Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

On-chain data shows the top buyers of XRP are still in an 11% net profit today. Here’s how other top coins like Bitcoin and Solana compare.

XRP Top Buyers Are The Only Ones In The Green Right Now

In a new post on X, the on-chain analytics firm Glassnode has talked about how the situation of the top buyers has been looking for different top digital assets.

The indicator of interest here is the “Realized Price,” which keeps track of the cost basis or acquisition level of the average investor on a given cryptocurrency network.When the value of the metric is above the spot price of the asset, the holders as a whole can be assumed to be in a state of net unrealized loss. On the other hand, it being under the token’s price implies the dominance of profit on the network.

In the context of the current discussion, the Realized Price of the entire userbase isn’t of relevance, but rather that of only a specific portion of it: the investors who got in during the earlier euphoria phase of December 2024 to January 2025.

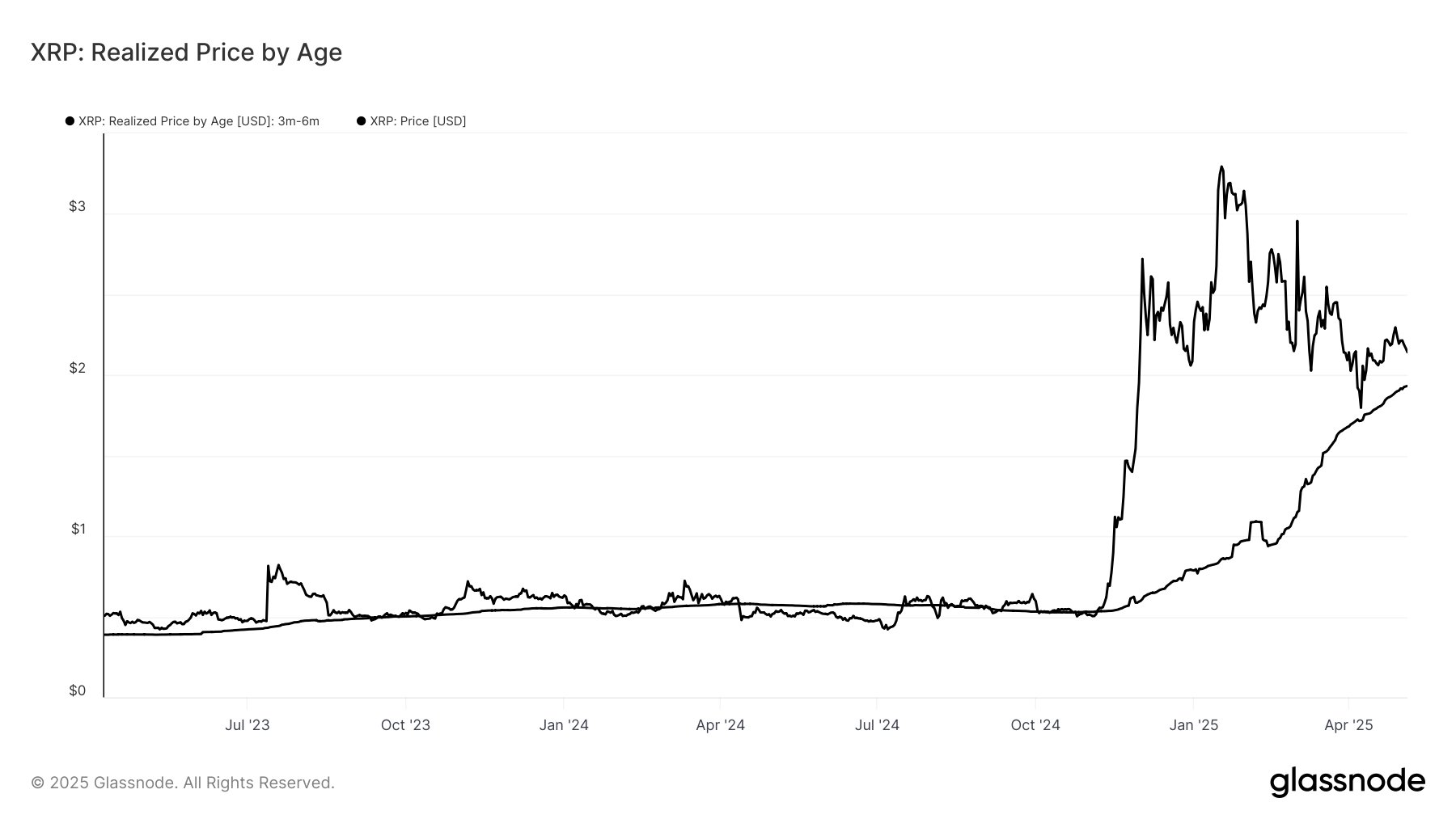

From today, this period lines up with the 3 months to 6 months old range, so Glassnode has referenced the average cost basis of these mid-term holders. First, here is a chart showing the Realized Price of this cohort for XRP:

