’s minimal risk of personal information leaks or hacks.

There are, however, two important details to bear in mind when using a no-KYC wallet:

- Responsibility for Security – Users are fully responsible for safeguarding their private keys and recovery phrases. Losing this information often means permanently losing access to funds, since there’s no central authority to back up your keys.

- Regulatory Uncertainty – Regulatory changes could affect usability, access, or legality of non-KYC wallets in certain regions. Note that this is less of an issue with hardware wallets.

What’s the key to using no-KYC wallets safely? Always use trusted, audited, and reputable wallets.

Store your private keys or recovery phrases securely offline, or use an option that relies on MPC. Finally, stay vigilant against phishing attacks or fake wallet websites; observe standard crypto best practices for privacy and safety.

If you keep these tips in mind, no-KYC crypto wallets are perfectly safe and convenient. But they do require greater personal responsibility compared to traditional custodial solutions.

How to Choose a KYC-Free Wallet

Selecting a reliable no-KYC crypto wallet involves research and careful consideration. If you’re not sure where to start, NewsBTC follows these criteria to identify and recommend trustworthy wallets, ensuring your privacy and safety:

- Level of Anonymity & Privacy: We look for no-KYC wallets that take privacy one step further by reducing overall information collection and ensuring legally compliant data management.

- Security: Our analysis prioritizes wallets that offer features like multi-factor authentication (MFA), next-gen encryption, and Multi-Party Computation.

- Cryptocurrency & Blockchain Support: We prefer wallets supporting a broad range of cryptocurrencies and popular blockchains to avoid limitations when managing your assets or diversifying your portfolio.

- DeFi & Staking Capabilities: Wallets with direct DEX and DeFi staking support allow you to trade and earn crypto anonymously — an obvious key factor if you want to forego identity verification. This improves overall security by minimizing centralization risks.

- Device & Platform Compatibility: We opt for wallets available across multiple devices (desktop and mobile) and Web3 platforms to ensure flexibility.

- Ease of Use: We prioritize wallets with a user-friendly interface, simple onboarding, and clear transaction management to help both beginners and experienced users.

- Reputation & Trust: Our process involves finding wallets with positive reviews, a good track record, transparent development, and third-party audits.

Tips on How to Use a Non-KYC Wallet Safely

Non-KYC wallets employ various security measures to protect your assets, including data encryption and multi-factor authentication. But you must still prepare for inherent risks like loss of private keys or vulnerability to phishing and hacks.

Follow these tips to stay safe:

- Use reputable, audited wallets from trusted providers only.

- Store private keys securely offline, never in notes, emails, or screenshots.

- Always verify URLs carefully before connecting to decentralized exchanges or platforms.

- Double-check wallet addresses and transaction details before confirming transfers.

- Avoid public Wi-Fi when accessing your wallet or performing crypto transactions.

- Regularly update your software to patch known vulnerabilities as soon as possible.

- Consider using hardware wallets for large or long-term cryptocurrency holdings.

Above all, be careful when you decide how and why to use your no-KYC crypto wallets. If you’re just trying to buy Bitcoin, no KYC or extra steps involved, either a no-KYC Web3 wallet or a hardware wallet with DEX compatibility might be a good bet.

It also makes sense to use a separate wallet from your primary long-term storage solution for any transaction with a DEX or when buying crypto.

No-KYC Crypto Wallets – The Takeaway

All the wallets reviewed here are no-KYC wallets, so you don’t need to provide personal information to register and use them. Some of them may require additional information for advanced features, add-on subscriptions, or buying through integrated CEXes, though.

Some options, like Ledger and Cypherock, are better for advanced security features, while others, like Zengo and Best Wallet, offer better integrations with the broader Web3 sector.

But overall, any of these wallets here will give you the tools you need to store crypto securely without compromising your personal information. Just remember, no-KYC isn’t a guarantee of safety; you still need to follow good safety practices.

FAQs

1. What is KYC in crypto?

Know Your Customer (KYC) refers to identity verification procedures that crypto platforms, like Binance, use to prevent fraud and comply with regulations. Users typically provide personal documents like IDs, passports, and proof of address to verify their identity, ensuring platform compliance with Anti-Money Laundering (AML) laws.

2. Can I buy crypto without KYC?

Yes, you can buy crypto without KYC by using Decentralized Exchanges (DEXes) like PancakeSwap, or peer-to-peer trading platforms like Bisq. However, these methods might have limitations, higher fees, or increased security risks, so thorough research and caution are essential.

3. What wallet has no KYC?

Non-custodial wallets, like Best Wallet, do not require KYC. They prioritize user privacy and security by allowing you to control your private keys. Still, some integrated third-party services (e.g., onramps connected to centralized exchanges) may require identity verification.