Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Wednesday, December 17, 2025 – Bitcoin (BTC) could be facing a deep correction, with veteran trader Peter Brandt warning of a potential 71% drawdown that would push prices from roughly $86,000 toward the $25,000 zone.

Even so, most market participants do not view that downside scenario as probable, or as a final verdict on Bitcoin’s trajectory.

Supporters of Bitcoin Hyper (HYPER) argue the issue is not Bitcoin’s value proposition, but its limitations. In their view, BTC has spent years functioning more as a passive store of value than as usable money, and that constraint is becoming increasingly relevant as the ecosystem matures.

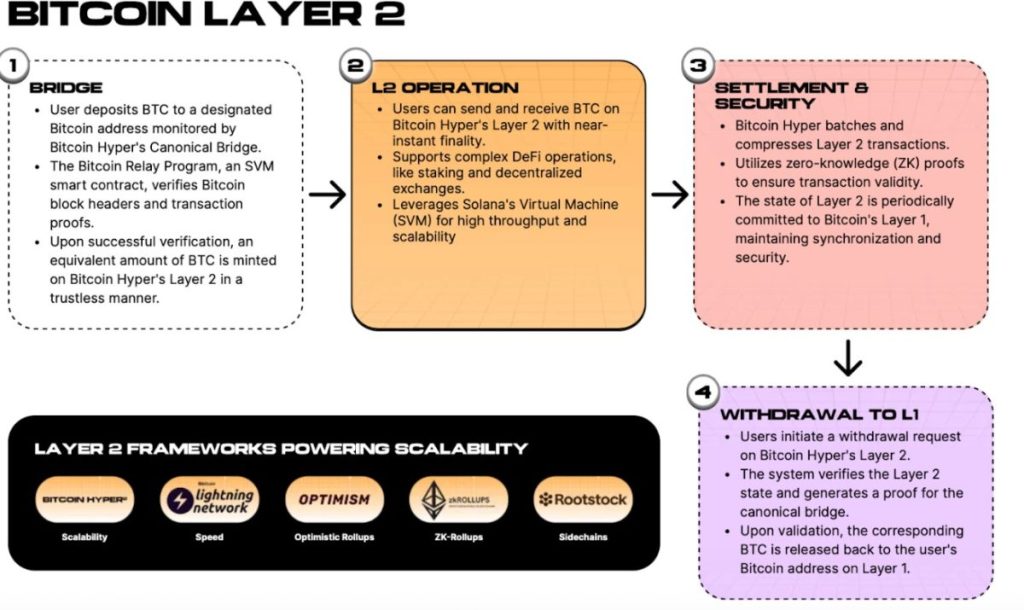

Bitcoin Hyper does not attempt to change Bitcoin’s core rules. Instead, it builds around them, creating a Layer-2 environment designed to let BTC operate at scale. As activity expands, more Bitcoin is drawn into the network, effectively locking value inside the system and converting real usage into economic gravity that could compound over time.

This mechanism also defines the role of HYPER, the network’s native token. As Bitcoin usage within the ecosystem increases, HYPER is structured to grow alongside it, offering exposure to expanding utility rather than short-term price volatility alone.

So far, the concept appears to be gaining traction. The presale has already raised $29.5 million, with momentum building as buyers position themselves ahead of scheduled price increases.

At the moment, HYPER is priced at $0.013435. That entry level remains available for just eight more hours before the next presale phase pushes the price higher.

Bitcoin’s Parabolic Run Starts to Crack

After touching $94,000 earlier this month, Bitcoin has slipped back into a clear downtrend. Price action now points toward a possible retest of the November 21 low near $82,000, down from current levels around $86,000.

That downside scenario is no longer just theoretical. According to Peter Brandt, Bitcoin has crossed a key technical line, what he describes as the point where “the parabolic advance has been broken.” In technical terms, this is where momentum structures stop bending upward and start failing outright.

Bitcoin’s past bull cycles tell a consistent story. Each major run followed a long acceleration phase that curved into a parabolic shape. Once that structure gave way, the rally ended. These breaks were not short-term pullbacks, they marked full cycle transitions.

