The Moving Average Convergence Divergence indicator (MACD) is a technical analysis indicator created by Gerald Appel in the 1960s.

It is a multifaceted tool that can give several different readings, depending on the convergence and divergence of two moving averages.

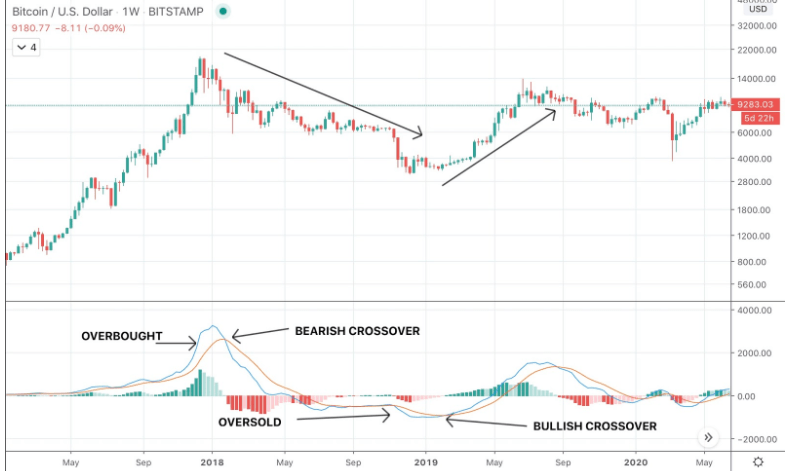

The tool consists of a short-term moving average, the EMA 12, and a longer term moving average, the EMA 26. When the two lines crossover, it can signal a trend change. When the two lines widen, it signals overbought or oversold conditions.

A further visual tool indicating the strength of moves called a histogram accompanies the two lines.

The MACD is often considered a lagging indicator, so many argue its effectiveness. However, those that utilize the tool swear by it as among the most consistently successful signals.