Bitcoin Price Key Highlights

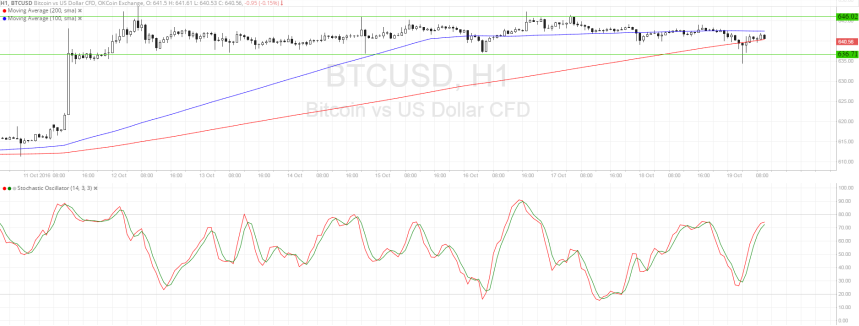

- Bitcoin price is still stuck in its tight range on the short-term time frames, bouncing off support once more.

- A test of the near-term resistance could be in the cards but technical signals are pointing to a downside break.

- Buyers seem to be running out of momentum or traders are simply waiting for fresh market catalysts.

Bitcoin price could continue to consolidate but if a breakout occurs, technicals are favoring a downside move.

Technical Indicators Signals

The 100 SMA is above the longer-term 200 SMA for now, which suggests that buyers still may have a bit of energy left in them. However, the gap between the moving averages is narrowing so a downward crossover may be imminent. If it happens, more sellers could hop in and trigger a downside break of consolidation for bitcoin price.

Stochastic is also on the move up for now so there’s some bullish momentum left, probably enough for a test of the range resistance at $646. If the ceiling still holds, bitcoin price could go for another test of support at $636 or perhaps a break lower. If so, the cryptocurrency could go for a move to the next floor at $615.

Market Events

US CPI failed to impress market watchers yesterday, unable to reinforce Fed rate hike expectations for November. Headline inflation was up 0.3% as expected while core inflation missed forecasts and printed a bleak 0.1% uptick versus the estimated 0.2% increase. With that, the dollar gave up some ground against bitcoin price.

Only building permits and housing starts data are up for release from the US economy today so there’s not much volatility expected again, although the Fed Beige Book could influence tightening expectations and therefore dollar price action.

There hasn’t been much in the way of bitcoin-related news as well, which explains the lack of direction in the cryptocurrency so far. But judging by the weakening upside momentum, it looks like bulls have run out of steam and bears might take this as an opportunity to push price back down.

Charts from SimpleFX