As is visible in the above graph, the Realized Price of the 3 months to 6 months old XRP investors is currently trading a notable distance under the cryptocurrency’s spot price. Naturally, at least some of the top buyers of the asset would have capitulated by this time, but it would appear that those that still continue to hold are sitting relatively comfortably at a profit margin of 11%.

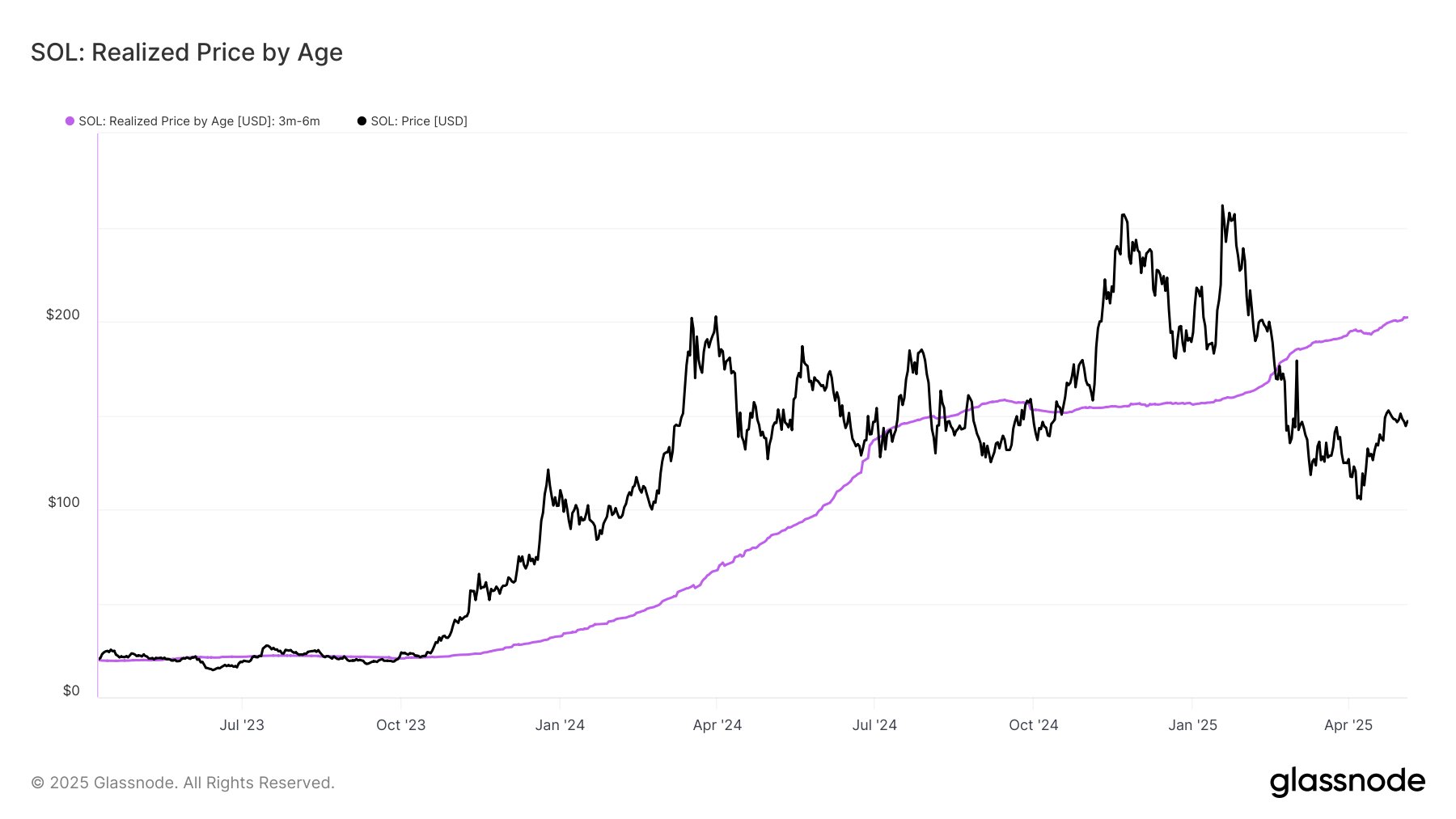

While this may be so for the mid-term holders of XRP, the trend is different for those present on the other major networks. As the below chart shows, Solana’s 3 months to 6 months old hands currently have their cost basis above the spot price.

