Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Monday, 5 January 2025 – Bitcoin (BTC) is holding onto its upward momentum and is on pace for a fifth consecutive day of gains as the new year begins.

Alongside the ongoing rally, activity around Bitcoin Hyper (HYPER) is also accelerating. Positioned as the fastest Layer-2 solution built on the Bitcoin network, the project attracted an additional $100,000 in funding over the weekend, following its $30 million raise on Friday. The fresh inflows point to a broader return of bullish sentiment across the market.

Early backers see Bitcoin Hyper’s anticipated 2026 launch as a major catalyst. By adding new layers of utility and flexibility to the Bitcoin ecosystem, the protocol could help drive BTC back toward and potentially beyond last year’s all-time highs.

By pairing Solana-level speed with Bitcoin’s security model, the Layer-2 is designed to support a new generation of applications capable of reshaping the industry.

For a limited time, investors can still purchase the native HYPER token at presale prices. HYPER is currently priced at $0.013535, though this rate will increase in 36 hours when the next funding round begins.

Bitcoin’s Strong Start to 2026 With a Key Catalyst Still Pending

After briefly falling below $87,000, Bitcoin has posted four straight days of gains. As Monday trading continues, the largest cryptocurrency is targeting a fifth consecutive green candle, reinforcing a strong start to the year.

One of the main drivers behind this bullish outlook has been growing geopolitical uncertainty following the U.S. capture of Venezuelan President Nicolas Maduro. The event has reignited global conversations around sovereignty and risk, further strengthening Bitcoin’s reputation as a safe-haven asset.

The same risk-off sentiment was reflected in the gold market, with prices rising to $4,434 per ounce on Monday.

Nicolas Maduro on board the USS Iwo Jima. pic.twitter.com/omF2UpDJhA

— The White House (@WhiteHouse) January 3, 2026

From a technical standpoint, the move toward $91,000 was driven by a sharp liquidation flush. Roughly $180 million in short positions were wiped out within hours, forcing traders to buy back BTC to cover losses. This burst of buy-side pressure helped push prices even higher.

Looking ahead, 2026 is increasingly being viewed as a potential recovery phase. While Bitcoin reached record highs of $126,000 in 2025, momentum weakened in the fourth quarter a period that typically supports rallies allowing bearish pressure to disrupt the trend. Still, early signals now suggest sentiment may be turning.

