Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Key Highlights

- Ethereum price started to move higher once again vs the US dollar, and it looks like my yesterday’s idea of a test $20.0 is possible.

- There is now a channel pattern forming on the hourly chart (data feed via Kraken) of ETH/USD, which may act as a catalyst for the upside move.

- If the current momentum continues, there is a chance of an upside move towards $20.00.

Ethereum price retained the bullish bias after a minor correction, and the current price action in ETH suggests more gains in the short term.

Ethereum Price Upside Move

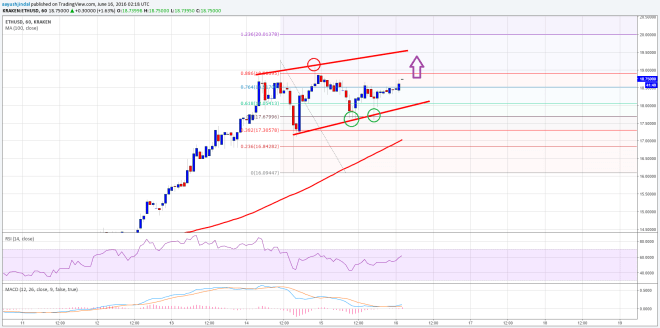

Ethereum price ETH after trading towards the $17.70 support area against the US Dollar started to climb higher once again. The price is currently trading near the 61.8% Fib retracement level of the last drop from the $19.30 high to $16.09 low, and almost broke it. There is also a channel pattern forming on the hourly chart (data feed via Kraken) of ETH/USD, which may play a major role for the next move in the short term.

If the price continues to trade higher from the current levels, then the all-important $20.00 level may be tested. The stated level also coincides with the 1.236 extension of the last drop from the $19.30 high to $16.09 low, which is a perfect technical level.

ETH/USD is also well above the 100 hourly simple moving average, which is a positive sign and could ignite further gains. An initial hurdle on the upside is around the $19.00 level, followed by $19.20. On the downside, the channel support trend line may be considered as a buy zone with a stop below it.

Hourly MACD – The MACD is back into the bullish zone, signaling more gains in ETH.

Hourly RSI – The RSI is above the 50 level, which is a bullish sign for the ETH buyers.

Major Support Level – $18.05

Major Resistance Level – $19.00

Charts courtesy of Kraken via Trading View