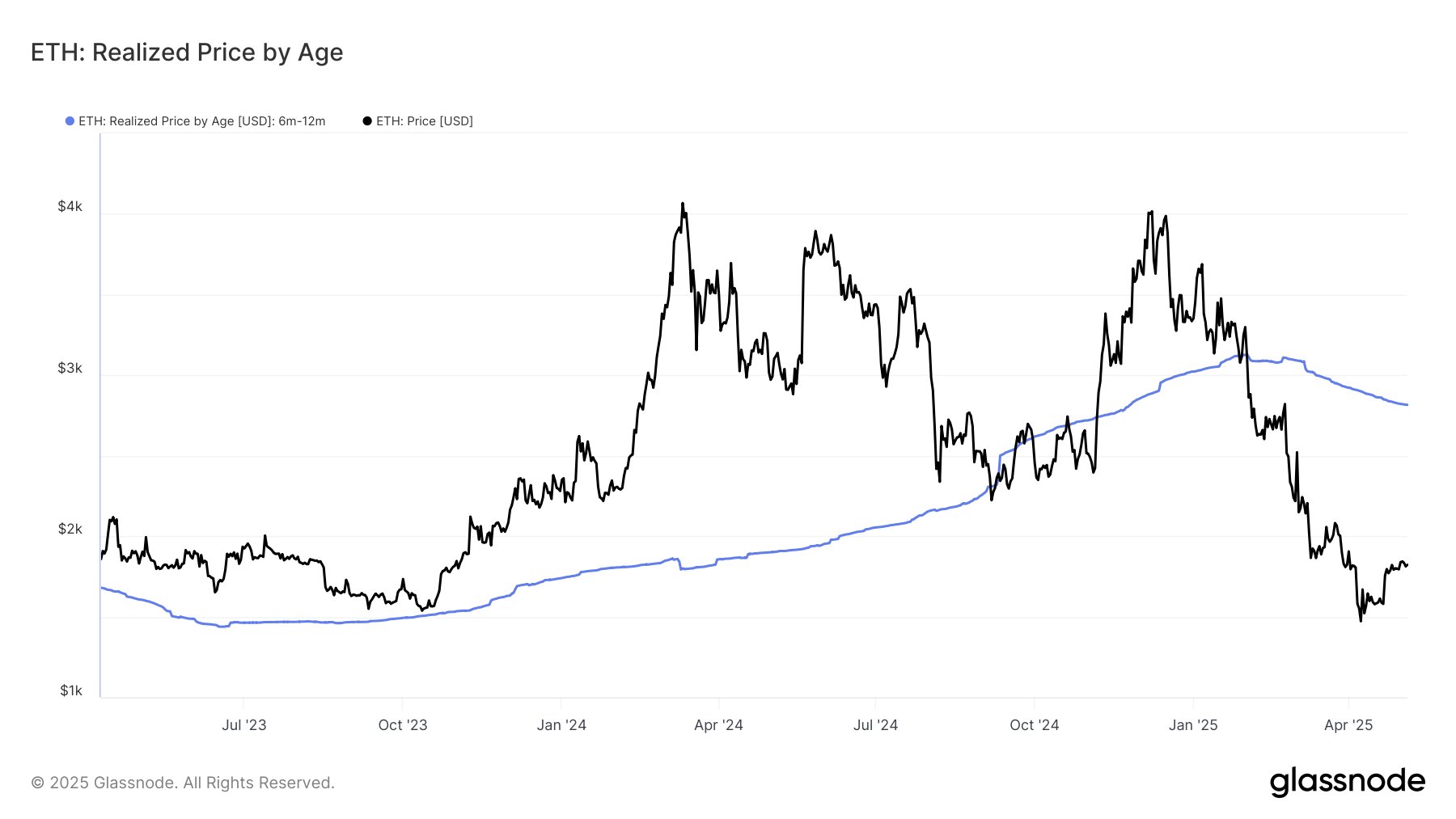

More specifically, SOL’s mid-term investors are holding a net unrealized loss of around 28%. The situation is even worse when it comes to Ethereum, with the cohort sitting about 36% underwater on the blockchain.