Bitcoin investors, do you know:

1. Bull cycles have experienced exponential decay

2. BTC's bull cycles have undergone parabolic advances

3. The violation of previous parabolas have all declined <80%

4. The current parabolic advance has been violated20% of ATH = $25,240 pic.twitter.com/0hWAaEd6Dy

— Peter Brandt (@PeterLBrandt) December 14, 2025

Brandt also points out a critical pattern. While Bitcoin’s upside gains have compressed with each cycle, the downside moves after parabolic failures have remained brutal. Historically, declines of 60% to 80% followed these breaks.

Using that framework, Brandt maps Bitcoin’s last peak near $126,000 to a potential retracement toward roughly 20% of that high. That places a downside target near $25,200, implying a drawdown of about 71% from current levels around $86,000.

This is not a warning about daily swings or short-term noise. It highlights a deeper issue, once Bitcoin loses its parabolic structure, price has historically struggled to find a floor without a fresh and sustained source of demand.

That question, where new demand actually comes from, is why some investors are shifting attention toward infrastructure-driven plays like Bitcoin Hyper.

Building a Framework Where Bitcoin Can Actually Function

Bitcoin Hyper starts from a simple premise, Bitcoin should be more than a passive asset held in cold storage. The project is built around the idea that BTC can operate as usable money if the right infrastructure exists around it.

At the center of that effort is a Layer-2 execution layer powered by the Solana Virtual Machine. The SVM enables fast settlement and low transaction costs, features Bitcoin’s base layer was never designed to provide. Rather than forcing those capabilities onto Bitcoin itself, Bitcoin Hyper keeps the base chain untouched.

From the project’s perspective, Bitcoin already does what it does best. It remains the most decentralized and censorship-resistant network in the space. Bitcoin Hyper’s goal is not to modify those properties, but to build on top of them in a way that expands what BTC can be used for.

Connecting Bitcoin to a Solana-style execution layer requires more than theory. Because the two networks operate very differently, Bitcoin Hyper uses a canonical bridging model. BTC is locked on the Bitcoin base layer and represented inside the Layer-2 as a wrapped asset. Once inside the SVM environment, Bitcoin is no longer constrained by slow throughput or high fees.

Within that Layer-2, BTC becomes the primary medium of exchange. Applications use it to settle transactions, pay for activity, and power on-chain use cases that are simply impractical on Bitcoin’s base layer.

If the ecosystem develops as intended, and applications attract users beyond the existing crypto-native crowd, the impact could be meaningful. Instead of relying solely on speculative cycles, Bitcoin’s value would be supported by continuous economic activity flowing through the network.

Why Early Investors Are Positioning Around HYPER

A core differentiator of Bitcoin Hyper is that it is not built around a single token doing everything. The network runs on a two-asset structure, with each token handling a specific function inside the ecosystem.

Bitcoin remains central to the system. As activity increases across Bitcoin Hyper, BTC serves as the settlement layer, anchoring value transfers throughout the Layer-2 environment. It is the monetary base that applications ultimately rely on.

HYPER plays a very different role. It is the engine of the ecosystem, used for governance decisions, staking participation, and transaction fees. As on-chain usage expands, demand naturally concentrates around HYPER, making it the asset most directly tied to growth in network activity.

This design is what allows the economics to scale quickly. Even a modest share of Bitcoin’s circulating supply flowing into Bitcoin Hyper would translate into billions of dollars moving through the Layer-2. As usage increases, the pressure shifts toward execution, coordination, and fees, all areas where HYPER is embedded.

That structural leverage is already showing up in early demand. The presale has surpassed $29.5 million, with tens of thousands of participants committing capital ahead of launch.

The model has also caught the attention of well-known crypto commentators. Analysts such as ClayBro and Borch Crypto have highlighted Bitcoin Hyper as a project with asymmetric upside, particularly if real adoption begins to take shape.

How to Access the HYPER Presale

Investors interested in getting early exposure to Bitcoin Hyper can purchase HYPER directly through the project’s official website. The presale supports multiple payment options, including SOL, ETH, USDT, USDC, BNB, and standard card payments, keeping entry straightforward for both crypto-native and newer participants.

For storage and tracking, Bitcoin Hyper points users toward established Bitcoin and crypto wallets like Best Wallet. The token is already listed in Best Wallet’s “Upcoming Tokens” section, allowing buyers to monitor their allocation and claim HYPER seamlessly once the token launches.

Those who want real-time updates on development milestones and announcements can follow the project through its official Telegram and X channels.

More details and access to the presale are available on the Bitcoin Hyper website.