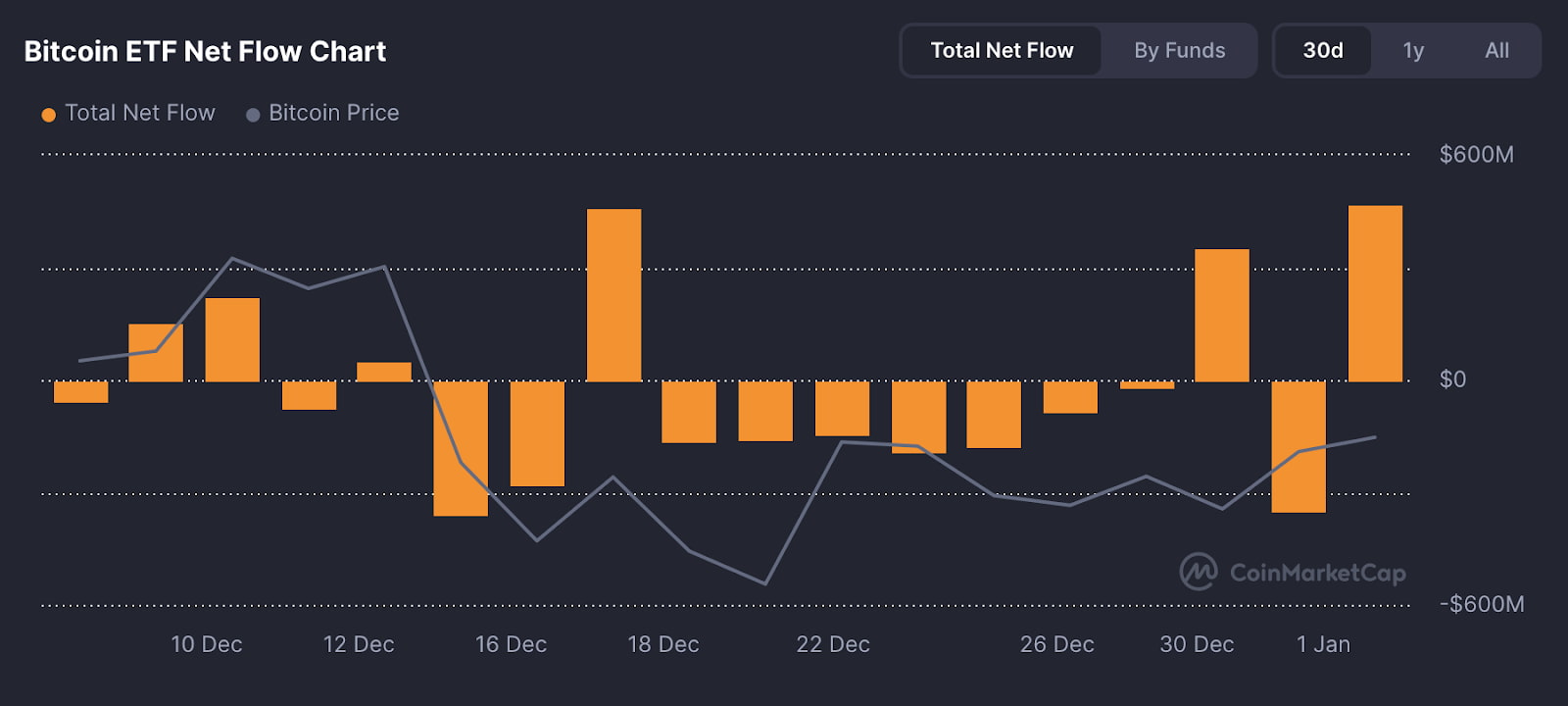

On January 2 alone, Bitcoin ETFs saw net inflows of $471 million. Combined with the $355 million inflow recorded on December 30, these represent the only two positive net-inflow sessions over the past ten trading days, highlighting a return of institutional interest.

Despite supportive macro conditions, one important catalyst remains largely under the radar: Bitcoin Hyper. As the project moves closer to launch, early supporters are beginning to consider how its Solana-like speed on the Bitcoin layer could generate new demand, potentially acting as the final trigger for Bitcoin’s next upward move.

Why Bitcoin Hyper Could Act as the Spark for the Next Bull Run

Bitcoin Hyper has already raised more than $30.1 million, reflecting strong investor interest in a high-performance ecosystem designed to ease Bitcoin’s long-standing structural limits while fully preserving its core security.

Bitcoin’s true strength lies in its deliberate simplicity. By keeping block sizes between 2MB and 4MB, the network ensures that running a node remains accessible to individuals. If block sizes were expanded to extremes like 1GB or more, only large-scale data centers could afford the hardware required to validate the chain. That shift would push out home-based node operators and lead to a more centralized verification process.

The Proof-of-Work (PoW) model plays an equally critical role. Miners must consume real-world electricity to solve complex mathematical problems in order to earn BTC rewards. This real cost was highlighted by Elon Musk in an October post last year, when he said Bitcoin is “based on energy,” pointing out that while digital data can be copied, energy cannot be faked.

This physical constraint makes attacks on the network economically unrealistic. Any attempt to compromise Bitcoin would require outspending the combined hardware and energy resources of all active miners a cost so extreme that it effectively makes sabotage pointless.

While these qualities make Bitcoin one of the most reliable stores of value ever created, they also impose limits on transaction speed and programmability.

