Traders and token holders of all kinds can now earn massive rewards on the dDEXX liquidity pools and yield farms.

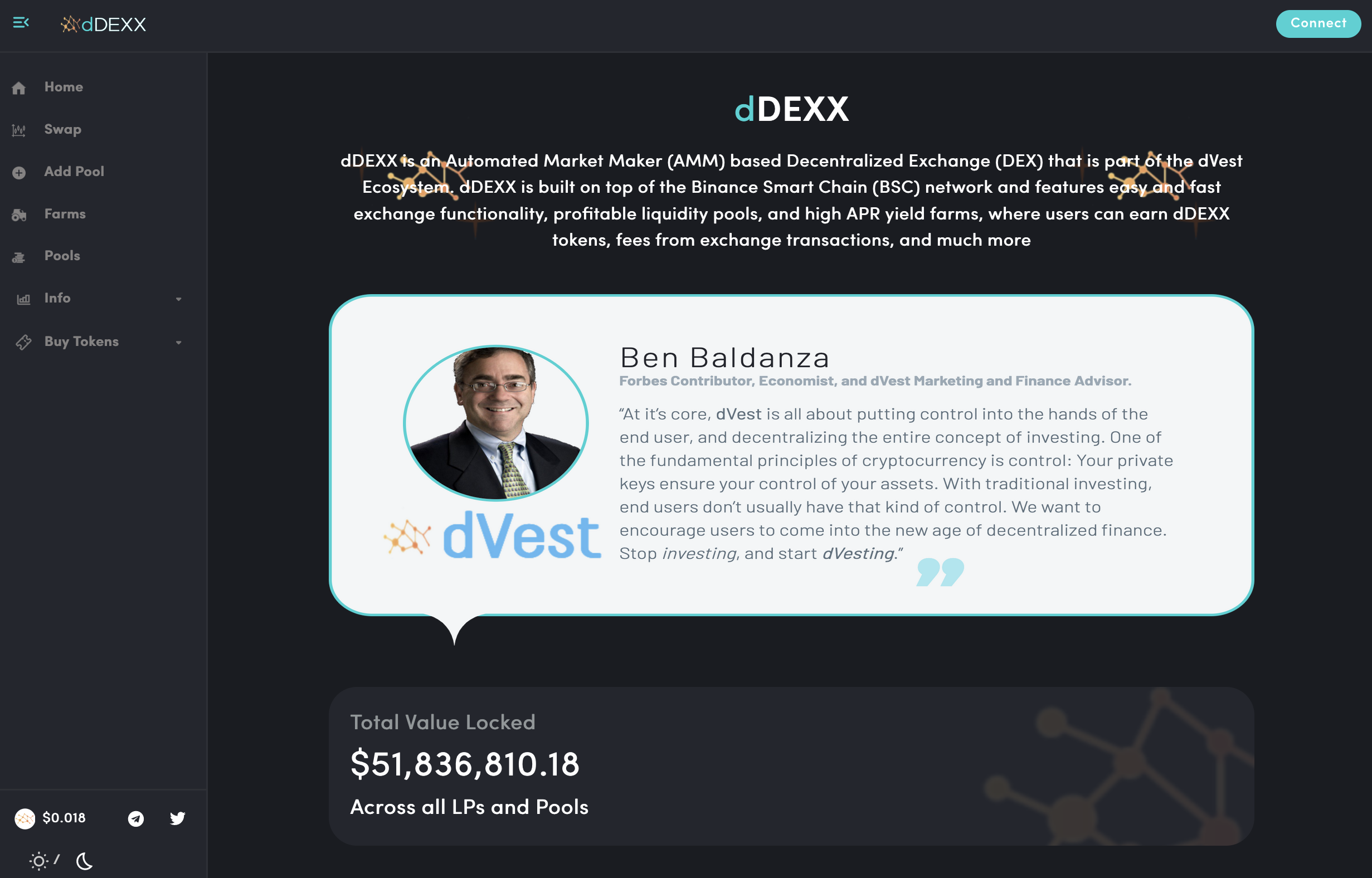

June 16th, 2021 — Fresh off the recent acquisition of the dVest Project portfolio and launch of the DeFiVest liquidity protocol, CPI Dev Team, Ltd. — the parent company of the Crypto Price Index project — has announced the launch of the dDEXX Automated Market Maker (AMM) based Decentralized Exchange (DEX) on the Binance Smart Chain.

In addition to the traditional exchange and swap functionality, users can now earn high APRs in the dDEXX yield farms and liquidity pools by providing liquidity to various trading pairs in the dVest ecosystem, in addition to the transaction fees they earn by providing liquidity in the first place.

“Our goal is to create a completely decentralized economic system that is self-sustainable, self-balancing, and can reward token holders and participants well, while remaining economically sound over the long term,” said Herbert Law, CEO of dVest and CPI Dev Team, Ltd. “We will be introducing additional features and expanding the platform fairly rapidly over the next several weeks and months,” he added.

The dVest team is currently developing the Ethereum network version of the DEX and plans to roll that out in the next month, and they are also looking into expanding the platform to other networks as well.

Check out dDEXX at www.ddexx.io

For more information about the dVest project, visit www.dvest.org

ABOUT dVEST

The dVest ecosystem consists of the DeFiVest liquidity protocol, the dDEXX decentralized exchange, and the Crypto Price Index project.

dVest tokens power the dVest ecosystem and earn rewards for token holders from dVest exchange revenues, liquidity mining, staking, and more.

Media Contact :

Contact Name: Herbert Law

Contact Email: herbert@cpiindex.io