Hi Everyone,

The Bitcoin is rising at a rapid pace and it seems that the recent crypto winter has done virtually nothing to stunt its growth.

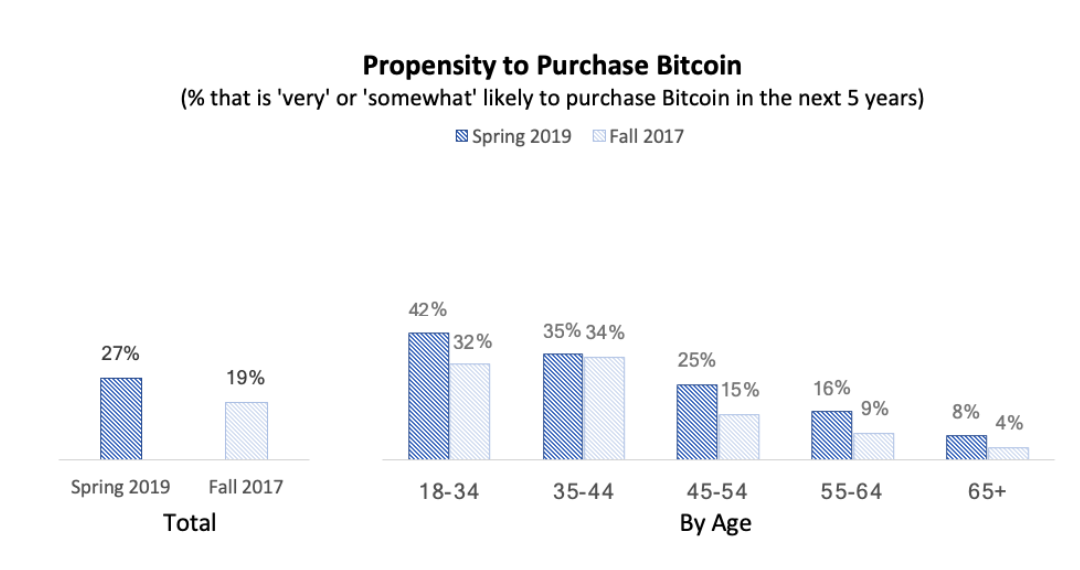

A new study just came out from the United States that shows a significant rise in all categories including awareness, familiarity, perception, conviction, propensity to purchase, preference to other assets, and of course ownership.

The study compares a survey that was done in October 2017, during the height of the bull market, to a more recent survey from April 2019. What was even more intriguing though was that in all of the above-mentioned categories it was the young who are leading the way.

Here’s one chart from the report that demonstrates this perfectly.

It’s becoming increasingly likely that the next generation will have a much freer and fairer economy. So that’s certainly something to strive for.

@MatiGreenspan – eToro, Senior Market Analyst

Today’s Highlights

- Fed Day!!

- Napoleon Crypto

- Know your Risk

Please note: All data, figures & graphs are valid as of May 1st. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

Volatility is light at the moment due to Labor day which has several markets closed around the globe. But that’s likely to change when the Fed announces their interest rate decision this evening.

Some PMI data will be coming out 30 minutes after Wall Street’s opening bell but unless the results are off the wall any impact is likely to not last very long as the market prepares for the Fed at 2:00 PM New York time and the subsequent press conference at 2:30.

Earnings season is going swimmingly, almost all economic data reported recently from the United States has been phenomenal, and the S&P500 index is tracking new record highs.

As we know, the Fed has recently (only four months ago) advocated a policy of patience in wake of a volatile market. Now that things are popping again I’m curious to see if they’ll backpedal on their backpedal and start to get aggressive again.

