Singapore is evolving to become a Smart Nation, bringing new, lucrative opportunities for investors in various sectors. The evolution of electronic payment systems in Singapore presents a great opportunity to expand to a growing and prosperous payment market in Asia. The untapped e-payment market in Singapore allows new payment platforms to thrive successfully, especially those integrating fresh technologies and concepts such as cryptocurrencies within their ecosystems. There remains much potential in this untapped e-payments market.

A Ready Market

The mobile payment market of Singapore is way ahead of other regional markets. Singapore’s population is more willing to embrace and adopt new technology in both electronic and mobile payments, than Philippines, Malaysia, Vietnam, and Thailand. Every Singaporean owns 3.3 mobile devices including smartphones, suggesting a high penetration rate for mobile devices being used to carry out daily activities.

Even in the presence of a huge pool of potential users, the market doesn’t have a dedicated integrated payments platform that embraces the trends found on mature footholds globally. Singapore has become one of the hubs for cryptocurrencies due to its fintech-friendly environment, government grants and accommodative status towards ICOs. It is an important and advanced source for various fintech firms to develop their business platforms.

However, the lack of a true third generation digital wallet combining integrative services in Singapore hence comes as a surprise.

How it Works?

SGPay is a 3rd generation e-wallet and e-payment mobile application that lets users trade cryptocurrencies, together with e-payments to make their purchases. SGPay‘s platform intends to be a leading e-payment and e-wallet mobile app for residents of Singapore and in neighboring regions. The users of the platform can pay for their movie tickets, groceries, flights and more, by selecting their preferred payment mode, either in fiat (through e-payments) or cryptocurrency.

Such an All-In-One (AIO) payments platform will make the usage of cryptocurrencies much more accessible to locals. It’s powerful APIs which tie-in with other services would make the platform popular as well as valuable. Tie-ups with virtual shopping malls and platforms such as Lazada and Carousell will also vastly increase the value-add of such a platform.

Ultimately, the creation of a third generation wallet would bring Singapore and SGPay alongside such heavyweights as PayTM in India and AliPay in China.

SGPay will have its own ERC-20 compliant utility token called SGPay Token (SGP). By holding tokens, the token holders gain benefits like lower transaction fee when buying and selling cryptocurrencies on SGPay platform. Token holders can also use SGPs for transactions on the platform. Tokens are also used to incentivize merchants who partner with SGPay, in the form of free cost-targeted advertising on the platform.

Following are the core features of SGPay:

- Compatibility with Android and Apple iOS

- Decentralized SGPay tokens on the blockchain

- ‘Cold-Storage’ style wallet protects 99% of crypto-assets saved

- Support for cryptocurrencies like the SGPay Token, Bitcoin, Ether

- Deposit/withdrawal of Singapore Dollar funds

- APIs support merchant and user funds exchange

- Full access for users over their private keys

- Debit and credit cards acceptance

- In-built monetized reward system

- QR code payment support in accordance with the new SGQR standard

- Future Support for local cryptocurrencies like Kyber Network Crystals, Zilliqa Tokens etc.

- Integrated services such as an online mall, insurance services, disruptive rental services ‘sharing economy’ for bikes and cars etc.

SGPay Token Generation Event (TGE)

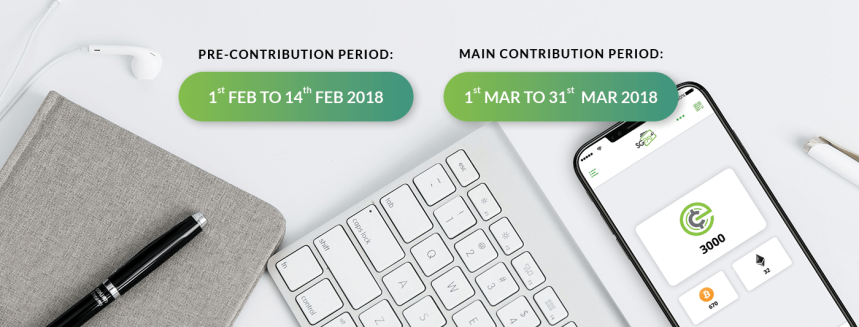

Only around 2 million SGPay tokens at US$0.40 each will be issued during the pre-contribution period that is from 1st to 14th February 2018. The main contribution period will be held from 1st to 31st March 2018 and will have a further 8 million tokens at US$0.50 each available. Investors will be able to purchase the tokens against ETH payments.

The SGPay TGE will have a relatively small hard cap of just US$4.8m.

To know more about SGPay platform and participate in its upcoming TGE, please visit http://www.sgpay.org.