Bitcoin Price Key Highlights

- Bitcoin price is closing in on its record highs so there’s a chance that profit-taking could happen soon.

- In that case, bitcoin could give back a lot of its recent gains as bulls close off their long positions ahead of the long weekend.

- Technical indicators are giving mixed signals at the moment, but market factors suggest that the climb could continue.

Bitcoin price is slowing in its climb as it is approaching strong resistance levels at the record highs.

Technical Indicators Signals

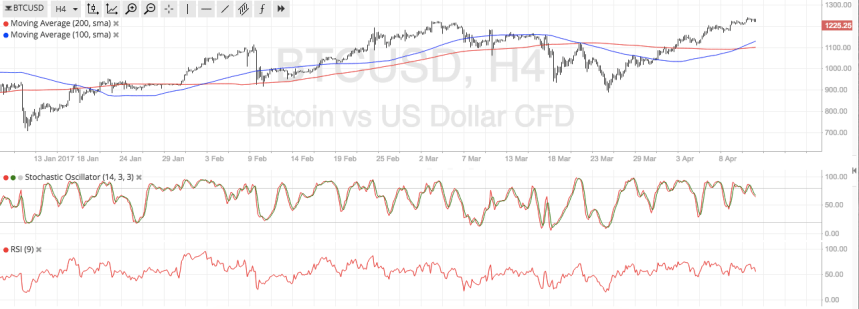

The 100 SMA just crossed above the longer-term 200 SMA to signal that buying pressure is gaining traction and that the path of least resistance is to the upside. However, stochastic is pointing down from the overbought zone to signal that bears could regain control of bitcoin price action and possibly trigger a pullback to the area of interest at $1100.

RSI is also turning down from the overbought region to indicate that sellers are getting back in the game. This could also be indicative of potential profit-taking in the days ahead.

Still, breaking above the $1250 area could set bitcoin price on track towards testing the $1300 levels or perhaps even going for more gains or new record highs. Market factors are in support of more bitcoin price gains as geopolitical risks haven’t subsided just yet.

Aside from that, the disappointment over the Trump administration’s inability to act faster on healthcare overhaul or tax reform could continue to drag the US dollar lower across the board. After all, this erases speculative gains in the stock market and leads traders to price in lower expectations of fiscal stimulus and Fed tightening.

Moving forward, US retail sales data are up for release later in the week and the low liquidity on Friday could make it a recipe for fast-paced price action. Aside from that, bitcoin price could be more sensitive to headlines as smaller positions could lead to larger moves in the market.

Charts from SimpleFX