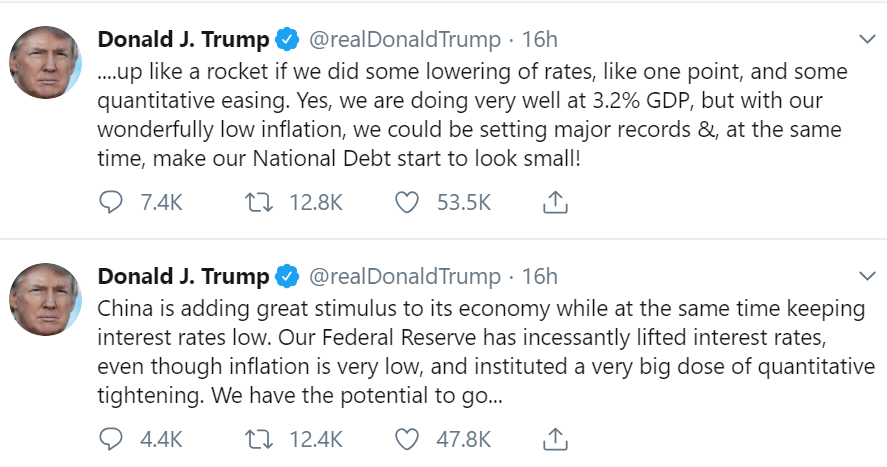

President Trump is doing his best to advocate the opposite, squeezing off two tweets aimed at Powell ahead of this meeting.

NapoleonX Crypto

For those of you asking for an active portfolio that trades crypto, I’ve got something for you. Just yesterday we announced…

This new CopyPortfolio is run by a machine learning algorithm designed by some very serious and experienced asset managers who hail from some of the top financial institutions in the world.

The idea is simple. To enjoy from the bull runs while limiting exposure during bear markets. So far the stats are pretty good but we’ll only really know if it’s doing its job when prices move down again. So hopefully, not for a long time.

Make sure to check them out @Napoleon-X

Asymmetrical Risk

Of course, it’s no surprise that asset managers are turning to crypto. This is something we’ve been speaking about for a while now. Cryptoassets provide an excellent tool for portfolio management due to their asymmetric risk.

Yes, they’re volatile and that makes them really risky compared to other assets, but the potential return on that risk is actually through the roof. So while having a 100% allocation on crypto might not be the best portfolio management practice, having a small exposure to crypto is certainly preferable to having none.

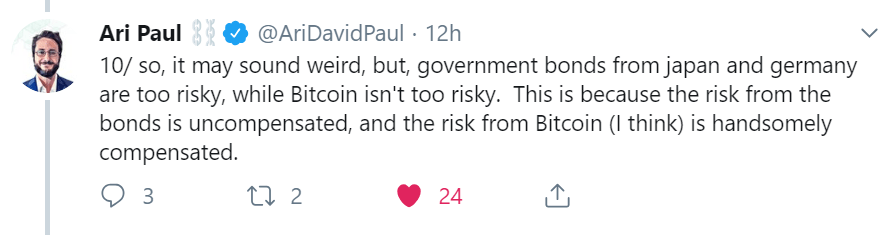

Ari Paul is a well-known cryptoanalyst, who is now reading our daily market updates, described this quite well in a tweet storm yesterday. The highlight, in my mind, was when he pointed out that investors are actually taking a risk, albeit a small risk, on government bonds from Japan and Germany even though the expected return is negative.

In any case, prices are moving up so far today. Let’s have an amazing day ahead.

Also, I’m will be in London tomorrow and Friday. So let me know if you’d like to hang out there.

About the Author: Mati Greenspan is a Senior Market Analyst at eToro Connect with Mati on…. eToro: http://etoro.tw/Mati Twitter: https://twitter.com/matigreenspan LinkedIn: https://www.linkedin.com/in/matisyahu/ Telegram: https://t.me/MatiGreenspan Office Phone: +44-203-1500308 (ext:311)

Disclaimer: The opinions expressed in this article do not represent the views of NewsBTC or any of its team members. NewsBTC is neither responsible nor liable for the accuracy of any of the information supplied in Sponsored Stories/Press Releases such as this one.

Image: Pixabay