The Parabolic SAR (Stop and Reverse) indicator is yet another technical analysis indicator developed by J. Welles Wilder. Wilder also created the Average Directional Index and the Relative Strength Index, featured elsewhere in this course.

The Parabolic SAR indicator is a lagging indicator, but a powerful one when used correctly. It’s lagging effect can even be used to the advantage of traders to set trailing stop losses.

First and foremost, Parabolic SAR signals potential reversals and trend continuation. It is so effective, it has a 95% confidence level. However, it is among the more conservative trading strategies, which results in some profits being left on the table. At the same time, trades are less risky, and have a much higher rate of success.

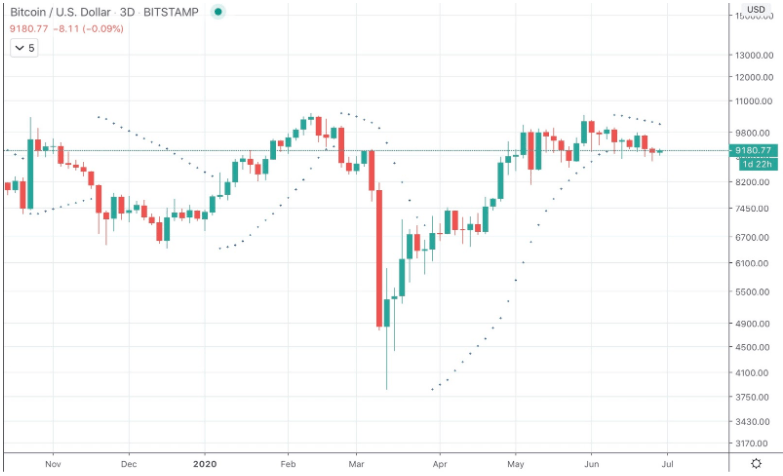

As an asset trends in one direction, SAR appears under or below the price action, depending on the direction.

If an asset is in an uptrend, the SAR appears below the price action. The inverse is true for a downtrend.

When price moves toward, and touches the rising or falling SAR, it is a signal that the trend is reversing. Since price had to reverse even to touch the SAR, a reversal may have already taken place. In this case, the Parabolic SAR indicator acts as the confirmation of the reversal.

Because signals are given late, there is less room for error. By the time the signal triggers, the new trend is likely already underway.

And because each SAR travels along with the price action, traders can use the SAR as a level to place a trailing stop loss.

Traders can continue to move this stop loss up in profit comfortably, and be confident when it is finally hit in profit, the trend is finished.