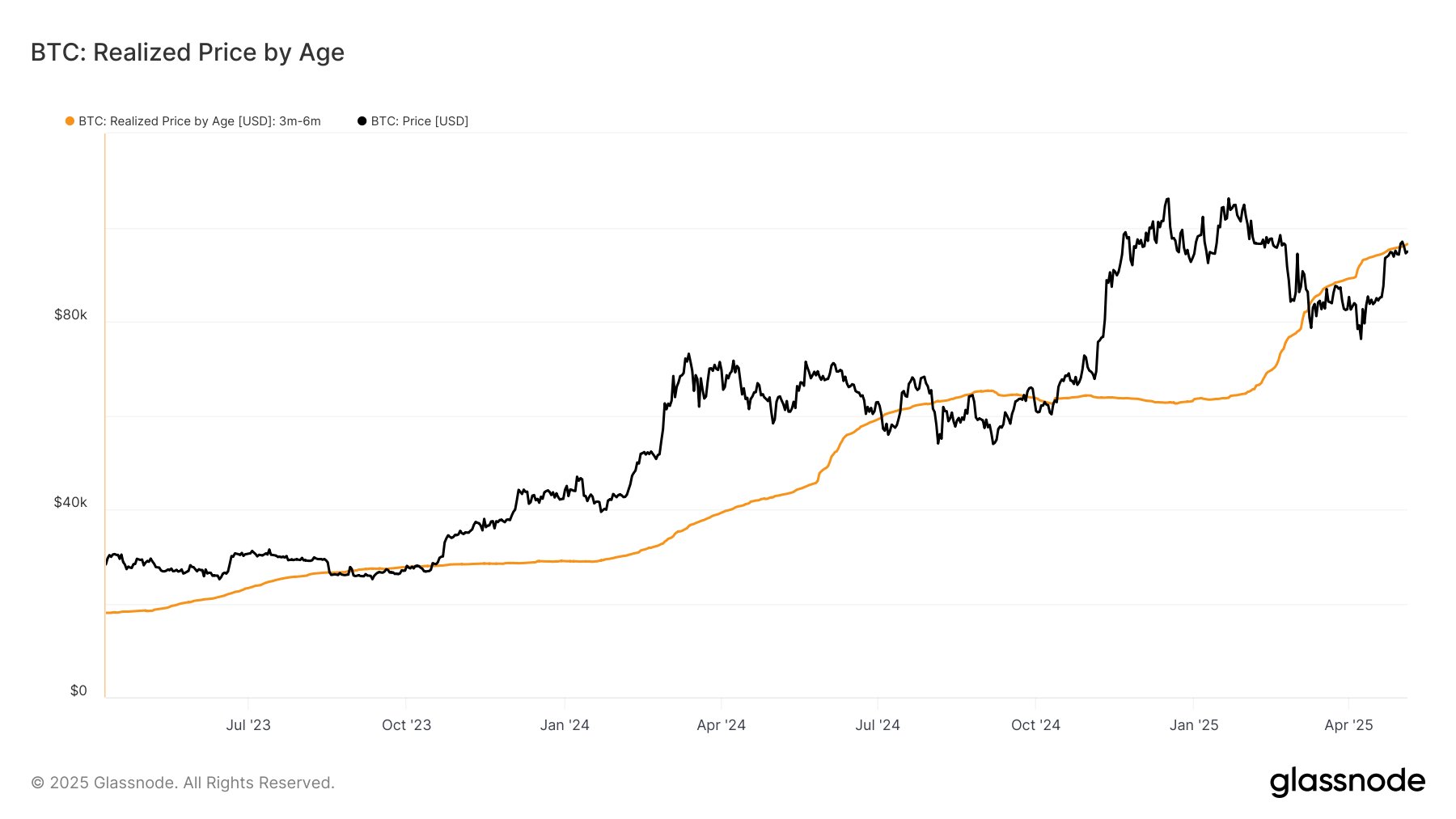

Even Bitcoin has this group carrying a loss, although the margin is just 1% in the case of the number one cryptocurrency.

As for what this trend of the top buyers being underwater could mean, the analytics firm has noted, “price stabilizing below the 3m–6m holders’ cost basis is a clear sign of market weakness.”

XRP Price

At the time of writing, XRP is floating around $2.13, down almost 4% in the last seven days.