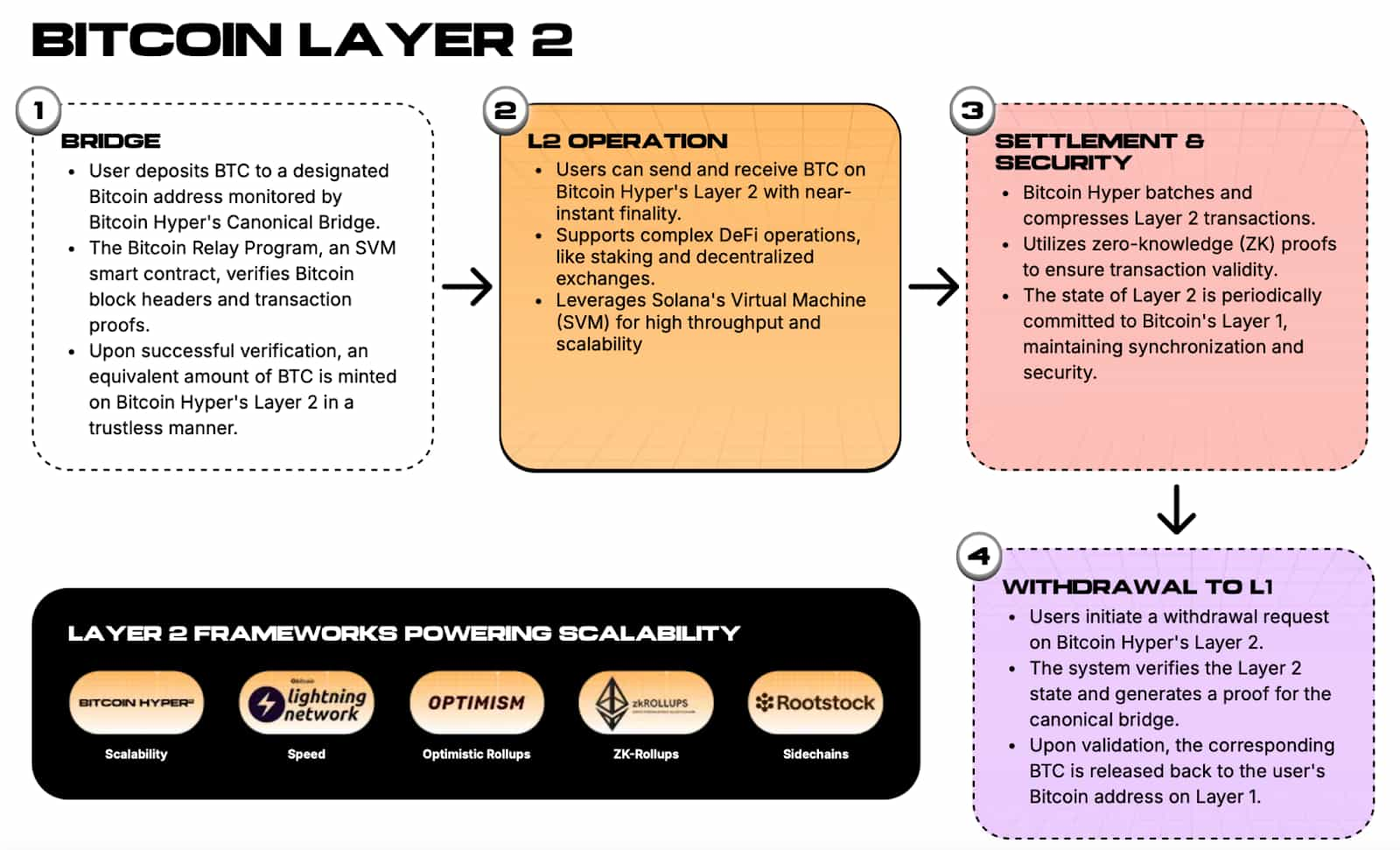

Bitcoin Hyper is built to address this balance. The project retains Bitcoin’s security model while adding a high-speed execution layer. Through a canonical bridge, Bitcoin Hyper links its SVM-based execution environment directly to the Bitcoin base layer.

Using a lock-and-mint structure, every Bitcoin secured within the bridge is matched 1:1 by an equivalent asset issued on Layer-2. This design allows developers to build Rust-based decentralized applications that benefit from Bitcoin’s security while achieving near-instant finality through the Solana Virtual Machine.

The result is an ecosystem where Bitcoin can finally function as programmable money, offering Solana-level performance without compromising the strength of its base layer.

Powering Bitcoin’s Utility With HYPER

As hybrid applications continue to grow, investors are increasingly expecting Bitcoin to evolve from a passive store of value into a faster, utility-driven asset. For early supporters, the real opportunity lies in creating a clear “demand pathway” where BTC is actively used as the primary currency within a new wave of decentralized applications, instead of remaining idle.

The potential scale of this shift is significant. If Bitcoin Hyper manages to pull a meaningful portion of BTC supply into its bridge, billions of dollars could transition from passive holding into active circulation. In this model, Bitcoin would move through DeFi protocols and consumer-facing apps, breaking away from its long-standing role of sitting dormant in cold storage.

This transformation also creates a strong alignment with the HYPER token. As the Layer-2 network absorbs more Bitcoin liquidity and processes higher transaction volumes, demand for the native token is expected to rise alongside it. With HYPER functioning as the network’s gas token, it becomes essential for settling and processing transactions.

Already started working on your 2026 goals? 🔥$HYPER never stopped the grind. 😉⚡️https://t.co/VNG0P4GuDo pic.twitter.com/NUNssgrEXk

— Bitcoin Hyper (@BTC_Hyper2) January 4, 2026

This is why HYPER’s growth trajectory closely tracks Bitcoin’s expansion within the ecosystem. Beyond transaction finality, the token also supports staking and governance, forming a multi-layered utility model across the network.

Given the scale and ambition of Bitcoin Hyper, early participants increasingly see HYPER as a key piece in unlocking Bitcoin’s next multi-billion-dollar utility phase. That view is fueling strong presale interest, as investors look to gain exposure while the opportunity remains open.

How to Join the Race to Buy HYPER at Presale

With substantial funding already secured, the opportunity to purchase HYPER at presale prices is becoming more limited.

To buy HYPER while the presale is still active, investors can visit the Bitcoin Hyper website and purchase the token using SOL, ETH, USDT, USDC, BNB, or a credit card.

Bitcoin Hyper also recommends using Best Wallet, widely regarded as one of the leading crypto and Bitcoin wallets on the market. HYPER is already featured in Best Wallet’s Upcoming Tokens section, making it easy to buy, track, and later claim tokens once trading begins.

Those wanting to stay informed can also join the Bitcoin Hyper community on Telegram and X.