In this morning’s bitcoin price watch analysis, our primary intent was to get across the importance of keeping things tight during the European session. Price has struggled to make any sort of sustained moves over the last few days, and while we have seen the odd spike, there has been no real trend momentum. The only way we are able to draw a profit from these sorts of market conditions is through a tight scalp strategy – that is, jumping in and out of the markets on the spikes and taking advantage of the action as it comes. Today’s session gave us a perfect example of how this strategy can be effective if employed correctly. A little earlier on, price broke through resistance and we we entered long towards a predefined, small upside target. Price quickly reached that target, took out our take profit order, and – almost straight away – reversed to trade back down within our range. If we hadn’t have had such a tight target, we would have lost out for a stop loss hit. We were lucky, but that’s not a bad thing.

We are going to employ the same strategy as we head into the Asian session tonight. Things are as range bound as ever, but if we can get in on a spike, we may be able to ride out a scalp for a tight profit.

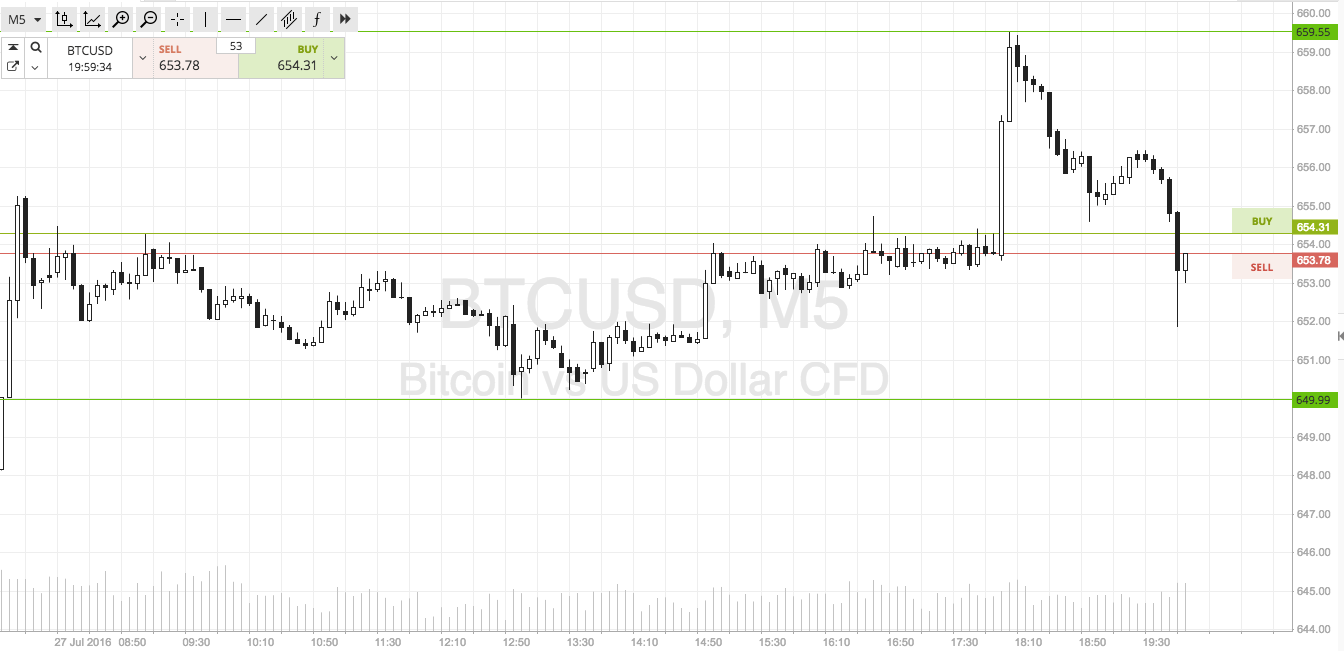

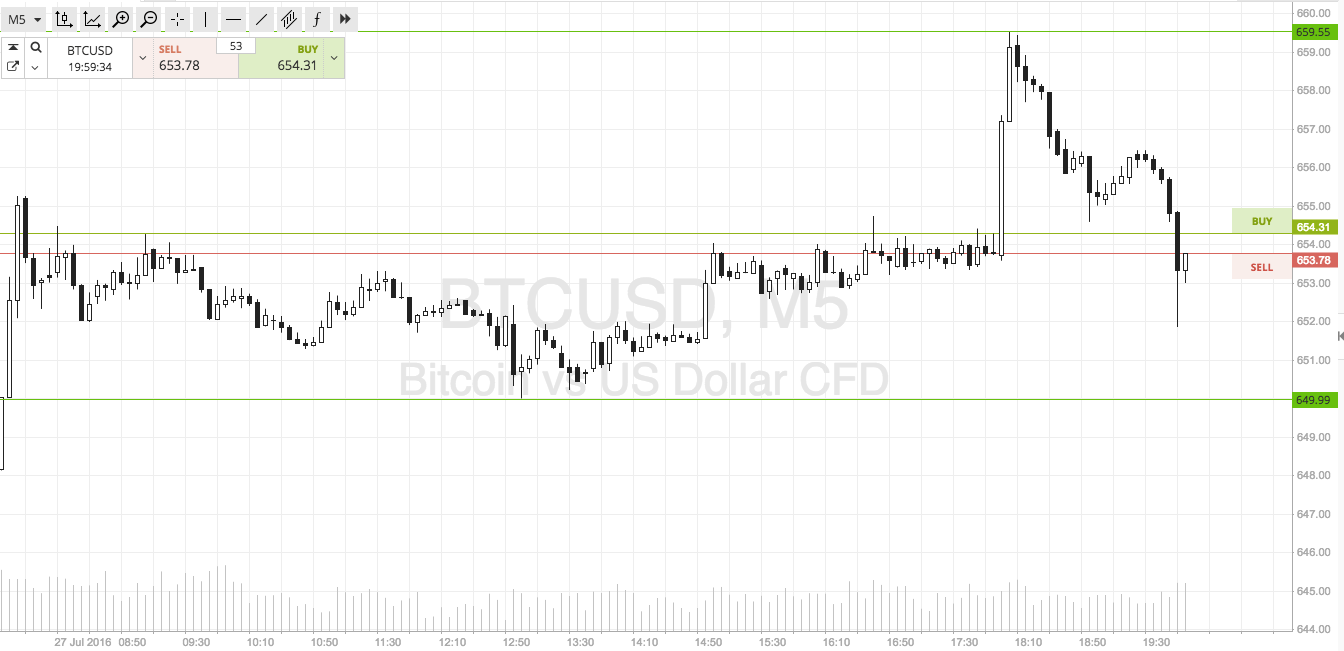

With this in mind, take a quick look at the chart below to get an idea of what we are focusing on.

As the chart shows, we are looking at in term support to the downside at 650, and in term resistance to the upside at 660. If price closes below support, we’ll get in short towards 645. Conversely, if we see a close above resistance, we will enter long with an initial upside target of 665.

Simple!

Charts courtesy of SimpleFX